Ethereum (ETH) Loses in the $5,000 Race! Investors Are Turning to This Asset Instead of ETH!

In 2025, Bitcoin (BTC) and altcoins were affected by macroeconomic developments, exhibiting sharp movements in both directions.

However, gold has made significant gains due to expectations of interest rate cuts and geopolitical risks.

Bitcoin and Ethereum (ETH) are struggling to maintain their key levels, while gold is reaching new highs.

At this point, gold has overtaken Bitcoin and other cryptocurrencies, and significantly surpassed Ethereum.

While gold’s price climb throughout the year suggests further upside potential, Ethereum’s upward momentum is weakening due to a slowdown in institutional buying and a weakening narrative.

This divergence was also reflected in investor expectations.

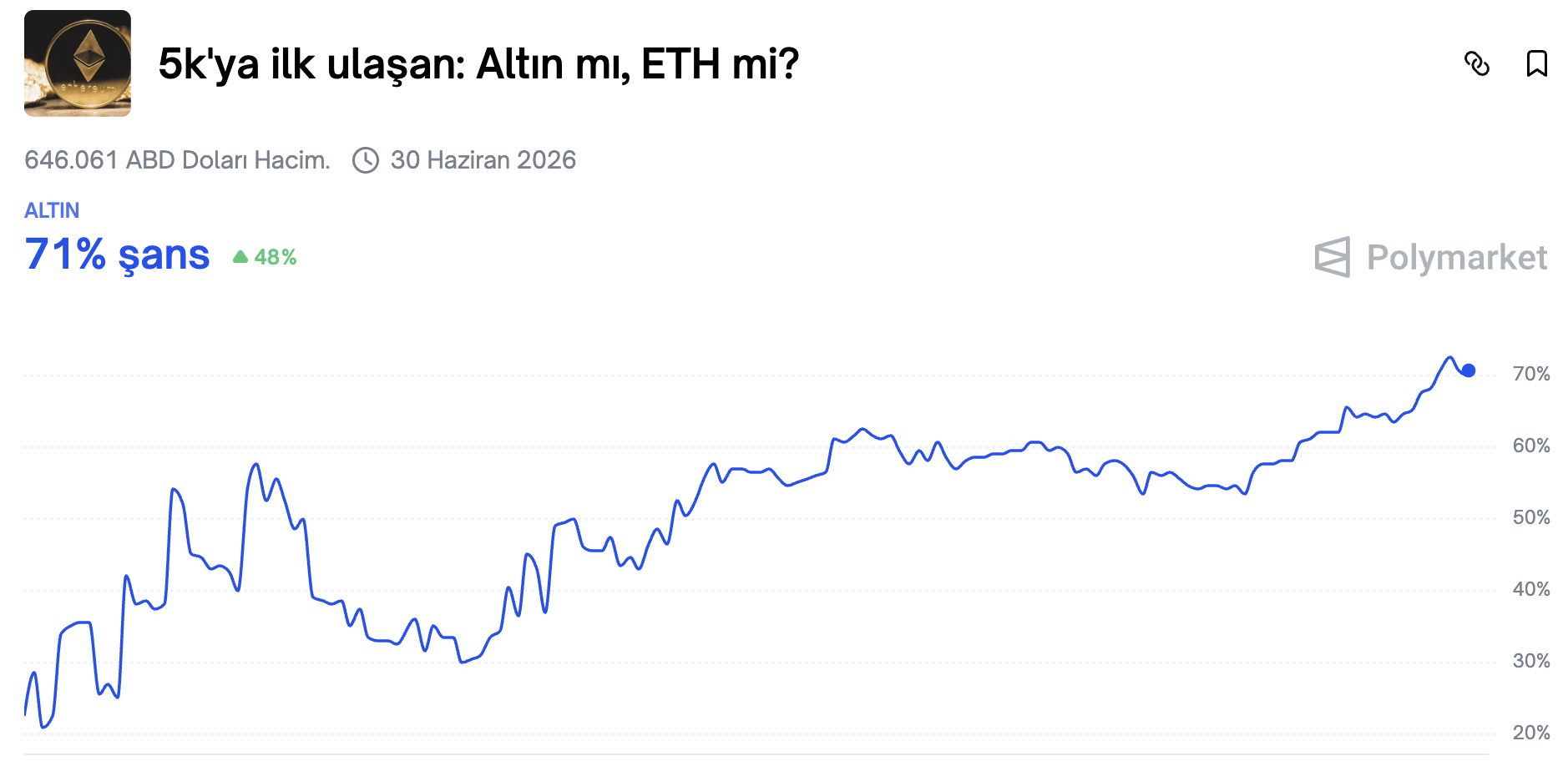

At the popular prediction market Polymarket, participants initially predicted that gold would reach $5,000.

According to the data, the probability of gold reaching $5,000 for the first time was priced at 71%.

Gold is currently trading at around $4,480 per ounce, seemingly very close to its target. In contrast, Ethereum continues to trade below $3,000, requiring a 70% increase to reach $5,000.

In the summer of 2025, a significant surge occurred due to increased inflows into DATs and spot Ethereum ETFs, pushing the price close to $5,000.

The combination of these factors created the impression that Ethereum could break through the psychological resistance level of $5,000, but the upward trend was short-lived. Since then, buying momentum has slowed and the price has fallen.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

4 Warning Signs Suggest Ethereum (ETH) Price May Not Recover Soon in Late December

Compliance-by-design or a liquidity squeeze: Crypto’s 2026 stress test | Opinion

BlockSec Enters SFA to Drive Global Crypto Compliance and Protection