News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

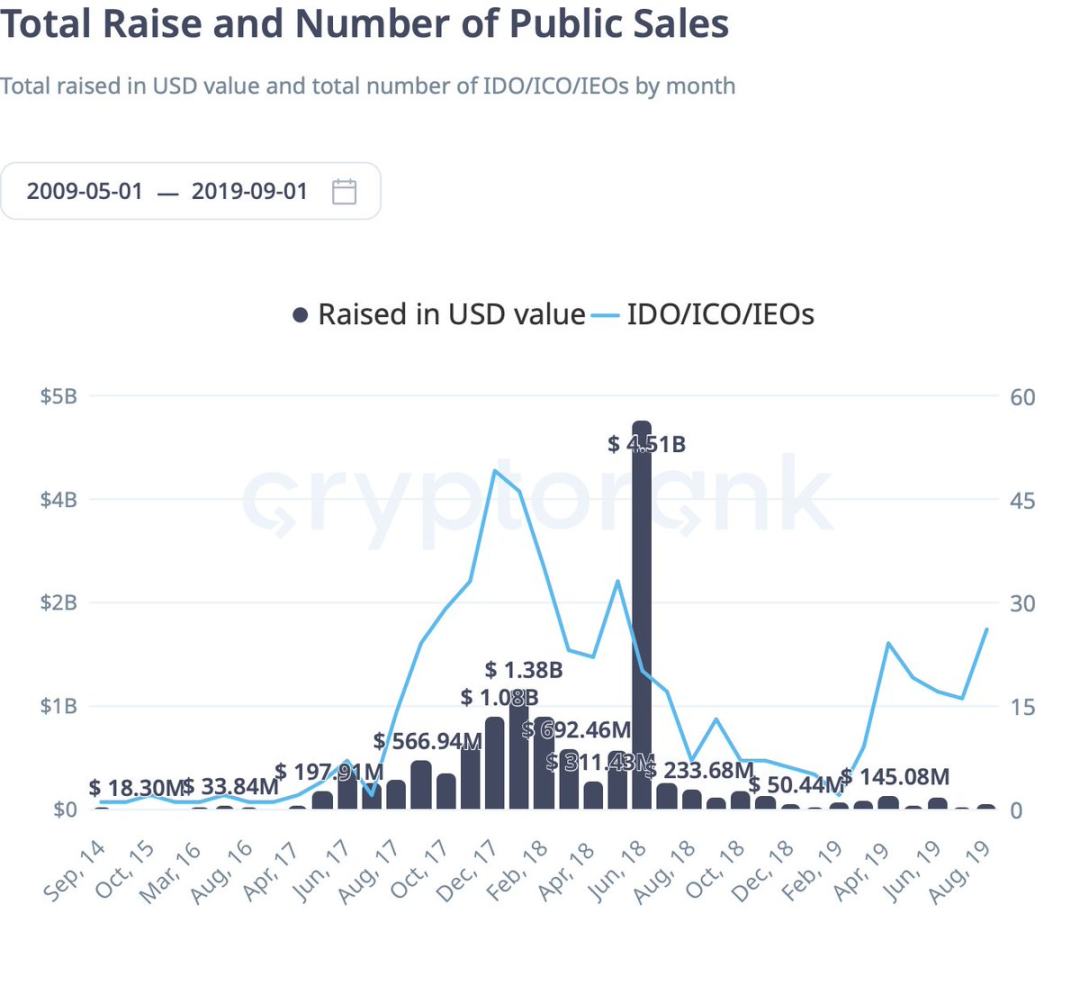

In 2025, ICOs accounted for approximately one-fifth of all token sale trading volume.

The L2 project MegaETH, backed by Vitalik, is about to launch its public sale.

Quick Take Summary is AI generated, newsroom reviewed. BitMine purchased 104,336 ETH worth $417 million during a 20% price dip. Rising Ethereum whale activity signals renewed institutional accumulation. On-chain data confirms large holders are steadily increasing their positions. The move highlights confidence in Ethereum’s long-term strength despite short-term volatility.References 🔥 TODAY: BitMine bought 104,336 $ETH worth $417M as prices fell 20% from August highs, per onchain data.

With the transfer of 127,271 BTC, the United States has become the world's largest sovereign holder of bitcoin.

- 05:57Bloomberg: Hyperliquid is currently controlled by a small group of insiders and lacks formal regulatory oversightBlockBeats News, October 17, according to Bloomberg, Hyperliquid is currently controlled by a small group of insiders, raising questions about its degree of decentralization. For its backers, including Paradigm and Pantera Capital, it is both a bet on the future of digital finance and a reminder that the entire industry still operates outside formal regulatory frameworks. Essentially, Hyperliquid is a minimalist trading platform operated by Hyperliquid Labs, a Singapore-based team of about 15 people. As is customary in the industry, the website frontend blocks US users, but anyone can trade on the blockchain that supports it. The lack of identity verification is precisely what makes it attractive, echoing an early pattern: rapidly growing trading platforms with similar models often quickly attract regulatory attention. If HLP is likened to an engine, then validator nodes are the control room. Hyperliquid has about 24 validator nodes, whereas the Ethereum network has over one million. Critics argue that this leads to excessive concentration of power. Hyper Foundation controls nearly two-thirds of the staked HYPE—its native token—thus wielding significant influence over validator node decisions and governance, although in several recent decisions, its nodes have chosen to abstain in order to respect community consensus. Kam Benbrik, Head of Research at blockchain validator node company Chorus One, stated, "If you control more than two-thirds of the staked tokens, you can basically achieve control over the chain." Currently, Washington's relatively relaxed stance provides Hyperliquid with room to grow. The question is, how much longer can it continue to operate outside the regulatory spotlight?

- 05:57A certain whale went long on BTC and ETH worth 163 million USD early this morning, currently facing an unrealized loss of 3.38 million USD.According to Jinse Finance, on-chain analyst Yujin monitored that after selling ETH and shorting BTC, the whale, who made a profit of $2.6 million from closing shorts yesterday, has now switched to opening long positions. In the early hours today, he opened long positions worth $163 million in BTC and ETH, currently with an unrealized loss of $3.38 million. He went long on 781 BTC, worth $85.23 million, with an entry price of $110,487; and went long on 19,900 ETH, worth $78.08 million, with an entry price of $4,037.

- 05:57aPriori releases airdrop announcement tweetOn October 17, crypto trading infrastructure startup aPriori posted an airdrop preview tweet on its official X account: "Airdrop claim loading (49% completed)". As previously reported, on August 28, aPriori completed a new $20 million funding round with participation from HashKey Capital, Pantera Capital, Primitive Ventures, and others, bringing its total funding to $30 million. The company utilizes high-frequency trading methods in an attempt to reduce many issues plaguing the crypto market, such as excessive spreads and maximum extractable value (MEV) leakage.