News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(September 28)|CoinFerenceX 2025 Web3 Conference is about to commence,JUP unlocks 53.47 million tokens; Kraken raises $500 million;2Grayscale’s XRP ETF Decision Set for October 183Solana price prediction 2025-2031: Trends and insights for investors

Smart "Gatekeepers": How "Conditional Liquidity" is Redefining Solana's Trading Rules

Conditional liquidity is not just a technological innovation; it is a profound restructuring of fairness and efficiency in the DeFi market.

Bitget Wallet·2025/09/28 06:24

Exploring Network School: A Web3 Utopia Built in an Unfinished Country Garden Building in Malaysia

Is it worth spending $1,500 to join Network School?

深潮·2025/09/28 05:11

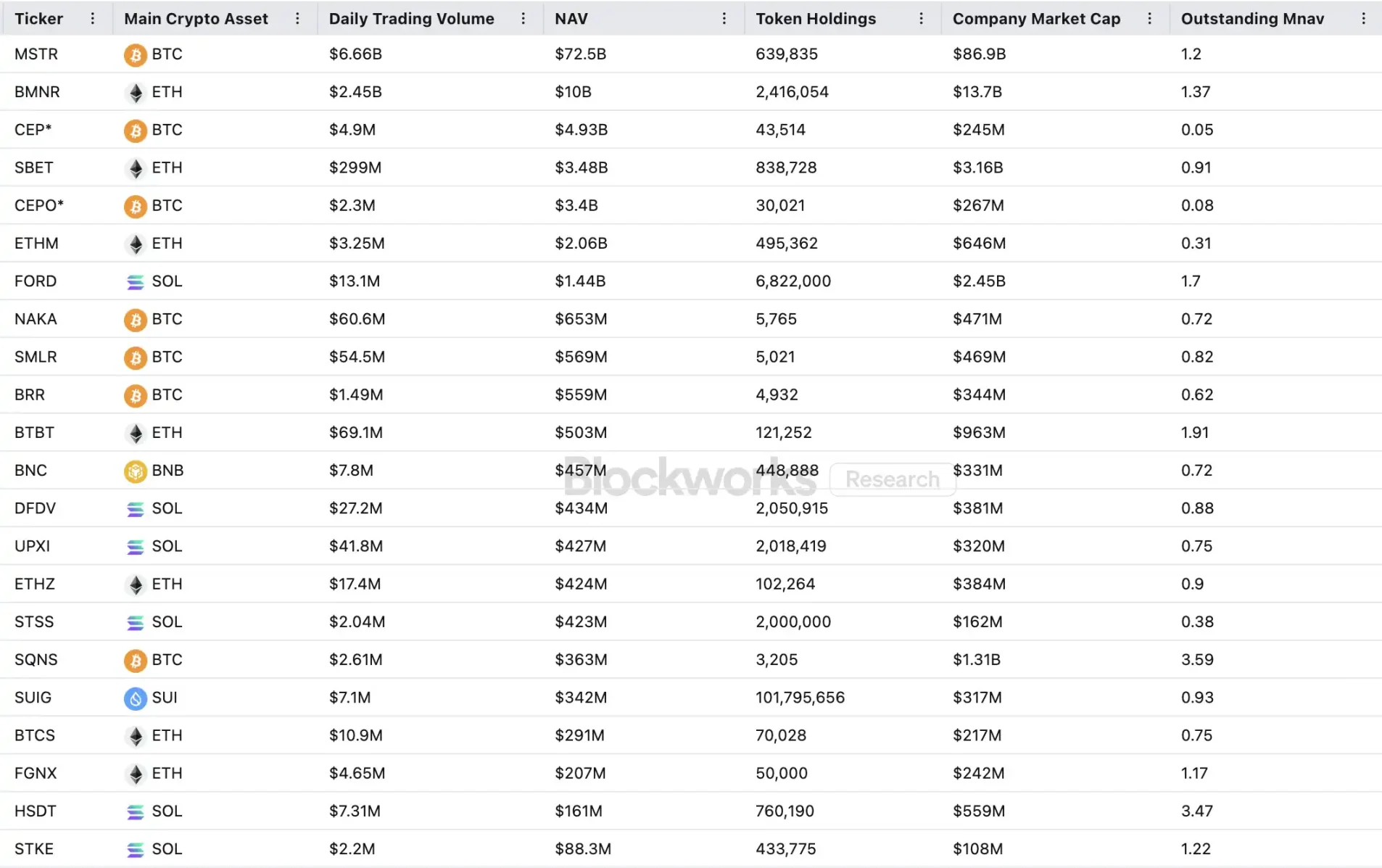

The US SEC starts targeting crypto treasury companies. Will the DAT narrative continue?

DAT hits the brakes—what should investors pay attention to?

深潮·2025/09/28 05:11

Cryptocurrency enters its "adolescent stage": What is the future development of Ethereum?

Cryptocurrencies have entered their "adolescent" stage, but progress in usability remains slow. This is largely due to previously high transaction fees and clumsy user interfaces.

Ebunker·2025/09/28 04:32

UAE Joins Crypto-Asset Tax Information Exchange

Coinspaidmedia·2025/09/28 04:03

Morgan Stanley to Open Crypto Trading to Retail Clients in 2026

Coinspaidmedia·2025/09/28 04:03

Cloudflare Launches NET Dollar Stablecoin for AI-Driven Internet Economy

Coinspaidmedia·2025/09/28 04:03

Options Data Reveals Growing Skepticism in Bitcoin Price Outlook

Cointime·2025/09/28 03:27

How Cryptocurrency is Disrupting Financial Markets and Future Prospects

These dizzying changes have generated billions of dollars in profits for the industry, while also bringing increased risks for investors and regulators.

Chaincatcher·2025/09/28 02:46

Flash

- 07:37Cathie Wood: Disagrees with Tom Lee, says BTC has never been hacked and continues to grow in scale, while ETH faces intense competitionJinse Finance reported that Ark Invest founder and CEO Cathie Wood, in a recent interview on "The Master Investor" podcast, stated that she does not agree with Tom Lee's views. She prefers bitcoin over ethereum because the scale of bitcoin will continue to expand. It is a rules-based global monetary system, a Layer 1 that has never been hacked, and the first platform to pioneer a new asset class. In contrast, ethereum supports DeFi but faces increasingly fierce competition from Layer 2. However, Cathie Wood also mentioned that she will pay more attention to ethereum and purchase Bitmine stock.

- 07:37A PEPE whale spent approximately $1.2 million to purchase EIGEN and LINEA tokens.According to a report by Jinse Finance, on-chain analyst OnchainLens (@OnchainLens) has monitored that a PEPE whale spent 262.84 ETH (worth $1.07 million) to purchase 561,923 EIGEN tokens at a price of $1.90 each, and also spent 30 ETH ($121,000) to acquire 4.26 million LINEA tokens. The whale's current holdings include: 1.34 trillion PEPE (worth $12.31 million), 19.73 million ENA (worth $11.29 million), 26,500 AAVE (worth $7.08 million), 685,980 PENDLE (worth $3.14 million), and 50.78 million LINEA (worth $1.41 million).

- 07:31The whale who previously profited $38.77 million by manipulating the price of XPL has once again made a profit of $41.38 million by going long on XPL.BlockBeats News, on September 28, according to on-chain data analyst Yu Jin's monitoring, the whale trader who profited $38.77 million a month ago by manipulating XPL liquidations has now made another $41.38 million profit from XPL trading. Previously, on August 27, he used two wallets to first take long positions in advance, then pushed up the price to trigger automatic liquidation, thereby earning a profit as high as $38.77 million. He then dispersed the profits across more than 20 addresses via cross-chain transfers, and used 1x leverage to open new long positions of about 45 million XPL at an average entry price of $0.77. At that time, the vast majority of XPL long positions on Hyperliquid were held by him alone. These XPL long positions remained unchanged until yesterday, when, with XPL priced at $1.3, he closed all these 1x leveraged XPL contract longs and bought XPL spot. He currently holds 45.47 million XPL spot, with a cost price of only $0.77, and an unrealized profit as high as $41.38 million.