News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

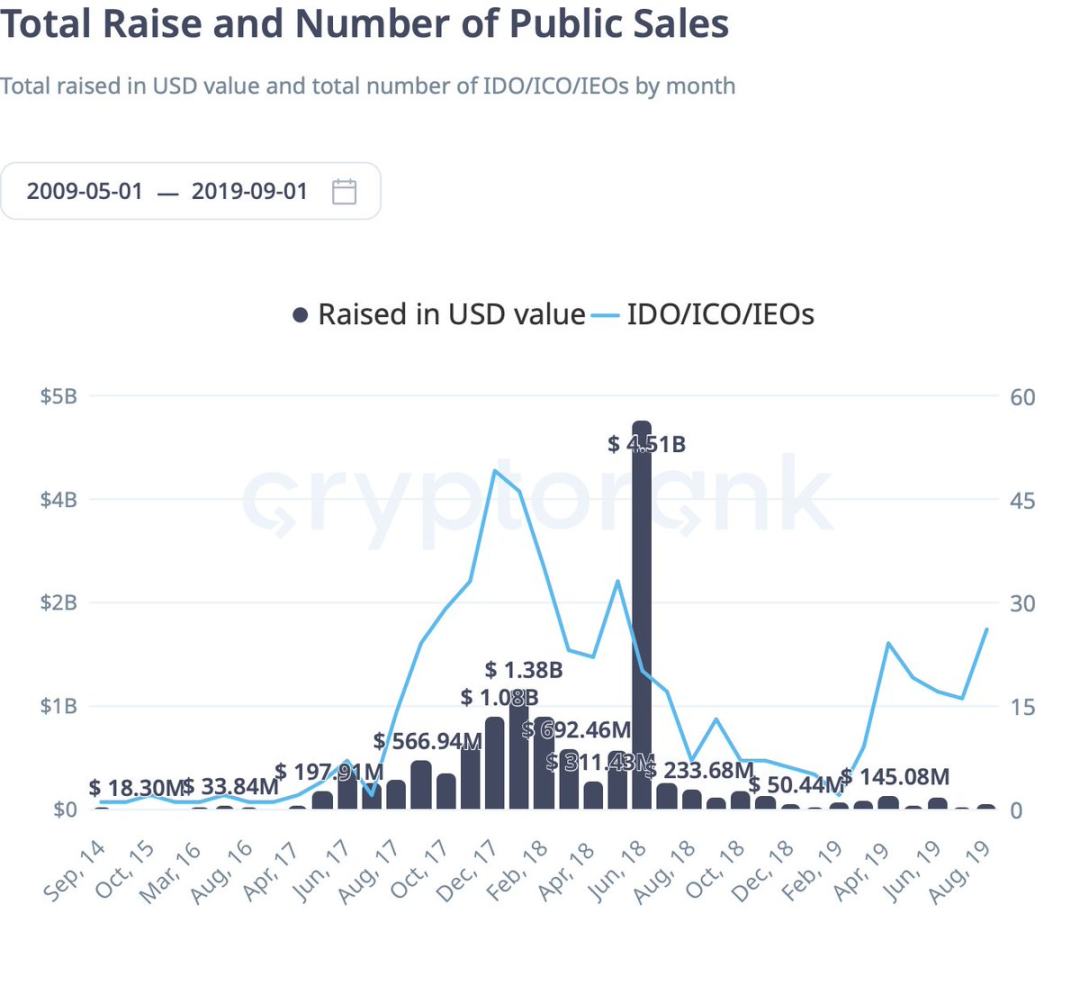

In 2025, ICOs accounted for approximately one-fifth of all token sale trading volume.

The L2 project MegaETH, backed by Vitalik, is about to launch its public sale.

Quick Take Summary is AI generated, newsroom reviewed. BitMine purchased 104,336 ETH worth $417 million during a 20% price dip. Rising Ethereum whale activity signals renewed institutional accumulation. On-chain data confirms large holders are steadily increasing their positions. The move highlights confidence in Ethereum’s long-term strength despite short-term volatility.References 🔥 TODAY: BitMine bought 104,336 $ETH worth $417M as prices fell 20% from August highs, per onchain data.

With the transfer of 127,271 BTC, the United States has become the world's largest sovereign holder of bitcoin.

- 06:01Analyst: Bitcoin's main support level is in the $106,000 to $107,000 range; if it fails, it will test $100,000.ChainCatcher news, CryptoQuant analyst Axel stated on social media, "The main support zone for bitcoin is currently concentrated in the $106,000–$107,000 range (STH 1-month to 3-month realized price - 200-day simple moving average). If this range is lost, BTC will test the $100,000 support, which is where the annual moving average (365-day simple moving average) is located. As long as this base holds, the market structure remains bullish."

- 06:01A certain whale has lowered the ETH buy order price to the $3,660-$3,710 range for $11 million.According to Jinse Finance, on-chain analyst Ai Yi (@ai_9684xtpa) monitored that after Ethereum fell below $3,900, a certain whale readjusted their limit buy order strategy in the early hours today. The whale adjusted the Ethereum bottom-fishing price range to $3,660-$3,710, planning to invest $11 million at this price range, which is about $100 lower than the previous order price.

- 05:57US crypto stocks mostly fell, with MSTR down 4.35% and SOL treasury stock HSDT down 36.49%.BlockBeats News, October 17, according to market data, U.S. stocks closed lower on Thursday, with all three major indexes declining. The Dow Jones closed down 0.65%, the S&P 500 Index fell 0.63%, and the Nasdaq Composite Index dropped 0.47%. Cryptocurrency stocks generally declined, including: Certain Exchange (COIN) fell 1.8% Circle (CRCL) fell 4.48% Strategy (MSTR) fell 4.35% Bullish (BLSH) fell 1.88% Bitmine (BMNR) fell 5.06% SharpLink Gaming (SBET) fell 3.83% BTCS (BTCS) fell 6.47% BNB Network Company (BNC) fell 10.6% ALT5 Sigma (ALTS) fell 9.13% American Bitcoin (ABTC) fell 10.02% New SOL treasury stock Helius (HSDT) fell 36.49% BTC treasury stock Kindly MD (NAKA) fell 5.36% New stock Figure (FIGR) fell 9.32%