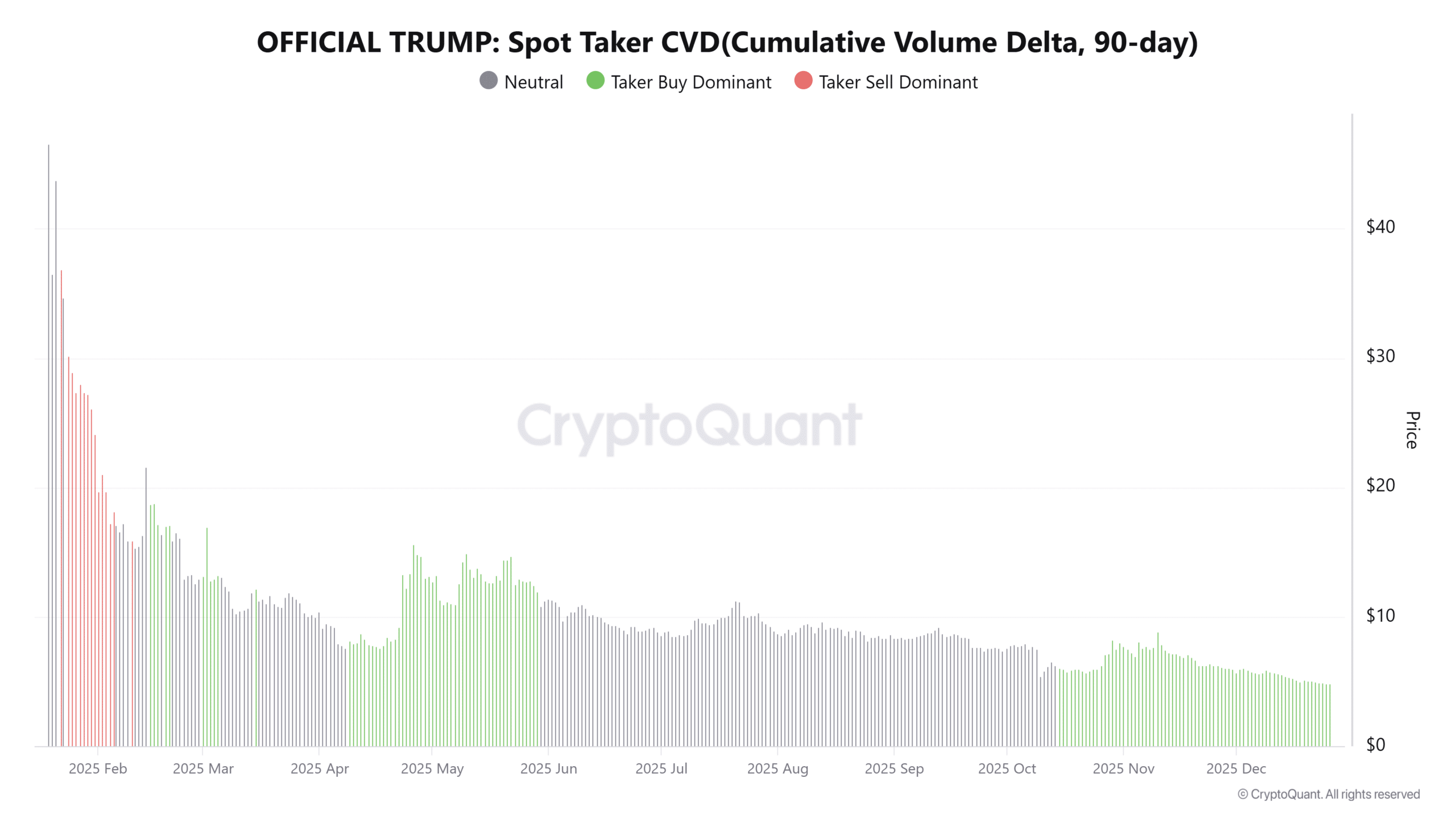

As we approach the end of 2025, the cryptocurrency market presents an unusual picture. Bitcoin prices have been stagnating within a narrow range for months, while on-chain data reveal that large investors are seizing this period of inactivity as an opportunity. At the same time, traditional safe havens like gold and silver have outperformed Bitcoin, garnering significant attention. This divergence provides important signals for understanding capital rotation and investor psychology in the markets.

On-Chain Data Insights: Large Wallets Spring into Action

According to Glassnode data, the final months of 2025 have witnessed a noticeable increase in net purchases by addresses holding between 100 and 1,000 BTC. Known as “Sharks,” this investor group increased their holdings, forming a new peak in total supply as Bitcoin prices hovered near cycle highs. Some analyses suggest that whales collected approximately $23.5 billion worth of Bitcoin during this period.

Nevertheless, charts indicate aggressive accumulation rather than consistent distribution at this time. Factors like exchange wallet restructuring or custodian address consolidation might affect the data. However, the overall picture implies that large investors’ long-term outlook remains robust. This scenario suggests that “smart money” is taking positions in an environment where smaller investors stay cautious.

Gold and Silver Shine, Bitcoin Lags Behind

Price comparisons over the past six months reveal a clear advantage in favor of traditional commodities over cryptocurrencies. Gold has appreciated by approximately 38%, while silver has soared over 100%, effectively experiencing a rally. In contrast, Bitcoin’s market value, approaching $1.8 trillion, has declined by roughly 17%. This development indicates a shift toward safer assets by investors amid growing global uncertainties.

Moreover, another noteworthy development involves renewed interest in spot Bitcoin ETFs in the United States. Net inflows into certain funds highlight that institutional interest has not disappeared entirely, and despite price pressure, infrastructural demand persists. From a technical standpoint, Bitcoin retraced sharply from its peak above $110,000 and is now trapped between $85,000 and $92,000. Experts believe such prolonged consolidations often herald significant movements.

To sum up, while Bitcoin may appear to have lost its appeal in the short term, a different narrative unfolds behind the scenes. Large investors’ accumulation, institutional interest in ETFs, and technical consolidation collectively suggest that the next market move is crucial. The strong performance of gold and silver casts a shadow over Bitcoin, but directional changes in cryptocurrency markets often occur unexpectedly.