Bitcoin has traded between the $85k-$92k range throughout December. The options expiry on Friday, the 26th of December, will likely shake things up.

QCP Capital noted in their latest US Colour market update that liquidity was thinning as traders closed out their positions ahead of the holidays.

This caused a drop in Open Interest for Bitcoin and Ethereum [ETH]. A 5%-7% price swing towards the end of the year is expected due to the options expiries towards the year-end.

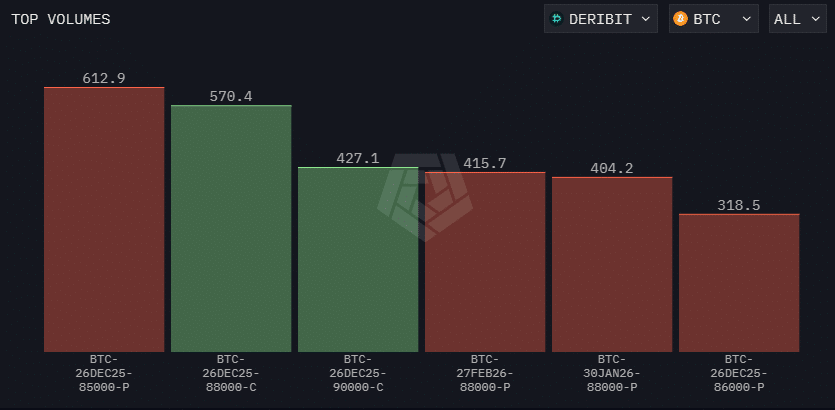

Friday’s record expiry measured $23.7 billion, with roughly 300k BTC options contracts and 446k IBIT option contracts.

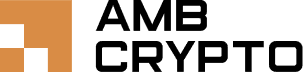

The Max Pain Point was at $95,000, with a sizeable concentration of strikes at $100k and $85k as well. How will this affect the Bitcoin [BTC] price action?

Analysts agree that Bitcoin is likely to bounce soon

Founder and CEO of Alphractal Joao Wedson highlighted the points of interest around Bitcoin right now. The Put/Call ratio is just 0.38, and the Max Pain Point created a strong short-term price gravity that would pull the price to $95k.

Wedson used the liquidation levels to highlight his expectations.

The leveraged positions around $84k and $95k were clear on the heatmap and were the short-term price targets. BTC would likely dip toward $82k-$84k before rallying to $95k and possibly higher.

Another user, David, highlighted similar expectations. The analyst observed that the $90k level was a false ceiling, and the $100k level was a structural magnet. Of particular interest were the levels mentioned for the initial flush, at $80k-$82k.

A move to $90k would be the breakout trigger.

QCP Capital noted that this rally might not be sustainable.

“…holiday-driven moves have historically tended to mean-revert. Much like low-liquidity weekend spikes that often retrace once markets reopen, Christmas week price action typically fades as liquidity returns in January.”

The holiday price action might be extra volatile as thin books encounter tax-loss harvesting from crypto investors ahead of the 31st of December deadline. These conditions can amplify short-term volatility instead of suppressing it.

Final Thoughts

- The options expiry on Friday is the largest of the year (quarterly + annual), equivalent to $23.7 billion.

- Analysts suggest that a BTC dip to $82k-$84k could be followed by a rally toward the max pain point at $95k upon options expiry.