News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 17)|U.S. seasonally adjusted nonfarm payrolls for November increased by 64,000; BlackRock transferred approximately $140 million worth of ETH to a CEX2Bitget US Stock Morning Brief | Fed Independence Reaffirmed; NFP Beats Expectations; Tech Rally Lifts Market (December 17, 2025)

Cardano (ADA) Bagholders Switch Strategies As This Under $0.05 Token Offers Fresh Hope for Recovery Gains

TimesTabloid·2025/12/17 10:00

Analyst Analysis: XRP Faces Risk of Falling to $1

币界网·2025/12/17 09:47

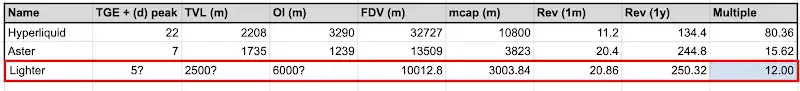

Opinion: Why Lighter Is Seriously Undervalued

BlockBeats·2025/12/17 09:39

Collably Network Partners with Flipflop to Revolutionize Fair Token Distribution

BlockchainReporter·2025/12/17 09:31

Flash

- 10:03Data: 17,000 SOL transferred to B2C2 Group, worth approximately $2.15 millionAccording to ChainCatcher, Arkham data shows that at 17:57, 17,000 SOL (worth approximately $2.15 million) were transferred from an anonymous address (starting with 5PX1SGx4...) to B2C2 Group.

- 10:02Securitize launches "Stocks on Securitize" program, enabling real stocks to be traded on-chainAccording to TechFlow, on December 17, asset tokenization platform Securitize announced the launch of "Stocks on Securitize," supporting real-time on-chain trading of real stocks. Securitize stated that this product is not a synthetic asset or IOU, but regulated real stocks, with shares directly recorded in the issuer's shareholder register and tradable on-chain within a familiar crypto trading experience. Unlike most current "tokenized stocks" that only provide price exposure, this solution offers investors real ownership and shareholder rights, and enables programmability under compliance, allowing stocks to interact with smart contracts, lending protocols, and DeFi infrastructure. This marks a key step forward in the tokenization of public market assets.

- 10:01BiyaPay Analyst: JPMorgan Sets Out Four Major Long-Term Trends, AI Power, Longevity Economy, Tokenization, Brain-Machine InterfaceBlockBeats News, December 17th, Morgan Stanley pointed out at its inaugural thematic conference earlier this month that the current market's long-term focus is on four major directions: AI capital expenditure and data center power bottlenecks, consumption and productivity reallocation brought about by the longevity economy, tokenization driving financial infrastructure upgrades, and the potential explosion of brain-machine interfaces at the intersection of healthcare, AI, and manufacturing. BiyaPay analysts believe that in the short term, attention should be paid to the deterministic opportunities in the "AI → Power → Infrastructure" chain; in the medium to long term, tracking the technological penetration and service upgrades of the longevity economy while focusing on the improvement in multi-asset trading and liquidity under a compliant framework through tokenization is advisable. As a multi-asset trading wallet, BiyaPay supports USDT trading for US stocks, Hong Kong stocks, and futures, and provides 0-fee cryptocurrency spot contract trading, enabling users to flexibly allocate and grasp the rhythm under different themes.

News