News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(September 29)|Ethereum Spot ETFs See Record $795 Million Single-Day Outflow; BTC Surges Past $110,000 Amid Market Volatility2Research Report|In-Depth Analysis and Market Cap of Falcon Finance(FF)3Will Bitcoin drop to $95,000 or surge toward $140,000? Cycle signals reveal the real direction

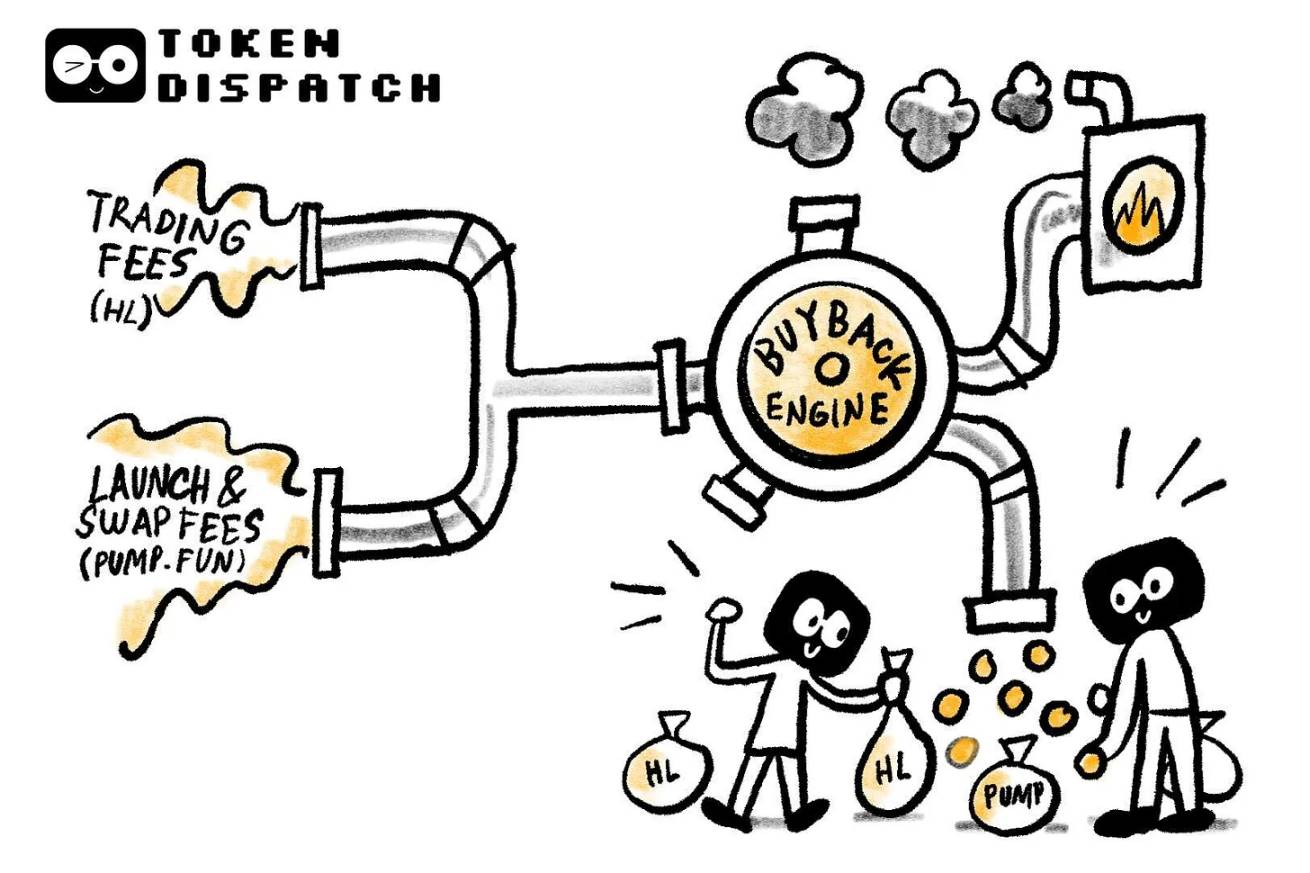

The "Token Deflation Experiment" of Hyperliquid and Pump.fun

Cryptocurrency projects are attempting to replicate the long-term success path of Wall Street’s "dividend aristocrats," such as Apple, Procter & Gamble, and Coca-Cola.

深潮·2025/09/29 22:40

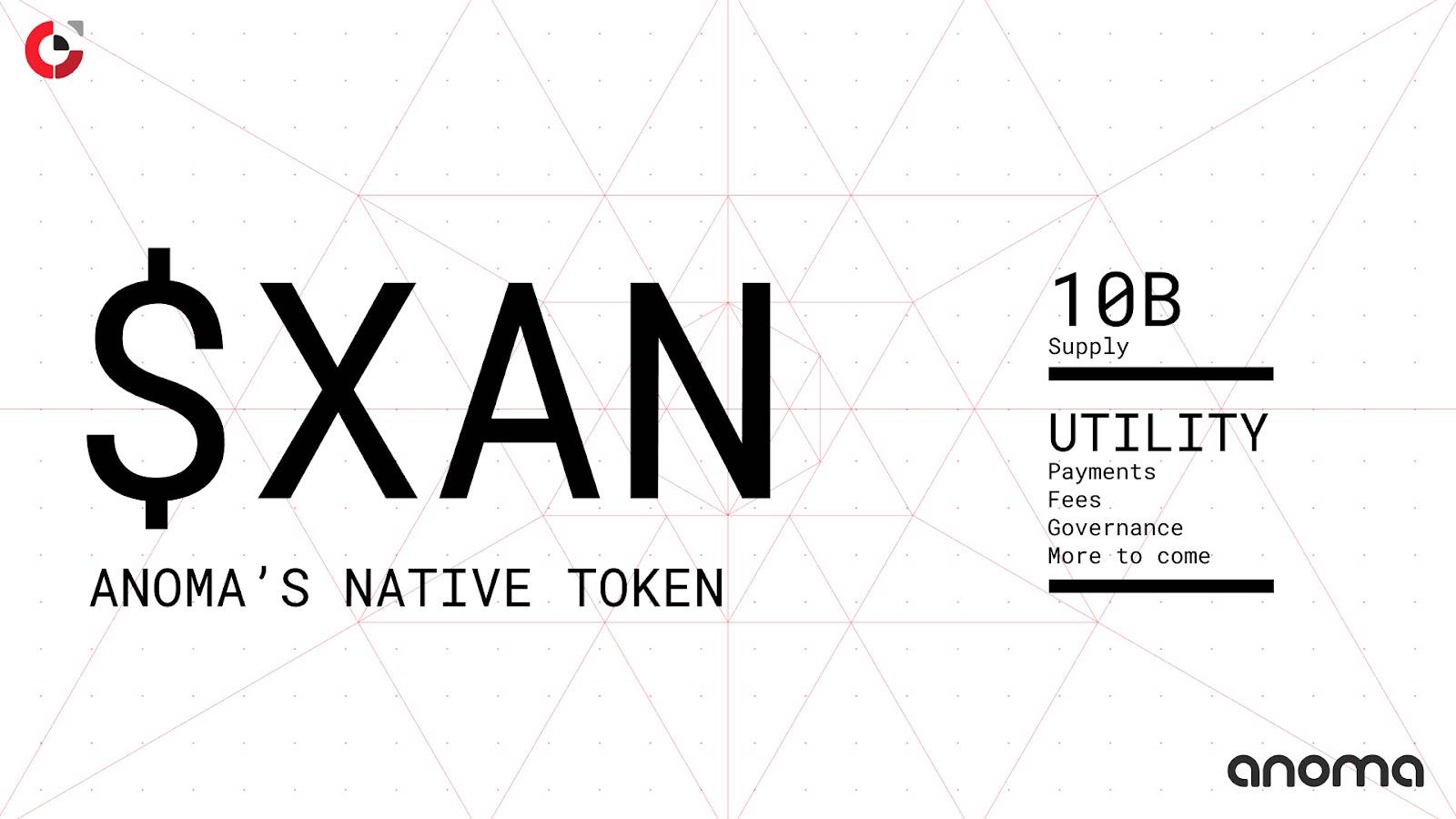

Anoma native token $XAN officially launched, mainnet deployment officially begins

After supporting the Ethereum mainnet, Anoma will first support key Ethereum Layer 2 networks before expanding to other ecosystems.

深潮·2025/09/29 22:38

Analysts Say XRP Could Reach $4 Following SEC Ruling and Growing Institutional, CBDC Interest

Coinotag·2025/09/29 20:55

Bitcoin May Consolidate Near $109K as 50 EMA and Fibonacci Retracements Could Provide Key Support

Coinotag·2025/09/29 20:54

Bitcoin’s 7% Dip Pattern Could Precede Rally as Altcoins Eye Breakout Above $1.2T

Coinotag·2025/09/29 20:54

Ethereum Could Hold Mid-Channel Support as Some Analysts Cite Momentum, Potential $10,000 Target

Coinotag·2025/09/29 20:54

Solana (SOL) Shows Signs Of Rebound – Will Bears Step In Again Soon?

Newsbtc·2025/09/29 20:54

Shiba Inu Consolidates Near $0.0000119 as Support Holds Steady

Cryptonewsland·2025/09/29 20:42

Dogecoin Forms Rare Bump and Run Pattern with 64.68% Success Rate

Cryptonewsland·2025/09/29 20:42

XRP Stuck in Tight Range as $2.74 Support and $2.86 Resistance Define Next Move

Cryptonewsland·2025/09/29 20:42

Flash

- 22:12Analysis: Spot gold price surpasses $3,800/oz; institutions say there is still room for medium- to long-term growthJinse Finance reported that institutional insiders believe that, supported by factors such as the Federal Reserve's interest rate cuts, gold prices still have room for long-term growth. The UBS Wealth Management Chief Investment Office (CIO) predicts that by mid-2026, the gold price may reach $3,900 per ounce. From a domestic perspective, the CIO stated that although China's investment demand for gold has weakened in recent weeks due to the rise in its domestic stock market, with the continued increase in gold prices, China's gold ETF holdings are expected to recover. In addition, the latest policy address in Hong Kong plans to expand gold reserves in Hong Kong and establish a central gold clearing system, which is also expected to provide support for gold prices.

- 22:05The probability of the Federal Reserve cutting interest rates by 25 basis points in October reaches 89.8%.According to ChainCatcher, citing Jinse Finance, CME "FedWatch" shows that the probability of the Federal Reserve keeping interest rates unchanged in October is 10.2%, while the probability of a 25 basis point rate cut is 89.8%. In addition, the probability of the Federal Reserve keeping interest rates unchanged in December is 2.5%, the probability of a cumulative 25 basis point rate cut is 29.9%, and the probability of a cumulative 50 basis point rate cut is 67.6%.

- 21:22The tokenized gold market approaches $3 billion, reaching a record high.Jinse Finance reported that against the backdrop of spot gold prices surpassing $3,800 per ounce, the total market capitalization of the tokenized gold market reached a historic peak of $2.88 billions on September 29. The two major gold tokens, XAUT and PAXG, both saw monthly trading volumes exceed $3.2 billions, with PAXG recording a net inflow of $40 millions in a single month. Analysts pointed out that expectations of a Federal Reserve rate cut, inflationary pressures, and a potential government shutdown have jointly driven this round of gold price increases. In comparison, gold's year-to-date increase of approximately 47% has far outperformed bitcoin's 22% gain. Tokenized gold, with its 24/7 trading and on-chain instant settlement features, is becoming an important supplementary channel for traditional gold investment.