Bitcoin Supply Overhang: 6.6 Million BTC Bought Above Current Price

On-chain data shows a chunk of the Bitcoin supply has its cost basis above the current spot price, which could potentially shape volatility if BTC rebounds.

Bitcoin Supply Overhang Could Dictate Volatility & Selling Pressure

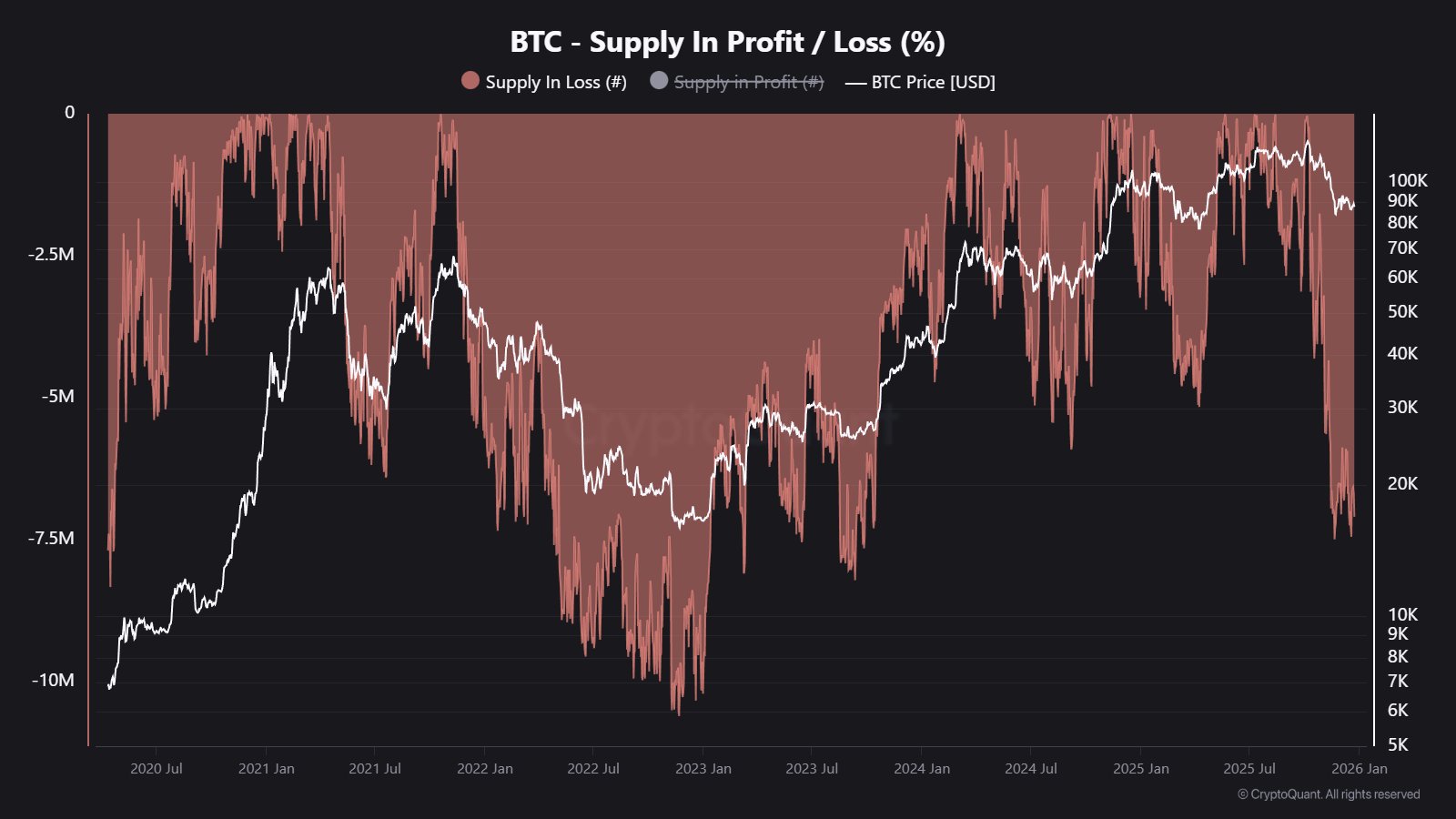

As pointed out by CryptoQuant community analyst Maartunn in a new post on X, over 6.6 million BTC is being held above the latest spot price of the cryptocurrency. The on-chain indicator of relevance here is the “Supply In Loss,” which measures, as its name suggests, the total amount of Bitcoin that’s currently carrying some net unrealized loss.

The metric works by going through the transaction history of each token in circulation to determine the price at which it was last transacted on the blockchain. If this previous transfer price was more than the current spot price for any coin, then that particular token is considered to be in a state of loss.

The Supply In Loss adds up all coins fulfilling this condition to find the total situation on the network. A counterpart indicator called the Supply In Profit accounts for the supply of the opposite type.

Now, here is the chart shared by Maartunn that shows the trend in the Bitcoin Supply In Loss over the last few years:

The value of the metric seems to have been elevated in recent days | Source:

@JA_Maartun on X

The value of the metric seems to have been elevated in recent days | Source:

@JA_Maartun on X

As displayed in the above graph, the Bitcoin Supply In Loss shrunk to a value of zero as the asset’s price set its all-time high (ATH) above $126,000 back in October, but with the market downturn that has followed since then, the indicator’s value has shot up.

Today, around 6.6 million tokens of the cryptocurrency sit below cost basis, equivalent to a third of the BTC supply in circulation. The recent highs in the Supply In Loss represent the highest degree of pain in the market since 2023.

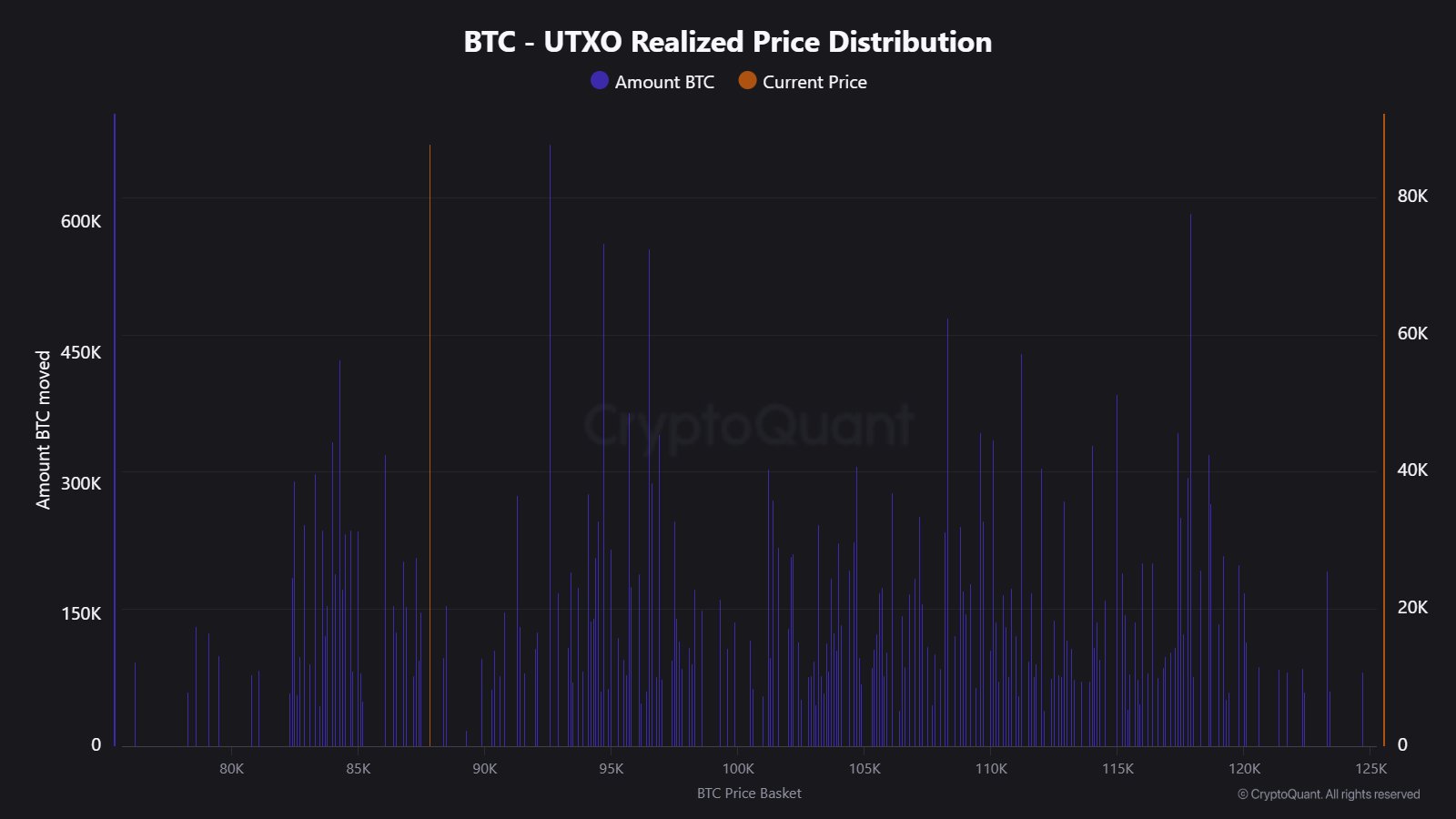

In another X post, the analyst has shared the chart for another Bitcoin indicator, this one called the UTXO Realized Price Distribution (URPD). The URPD contains information about how much BTC was bought last at each of the levels that the asset has visited in its history.

From the chart of the URPD, it’s visible how the Bitcoin supply that’s in loss is distributed across the various levels right now. A few levels are particularly prominent in the degree of supply that they carry, while some others are notably thin with coins.

Generally, investors who are in loss look forward to a retest of their cost basis so that they can get their money “back.” Once this happens, some of these hands decide to exit, fearing that BTC will go down again in the near future. This selling can make large supply clusters above the spot price, potential points of volatility.

Considering that a large portion of the supply is underwater right now, a venture back to higher levels could be met with selling pressure for Bitcoin.

BTC Price

Bitcoin has made some recovery during the past day as its price has returned to $88,600.

The trend in the price of the coin over the last five days | Source:

BTCUSDT on TradingView

The trend in the price of the coin over the last five days | Source:

BTCUSDT on TradingView

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Company Founder Predicts the Level the BTC Price Will Reach in 2026

China Tightens Silver Exports as Bitcoin Sees Whale Activity

Massive SHIB Withdrawal Stirs Crypto Community’s Curiosity