News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

With a $200 million endorsement, a new force is accelerating its entry into the perpetual contract sector.

The Messari report analyzes the latest developments of USDD 2.0, including multi-chain ecosystem expansion, over-collateralization mechanisms, PSM, and innovative designs such as smart allocators, demonstrating its robust growth and long-term value potential. Summary generated by Mars AI This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still undergoing iterative updates.

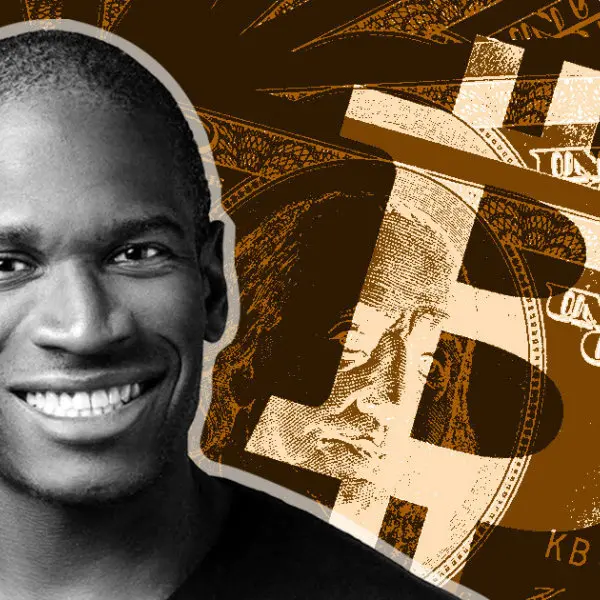

This article summarizes Arthur Hayes' key viewpoints at the KBW 2025 Summit, stating that the United States is heading towards a politically driven “money-printing frenzy.” It details the mechanisms of financing reindustrialization through Yield Curve Control (YCC) and commercial bank credit expansion, emphasizing the potentially significant impact this could have on cryptocurrencies.

Australia's financial environment has become more accommodative and certain effects are already evident, but it will still take time to see the full impact of earlier interest rate cuts. The bank believes it should remain cautious and continually update its outlook as new data emerges.

The Reserve Bank of Australia finds itself in a "happy dilemma": the economy is performing well, but inflation may be running a bit too hot...

This release marks a key step for Edgen toward building a transparent and collaborative financial ecosystem—enabling investors, developers, and protocols to operate efficiently on a unified smart foundation.

Quick Take Summary is AI generated, newsroom reviewed. BlackRock's Ethereum ETF (ETHA) executed a large $154.2 million ETH purchase via Coinbase Prime, as confirmed by Arkham Intelligence on-chain data. This represents one of BlackRock's largest Ethereum acquisitions recently, reinforcing its active presence in the digital asset space since the ETH ETF approvals. The accumulation signals institutional confidence in Ethereum's long-term investment case, driven by its role as a backbone for DeFi and ongoing

- 11:03The total amount of ETH held by ETH reserve entities exceeds 12 million, accounting for over 10% of the total ETH supply.According to Jinse Finance, data from StrategicETHReserve shows that the total amount of ETH currently held by ETH ETFs, DAT companies, DeFi, and other ETH reserve entities has reached 12.11 million ETH, accounting for over 10% of the total ETH supply. Among them, ETH ETFs hold 6.62 million ETH, with a market value of approximately $26.6 billion; DAT companies, DeFi, and other SER entities hold 5.49 million ETH, with a market value of approximately $22.1 billion.

- 10:46Jefferson: The Federal Reserve's balance sheet will continue to shrink in an orderly mannerChainCatcher news, according to Golden Ten Data, Federal Reserve Vice Chairman Jefferson stated that the balance sheet will continue to shrink in an orderly manner.

- 10:29Prediction market data: Probability of U.S. government shutdown rises to 86%ChainCatcher news, according to a report by Gelonghui, as of Tuesday morning local time, the latest data from the Polymarket prediction market shows that the market expects the risk of a US government shutdown this year to rise to 86%(up from 85% earlier). This probability has been increasing after the final negotiations between Trump and Congressional leaders failed to reach an agreement. Data from the Kalshi prediction market shows the probability of a US government shutdown at 83%, compared to about 70% before yesterday's White House meeting.