News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Quick Take Summary is AI generated, newsroom reviewed. Ripple CEO Brad Garlinghouse highlighted XRP's ability to settle transactions in approximately 3 seconds, positioning it as a superior alternative to traditional financial networks. Garlinghouse stressed that XRP's long-term value is driven by its utility in solving a big problem, particularly streamlining cross-border payments and asset tokenization. Ripple is focusing on XRP to tokenize and transfer real-world assets like real estate, facilitating ef

Quick Take Summary is AI generated, newsroom reviewed. BitMine added 264,400 ETH, bringing total holdings to 2.42 million. Mid-August purchases spiked with 317,100 ETH, showing an aggressive accumulation strategy. Late August acquisition added 269,300 ETH, strengthening BitMine’s ETH treasury. The company now controls Ethereum worth approximately $9.72 billion in total. Chairman Tom Lee envisions Ethereum’s growth amid rising institutional adoption trends.References UPDATE: Bitmine added another 264K $ETH

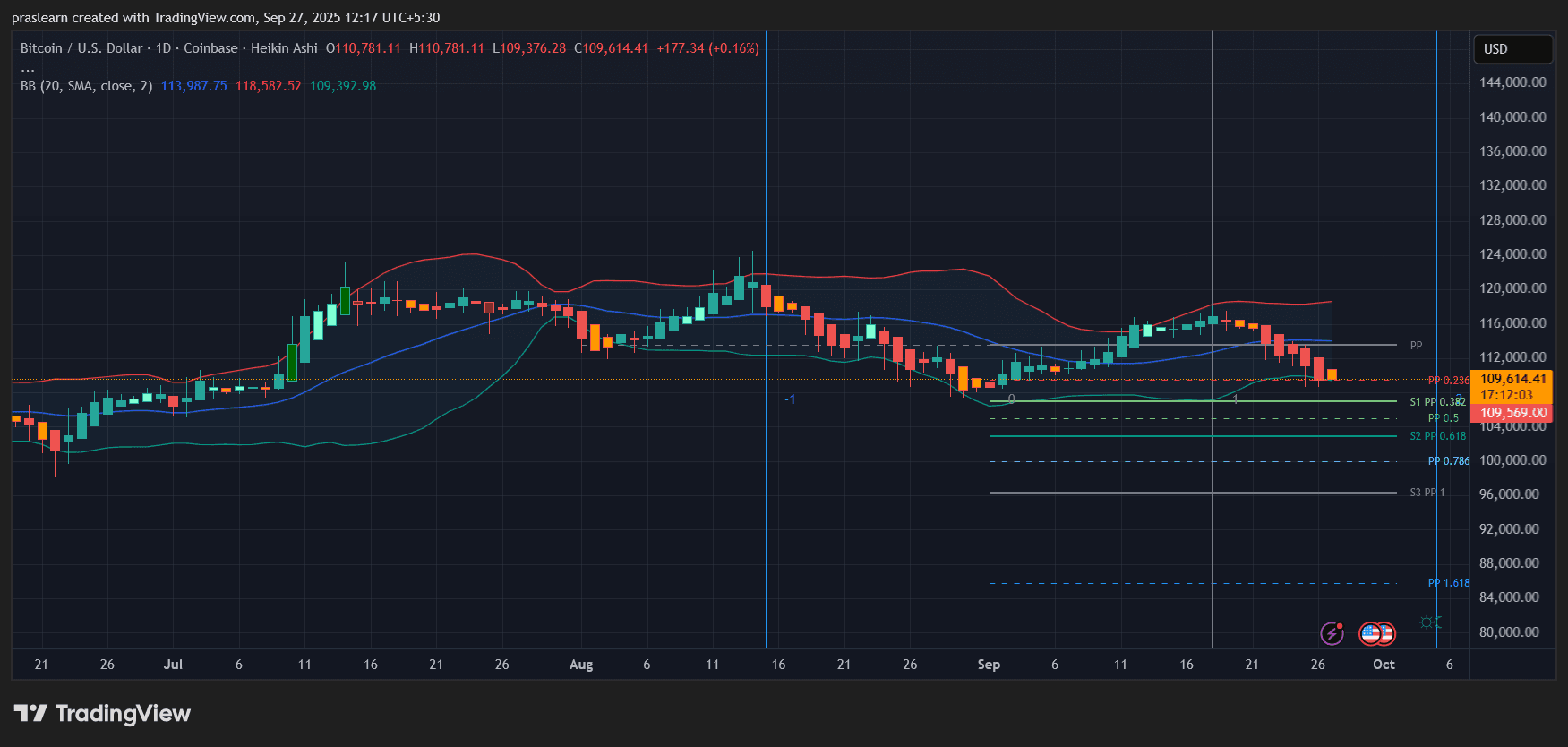

Bitcoin is sliding towards a key support level as inflation rises and the Federal Reserve remains hesitant about cutting interest rates.

For retail investors, for projects that have not yet had a TGE, you can interact with a few of them to earn points; for projects that have already had a TGE, it's best to consider both market cap and trend, and ideally buy on the right side.

- 00:34Hyperdrive: The security incident only affects the Primary USDT0 market and the Treasury USDT market; all market trading and withdrawal functions are currently suspended.According to ChainCatcher, Hyperdrive has officially disclosed that the security issue affecting the protocol has so far been confirmed to impact only two markets: the Primary USDT0 market and the Treasury USDT market. To prevent malicious activity, the protocol has temporarily suspended all markets (including the interest mechanism) and paused all withdrawal functions. The Hyperdrive team stated that they are working with top security and forensic experts to investigate the issue and are developing a patch to resolve it. The team has committed to releasing a full post-mortem report after the investigation is complete and will provide the next substantial update within 24 hours via their official Twitter and Discord channels. The team is currently exploring all possible avenues to mitigate the impact on affected users, prioritizing a comprehensive assessment of the event's overall impact and formulating an integrated remediation plan. Users are advised not to interact with the protocol or send funds to its smart contracts for the time being.

- 00:34Analyst: Options and derivatives may drive Bitcoin's market cap to $10 trillionAccording to ChainCatcher, market analyst James Van Straten pointed out that derivatives such as options contracts will drive bitcoin's market capitalization to at least $10 trillion. He believes that derivatives can not only attract more institutional investors, but also effectively buffer the inherent high volatility risks of the digital currency market. Van Straten cited the record high open interest in bitcoin futures on the Chicago Mercantile Exchange (CME) as an example, illustrating that the market structure is undergoing a significant transformation. He analyzed that this phenomenon is partly due to the widespread adoption of systematic volatility selling strategies (such as covered call options strategies), reflecting enhanced liquidity and increasing maturity in the bitcoin derivatives market. At the same time, he also pointed out that lower volatility has a two-way impact: while it can mitigate the sharp declines commonly seen in the crypto market, the high-yield surges that investors are accustomed to will also decrease accordingly.

- 00:22Analyst: Multiple Solana ETFs may be approved within weeks as several asset management firms simultaneously revise their application documentsChainCatcher reported that several asset management companies collectively updated their Solana ETF application documents on Friday, marking another round of intensive revisions following similar activities. Several of the updated application documents include detailed information on how the funds plan to earn additional income for their holdings by staking SOL tokens. Analysts believe that this coordinated wave of application revisions indicates close cooperation between asset management firms and the U.S. Securities and Exchange Commission (SEC), and predict that these Solana ETF products could officially enter the market within weeks.