News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1BTC Eyes $120K With Bullish H&S Pattern: Technical Analysis2Is Pudgy Penguins (PENGU) Poised for a Bullish Breakout? Key Fractal Pattern Saying Yes!3Fed Rate Cuts Incoming: Can Bitcoin Smash Through 120K?

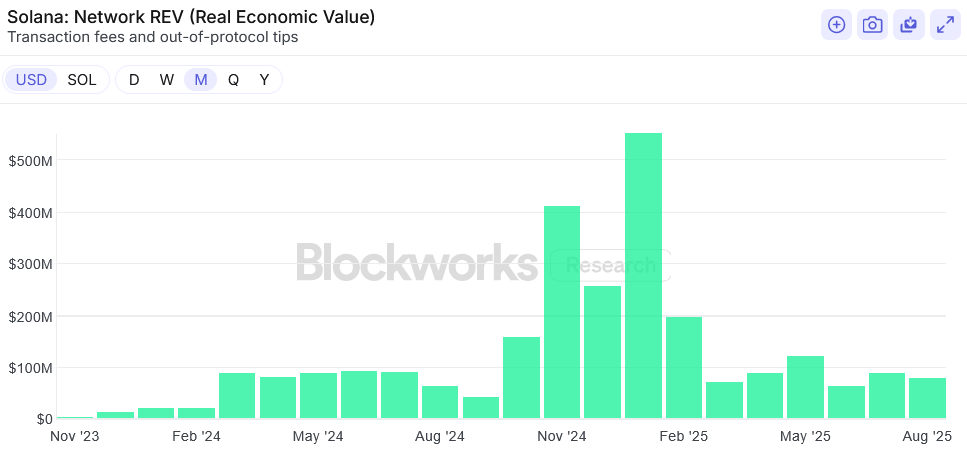

Solana in 8 charts: August edition

Solana saw $78 million in REV for August

Blockworks·2025/09/08 15:27

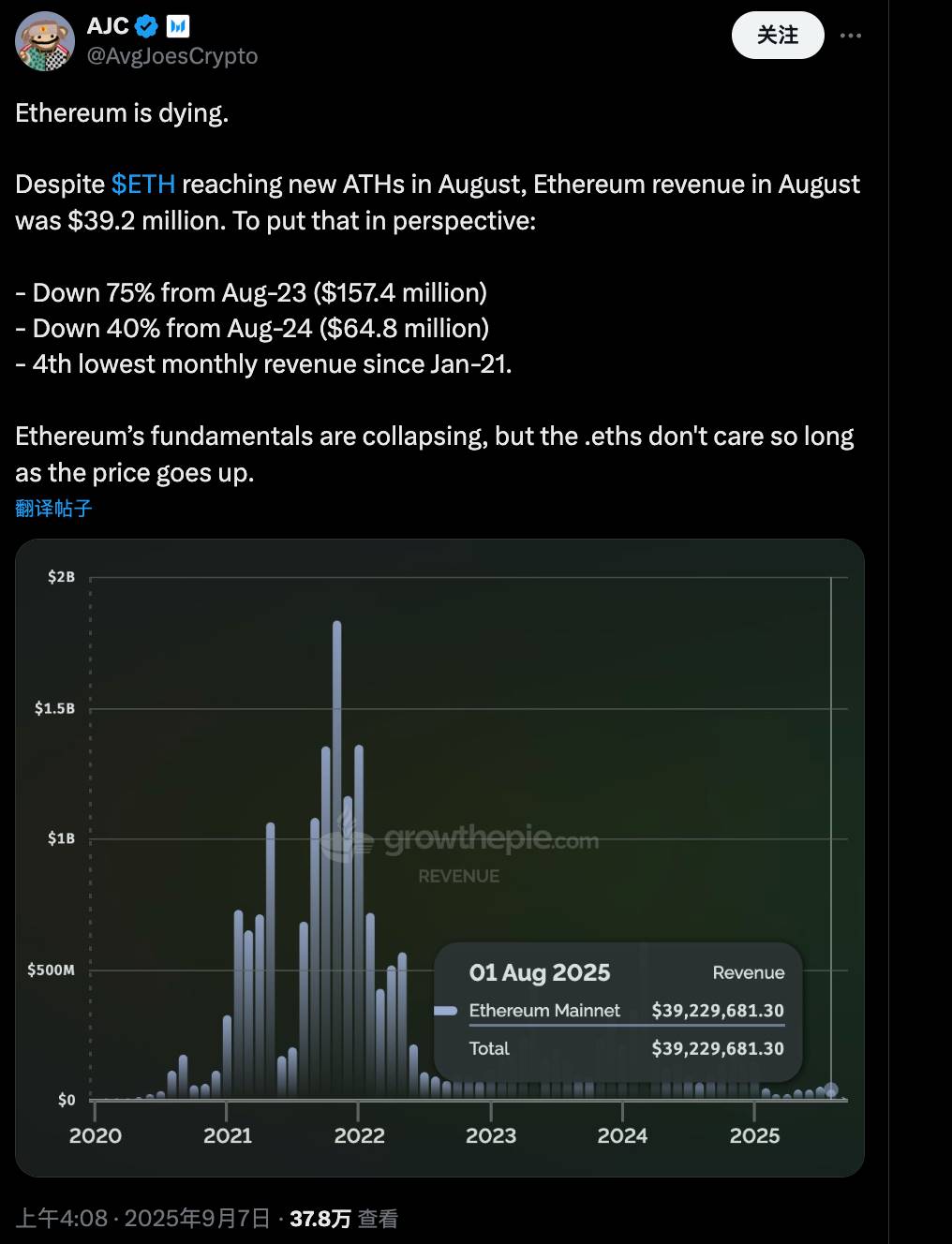

Ethereum revenue plummets, sparking heated debate in the community—has the alarm bell of decline sounded?

Ethereum carries a more complex and ambitious vision.

深潮·2025/09/08 15:21

Millionaires flock to renting, marking a major shift in American wealthy living preferences

From 2019 to 2023, the number of millionaire renters in the United States more than doubled.

深潮·2025/09/08 15:20

Ethena Labs Invests in Based to Boost USDe Stablecoin Adoption on Hyperliquid

TheCryptoUpdates·2025/09/08 15:18

Bitcoin, Ethereum ETFs See $400M Outflows, Institutional Interest Intact

Coinlive·2025/09/08 13:36

World Liberty Financial Blacklists 272 Crypto Wallets

Coinlive·2025/09/08 13:36

Public Blockchains Affirmed as Regulatory Standard Amid Corporate L1 Growth

Coinlive·2025/09/08 13:36

SEC and CFTC Harmonize Crypto Rules to Enhance Market

Coinlive·2025/09/08 13:36

SEC and CFTC Propose 24/7 Crypto Market Policy

Coinlive·2025/09/08 13:36

Linea Announces $LINEA Airdrop and Incentive Program

Coinlive·2025/09/08 13:36

Flash

- 16:07New York Fed: Tight Labor Market Impacts Consumer ConfidenceJinse Finance reported that the weak labor market this summer has affected Americans' outlook on the economic future. The latest consumer expectations survey from the New York Fed shows that in August, consumers' views on future employment prospects and the unemployment rate worsened, while short-term inflation expectations rose. In August, the proportion of people expecting the unemployment rate to rise in the next year increased by 1.7 percentage points from 37.4% in July to 39.1%. Meanwhile, expectations for the likelihood of finding a new job if losing their current one dropped by 5.8 percentage points to 44.9%—the lowest value since the New York Fed began tracking this data in June 2013. The pessimism toward the labor market may be justified. Hiring has been weak since May. In August, the U.S. added only 22,000 jobs, far below economists' expectations of an increase of 76,500 jobs. The unemployment rate rose to 4.3%, the highest level since 2021, while the number of people applying for unemployment benefits steadily increased in August.

- 16:06Market Analysis: Five Major Reasons for Gold's New All-Time HighJinse Finance reported that gold prices have reached a new high, standing at $3,640 per ounce, with an intraday increase of nearly 1.5%. According to Adam Button, an analyst from the US financial website investinglive, after breaking out of the consolidation range from April to September, gold prices have shown a parabolic upward trend. There is no real secret behind this, mainly due to the following five reasons: 1. Trump is attempting to control the Federal Reserve and push interest rates down to levels they would not otherwise reach. 2. The global trade order is disintegrating. 3. The global order surrounding military intervention is collapsing (referencing US Vice President Vance's weekend remarks about the killing of a Venezuelan citizen). 4. Fiscal spending is out of control. 5. Technical indicators are unanimously supportive.

- 16:05New WLD treasury company OCTO surges over 1300% intradayBlockBeats News, on September 8, according to market data, the share price of the new WLD treasury company Eightco Holdings (OCTO) surged by 1,338.62% during trading, now quoted at $20.86, with a current market capitalization of $49.6293 million. BlockBeats previously reported that the company's closing price in the previous trading session was only $1.45, with a market capitalization of just $4.4149 million. BlockBeats previously reported that Eightco Holdings announced a $250 million private placement and received a $20 million strategic investment from BitMine to launch the world's first Worldcoin (WLD) treasury strategy.