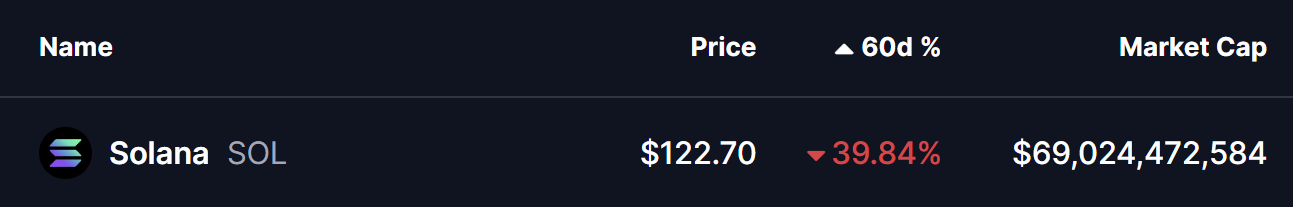

The broader altcoin market continues to face pressure in Q4, with risk appetite remaining muted after the recent market-wide correction. Solana (SOL) has not been spared, dropping nearly 40% in last 60 days, leaving many traders cautious in the near term.

However, beneath the surface, a combination of macro adoption signals and long-term technical structure suggests that SOL may be quietly setting the stage for its next major bullish phase.

Source: Coinmarketcap

Source: Coinmarketcap

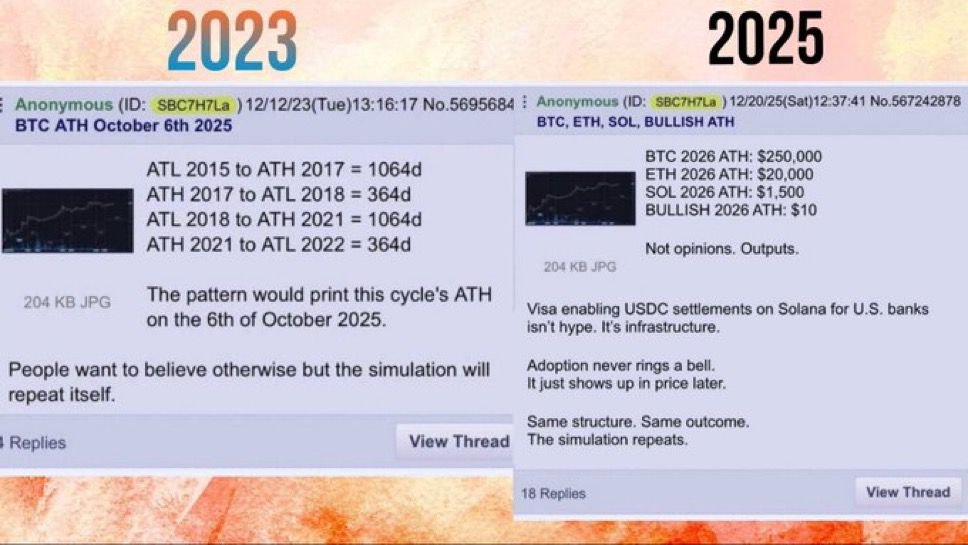

Trader Predicts Solana (SOL) ATH in 2026

A post gaining traction on 4chan comes from an anonymous trader who previously earned attention for accurately calling Bitcoin’s cycle top in October 2025. The same trader is now making an aggressive long-term forecast, projecting Solana (SOL) to reach a new all-time high of $1,500 in 2026, representing more than a 12x move from current levels near $122.

In the December 20, 2025 post, the trader outlined bold targets for the next cycle:

- Bitcoin (BTC) ATH: $250,000

- Ethereum (ETH) ATH: $20,000

- Solana (SOL) ATH: $1,500

- BULLISH (Solana memecoin) ATH: $10

While the targets are ambitious, the thesis behind Solana’s projection is rooted in real-world adoption rather than pure speculation.

Source: @RoundtableSpace (X)

Source: @RoundtableSpace (X)

Core Thesis: Visa’s Solana Integration Is Real Infrastructure

At the heart of the bullish case is Visa’s December 16, 2025 announcement confirming USDC stablecoin settlement support on Solana for U.S. banks. According to the details shared, institutions such as Cross River Bank and Lead Bank can now settle Visa obligations using Circle’s USDC directly on Solana.

This move enables near-instant, 24/7 settlements, including weekends and holidays, significantly improving liquidity efficiency without altering the consumer payment experience. Importantly, this development builds on Visa’s earlier pilot program, which reportedly processed over $3.5 billion in annualized volume. For long-term investors, this signals institutional-grade validation of Solana as a payment settlement layer rather than a short-lived narrative.

As the trader notes, adoption of this kind often goes unnoticed in the early stages, only to be reflected in price action much later.

Fractal Support Strengthens the Bullish Thesis

From a technical perspective, a long-term chart shared by analyst CryptoCurb adds further weight to the outlook. The chart highlights a striking similarity between Solana’s current structure and the descending triangle breakout that formed during the 2021 cycle. Back then, SOL consolidated near its rising support before breaking above descending resistance, triggering a rally of more than 700% from roughly $29 to its $260 all-time high.

Solana (SOL) Fractal Chart/Credits: @CryptoCurb (X)

Solana (SOL) Fractal Chart/Credits: @CryptoCurb (X)

In the current setup, SOL appears to be once again testing the lower boundary of a long-term triangular structure. Price action is stabilizing near this support zone, mirroring the same positioning seen before the previous explosive breakout. This resemblance does not guarantee a repeat, but it provides a compelling technical context that aligns with the broader adoption narrative.

What’s Next for SOL?

If this long-term fractal continues to play out, a sustained bounce from the rising support followed by a clean breakout above the descending resistance trendline would be a key confirmation signal. Such a move could shift long-term sentiment decisively bullish and lend credibility to the 2026 all-time high thesis outlined by the trader.

Until then, Solana remains in a critical phase where patience and confirmation matter more than short-term price fluctuations. The coming months may determine whether SOL is merely consolidating or quietly preparing for its next major expansion phase.