We read 500 pages of reports from five institutions for you—this one article is all you need for the annual crypto outlook.

Author:Eli5DeFi

Compiled by: TechFlow

As the crypto industry moves towards 2026, leading research institutions are gradually reaching a consensus:

“The era of pure speculative cycles is coming to an end.”

In its place is a structural maturity driven by liquidity convergence, infrastructure development, and industry consolidation, rather than market volatility dominated by short-term narratives.

Below are the core viewpoints of major crypto research institutions regarding the outlook for 2026 (saving you the time of reading hundreds of pages of reports):

Core Summary:

-

“The Death of Cycles”: Research institutions unanimously believe that the traditional four-year halving speculative cycle is gradually fading. The future will be dominated by structural maturity, with value focusing more on “Ownership Coins” with revenue-sharing models and projects with real-world applications, rather than short-term speculative narratives.

-

The Rise of “Agentic Finance”: Major institutions (such as Delphi Digital, a16z, Coinbase) predict that AI Agents will become major economic participants. This will drive the development of “Know Your Agent” (KYA) identity protocols and machine-native settlement layers, technologies that surpass the capabilities of manual human operations.

-

Integration of Super-Apps: As US regulation becomes clearer (according to research from Four Pillars, Messari, etc.), complex crypto experiences will be integrated into user-friendly “Super-Apps” and privacy-supporting blockchains. These technologies will hide technical details and drive mass adoption.

Delphi Digital’s Perspective: Infrastructure, Applications, and Markets

Delphi Digital’s macro hypothesis is based on “Global Convergence.” They predict that by 2026, the divergence in global central bank monetary policies will end, shifting towards a unified cycle of rate cuts and liquidity injections. After the Federal Reserve ends Quantitative Tightening (QT), improved global liquidity will benefit hard assets such as gold and bitcoin.

2026 Outlook:

-

Agentic Finance

The major expansion of infrastructure is reflected in the rise of “Agentic Finance.” AI agents will no longer be just chatbots, but will be able to actively manage capital, execute complex DeFi strategies, and optimize on-chain yields without human intervention.

-

Social Trading and the “Pump” Economy

In consumer applications, Delphi highlights the stickiness of platforms like @Pumpfun and predicts the maturation of “Social Trading.” The trend will shift from simple meme coin speculation to more complex copy-trading hierarchies, with strategy sharing becoming a tokenized product.

-

Institutional Liquidity

The market structure will change with the further popularization of Exchange-Traded Funds (ETFs). TradFi liquidity will enter the crypto market, no longer just as a hedging tool, but as a standard portfolio allocation driven by macro liquidity easing.

Click to view the full report:

Messari: 2026 Crypto Industry Outlook—Market Structure and the Rise of Utility

Messari’s core argument is “the separation of utility and speculation.” They believe the traditional “four-year cycle” model is gradually losing relevance, and the market is moving towards differentiation. They hypothesize that 2025 will be a year where institutional investors win and retail investors lose, while 2026 will become the era of “system-level applications” rather than just a speculative game of asset prices.

2026 Outlook:

-

Privacy Shift ($ZEC)

Messari presents a contrarian view: the revival of the privacy sector. They specifically mention assets like @Zcash (ZEC), not just as “privacy coins,” but as necessary hedging tools against increasing surveillance and corporate control, predicting that “privacy cryptocurrencies” will have a chance for repricing.

-

Ownership Coins

2026 will see the emergence of a new token category—“Ownership Coins.” These tokens combine economic, legal, and governance rights. Messari believes these tokens could solve the accountability crisis in DAOs and may give rise to the first projects with a market cap of 1.1 billions.

-

DePIN and AI Integration

The research also delves into the potential of DePIN (Decentralized Physical Infrastructure Networks), predicting that these protocols will find product-market fit in the real world by meeting the massive demand for computation and data in the AI sector.

Read the full report:

Four Pillars: Regulatory Restructuring and Super-Apps

Four Pillars’ 2026 outlook centers on “regulatory restructuring.” Their core hypothesis is that US legislative actions (specifically mentioning the GENIUS and CLARITY Acts) will serve as a blueprint for comprehensive market reform.

This regulatory clarity will act as a catalyst, transforming the market from a “Wild West” state into a formal economic sector.

Four Pillars’ 2026 Outlook

-

The Era of Super-Apps

Four Pillars predicts that the current fragmented crypto application ecosystem will gradually integrate into “Super-Apps.” These platforms will be driven by stablecoins, integrating payment, investment, and lending functions, thoroughly simplifying blockchain complexity and enhancing user experience.

-

Tokenization of RWA Assets

As the market restructures, the tokenization of stocks and traditional assets will become a trend, but the focus will be on actual utility rather than experimental projects.

-

Technological Maturity

On the technology front, the report highlights the importance of Zero-Knowledge Virtual Machines (ZKVM) and Proof Markets on Ethereum. They are seen as key technical infrastructure to cope with the scale of emerging regulatory agency traffic.

Read the full report:

Coinbase: 2026 Crypto Market Outlook—Markets, Regulation, and Adoption

Coinbase’s report puts forward the view of “the death of cycles.” They clearly state that 2026 will mark the end of the traditional bitcoin halving cycle theory. The future market will be driven by structural factors: including macro demand for alternative stores of value and the formalization of the crypto industry as a mid-sized alternative asset class.

2026 Outlook:

-

Tokenomics 2.0

Shifting from “governance-only” tokens to models linked to revenue. Protocols will gradually introduce buy-and-burn or fee-sharing mechanisms (in line with new regulatory requirements) to better align token holders’ interests with platform success.

-

Digital Asset Trading 2.0 (DAT 2.0)

The crypto market will move towards more specialized trading models, especially the procurement and trading of “sovereign block space.” Block space will be regarded as an important resource in the digital economy.

-

The Intersection of AI and Crypto

Coinbase predicts that AI agents will make extensive use of crypto payment channels, driving demand for “crypto-native settlement layers.” These settlement layers can support continuous microtransactions between machines, which traditional payment systems cannot meet.

Read the full report:

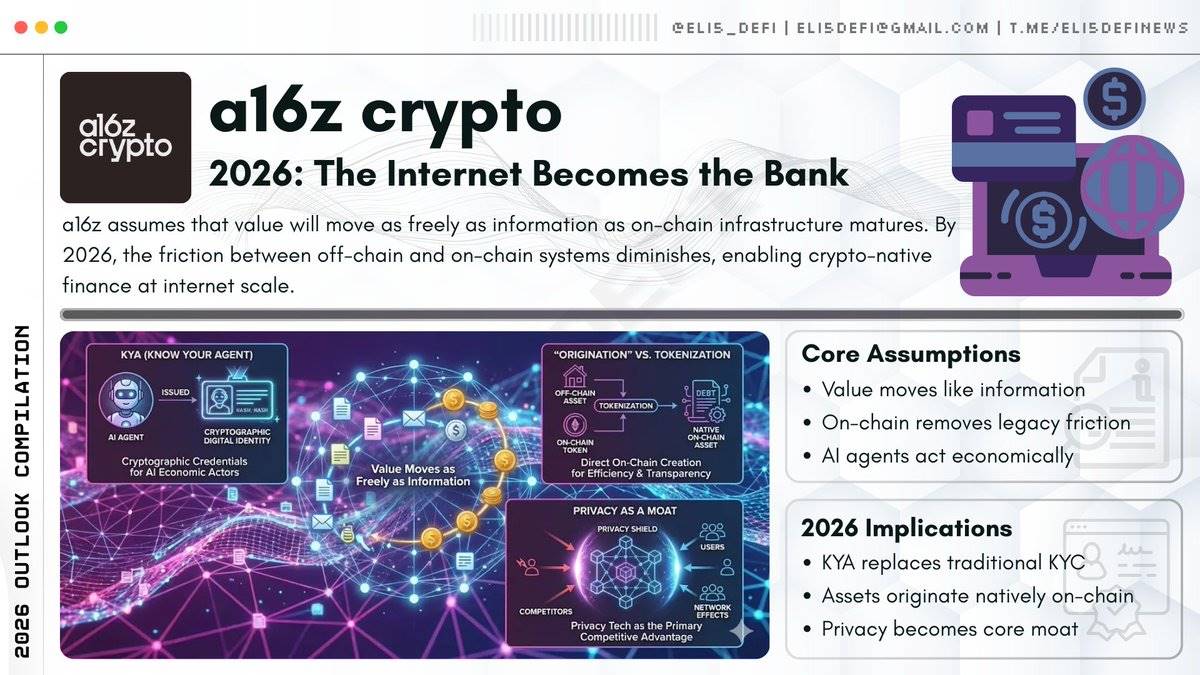

a16z Crypto: 2026 Outlook—The Future of Internet-Native Finance and AI

a16z Crypto’s outlook is based on a core hypothesis: “The internet has become the bank.” They believe that the flow of value will become as free as information. The current friction between on-chain and off-chain worlds is the main bottleneck, and 2026 will be the year to eliminate this barrier through more robust infrastructure.

a16z Crypto’s 2026 Outlook

-

KYA (Know Your Agent)

As AI agents become major economic participants, identity verification will shift from traditional KYC (Know Your Customer) to KYA (Know Your Agent). AI agents will require cryptographically signed credentials to transact, giving rise to an entirely new identity infrastructure layer.

-

“Asset Origination” VS “Asset Tokenization”

a16z predicts that the market will gradually shift from tokenizing off-chain assets (such as buying government bonds and putting them on-chain) to directly originating debt and assets on-chain. This shift can not only reduce service costs but also greatly enhance transparency.

-

Privacy as a Moat

In a world where open-source code is widespread, a16z emphasizes that privacy technology (especially the ability to maintain state privacy) will become the most important competitive advantage for blockchains. This will bring strong network effects to privacy-supporting blockchains.

-

Wealth Management for All

The combination of AI and crypto payment channels will democratize complex wealth management (such as asset rebalancing and tax-loss harvesting), allowing ordinary users to enjoy services previously limited to high-net-worth individuals.

Read the full report:

Summary

The 2026 outlook for the crypto industry shows that structural maturity will replace speculative cycles, driven by liquidity convergence, regulatory clarity, and infrastructure.

Major research institutions unanimously believe that value will concentrate in settlement layers, aggregation platforms, and systems capable of attracting real users and capital.

Future opportunities will shift from chasing cycles to understanding capital flows. 2026 will reward projects that quietly build infrastructure, distribution capabilities, and trust at scale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Traders Who Tell Fortunes with Candlestick Charts

BitMines’ $15B Ethereum bet suffers a $3.5B loss – Is a relief likely?

Small Cap Altcoins Surge with Stronger Ethereum Accumulation

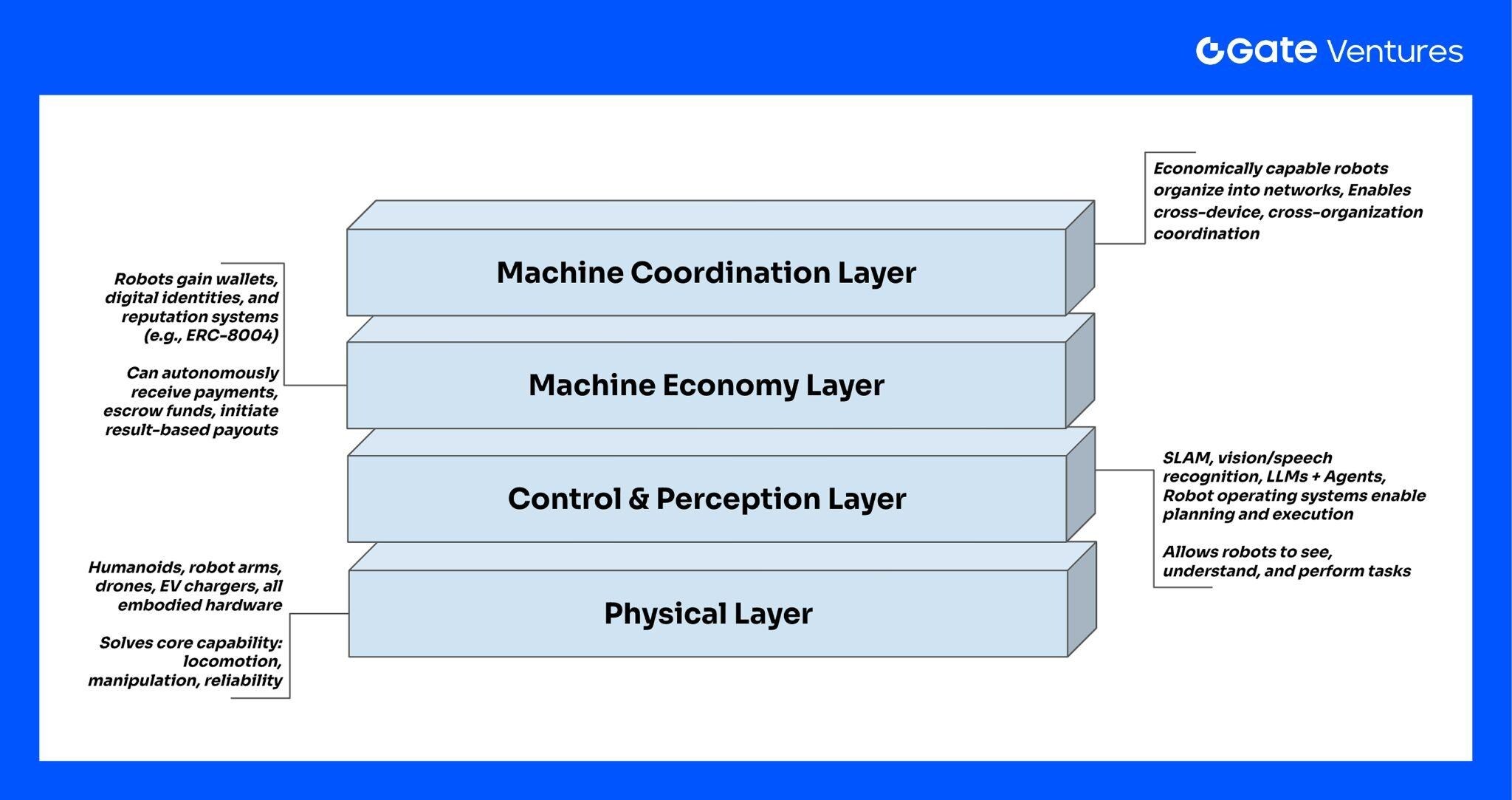

The Rise of the Machine Economy: How Web3 Drives Robots from Tools to Autonomous Systems