News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Morning Brief (October 22) | Japan’s Financial Services Agency Explores Allowing Banks to Hold and Trade Cryptocurrencies; Tether’s USDT Users Surpass 500 Million2Crypto Market Prediction: XRP Switches From Bullish to Bearish, Shiba Inu's (SHIB) Evil Zero Is Back, Who Pushed Bitcoin (BTC) Down From $110,000?3Ethereum ETFs lose $145 million as investors await inflation data

Nearly $300M wiped out as Bitcoin retreats to $108K

Coinjournal·2025/10/22 17:48

Jupiter DEX partners with Kalshi to launch F1 Mexico Grand Prix prediction market on Solana

Coinjournal·2025/10/22 17:48

ASTER price outlook after Solana co-founder unveiled a rival perp DEX

Coinjournal·2025/10/22 17:48

APT price soars as BlackRock’s BUIDL fund expands to Aptos

Coinjournal·2025/10/22 17:48

Cardano Price Prediction: ADA Price Drops to CRITICAL Level as Bitcoin Crashes

Cryptoticker·2025/10/22 17:39

Crypto Adoption Booms Worldwide — So Why Is the Market Still Down?

Cryptoticker·2025/10/22 17:39

Ethereum Foundation’s $654 Million ETH Transfer Sparks Debate Over Transparency

Cryptoticker·2025/10/22 17:39

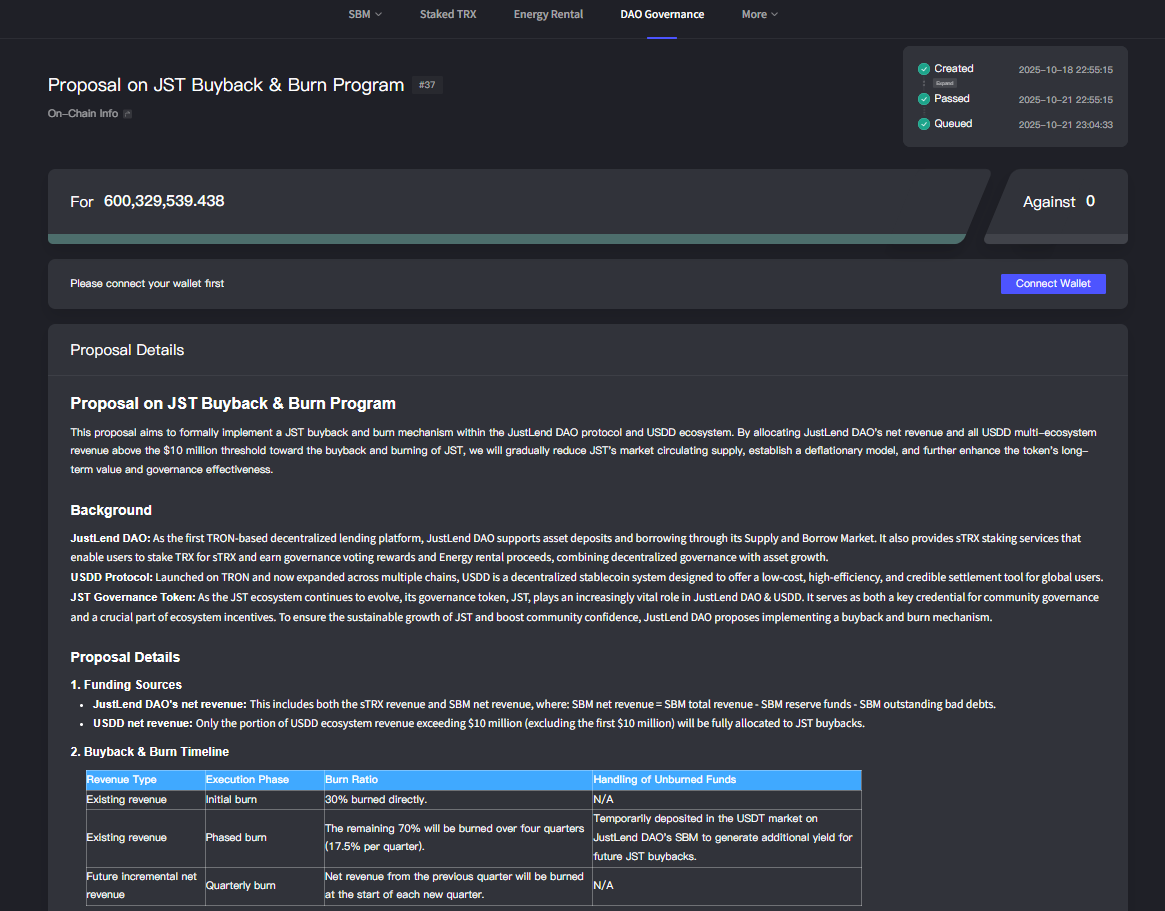

JustLend DAO launches nearly $60 million JST buyback and burn plan powered by ecosystem revenue

The "JST buyback and burn" proposal has been officially approved with a high number of votes in favor, marking the official implementation of JST's deflationary mechanism.

深潮·2025/10/22 17:23

Bitcoin Cash Weakens, PEPE Coin Falls, While BlockDAG’s $430M Presale Highlights Which Crypto to Buy Now

Coinlineup·2025/10/22 17:09

Flash

- 17:06BNB treasury company Applied DNA completes PIPE financing and additionally purchases 4,908 BNBForesight News reported that BNB treasury company Applied DNA Sciences, Inc. (NASDAQ: BNBX) announced the completion of its previously disclosed PIPE (Private Investment in Public Equity) financing, which was co-led by institutional DeFi and TradFi investors. This PIPE financing brought the company approximately $27 million in total proceeds (before deducting underwriting and related fees), and the company may obtain up to an additional $31 million in total proceeds through the exercise of warrants in the future. The total proceeds from this PIPE round include: $15.3 million in cash and stablecoins; and $11.71 million worth of units of the OBNB trust. The company received 0.126 units of the OBNB trust per prefunded warrant and common warrant, totaling 435,638 trust units, representing indirect ownership of 10,647 BNB tokens. In addition, the company announced today that it has purchased an additional 4,908 BNB tokens, with a total value of approximately $5.3 million as of 10:00 PM (UTC+8), October 20, 2025, Eastern Time.

- 17:06"Fed Mouthpiece": The Federal Reserve Loses Access to "ADP" Employment DataJinse Finance reported that "Fed mouthpiece" Nick Timiraos wrote that Federal Reserve officials have recently lost access to employment data provided by third parties. Since 2018, payroll processing company ADP has been providing the Federal Reserve with a dataset containing anonymous employment and income information, covering 20% of the U.S. private sector workforce. The Fed typically received this data with about a one-week delay, making it a timely and comprehensive measure of labor market conditions. According to informed sources, after Federal Reserve Governor Waller delivered a speech at the end of August that drew public attention to the Fed's long-term use of ADP employment data, ADP stopped providing this data to the Fed. The specific reason for this change remains unclear. In Waller's speech, he cited ADP data in a footnote, further illustrating his concerns about the slowdown in the labor market. The footnote pointed out that preliminary estimates showed a continued deterioration in hiring conditions over the summer, and the data covered a period beyond the latest government data.

- 17:06MegaETH will conduct its ICO through an auction format, starting with a valuation of 1 million USD.Foresight News reported that MegaETH, an Ethereum scaling solution developed by MegaLabs, announced on X platform that it will launch a public sale on Echo's Sonar platform, with an initial fully diluted valuation (FDV) of $1 million and a valuation cap set at $999 million. Users can bid through an English auction, with the highest bid reaching $186,282. In the event of oversubscription, priority will be given to existing MegaETH community members, as well as investors who demonstrate long-term consistency through social activities, on-chain behavior, and locking preferences. The dual-peak allocation process ensures both broad token distribution and priority protection for key contributors. MegaETH's core supporters will receive priority allocation, while at least 5,000 participants will be granted a basic allocation at the starting price of $2,650. 5% of the total MEGA tokens will be sold on October 27. The registration process for participation eligibility is now open.