Wall Street bull Tom Lee quietly lowered his year-end forecast from $250,000 to "perhaps a recovery" to $125,100. Behind this adjustment lies the collective failure of the entire market forecasting system.

At the end of 2024 and the beginning of 2025, as bitcoin prices rose amid halving expectations and optimism over spot ETF approvals, the market was filled with widespread anticipation of the "$200,000" target. Analysts painted a seemingly clear path: reduced supply, institutional inflows, and improved regulation.

However, the reality is that bitcoin experienced repeated volatility in 2025, with year-end prices showing a significant gap from mainstream forecasts at the start of the year. The market did not experience the smooth, one-sided rally that was expected.

1. Forecast Consensus: The Frenzy of Institutional Narratives

At the beginning of 2025, the bitcoin market formed a rare consensus expectation. Multiple institutions and well-known market figures provided relatively concentrated annual target ranges, with $200,000 repeatedly appearing as an anchor point.

● This was not a fringe view. Wall Street bulls, including Tom Lee, emphasized institutional allocation and macro tailwinds; Cathie Wood and her team argued for higher valuation space based on long-term adoption and structural deflation.

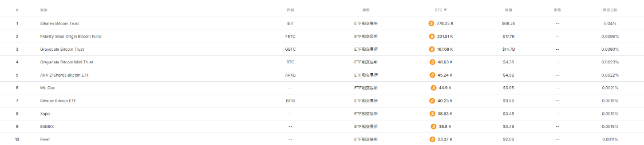

● The core pillar of market optimism was the approval of spot bitcoin ETFs. The batch of ETFs approved by the U.S. Securities and Exchange Commission in 2024, especially BlackRock's IBIT fund, became one of the most successful ETF launches in the industry's 35-year history.

Traditional financial institutions finally obtained regulated investment tools, and mainstream capital inflows into the market became only a matter of time.

2. Divergence from Reality: The Misalignment of Price and Expectations

Entering 2025, bitcoin's actual performance stood in stark contrast to the optimistic forecasts at the start of the year. Although prices rose several times during the year and set new stage highs, the upward path was highly unstable.

● Whenever the price approached the high range, volatility quickly intensified, and pullbacks repeatedly interrupted the trend. After bitcoin broke through $122,000 in July to reach a new all-time high, the market did not continue to break upward as expected, but instead entered a period of high-level consolidation.

● Analyzing the market at the end of 2025, although bitcoin remained in the high $90,000 range, market sentiment fell to extreme fear levels not seen since the 2020 pandemic. The Fear and Greed Index once touched 16, the coldest sentiment reading since the global market crash in March 2020.

The extreme divergence between price and sentiment reflects structural differentiation within the market.

3. Cycle Shift: The End of the Four-Year Halving Narrative

The traditional four-year halving cycle theory was once the most reliable macro framework in the crypto space. This theory held that halving mechanically reduces new supply, weak miners exit, selling pressure decreases, and prices eventually rise, repeating roughly every four years.

However, data from 2025 suggests that this cycle may have become obsolete.

● The key change is that the impact of supply shocks has significantly weakened. After the 2024 halving, bitcoin's daily issuance was only about 450 coins, worth about $40 million at the time. In contrast, ETF inflows/outflows typically exceeded $1 billion to $3 billion in a single week.

● Institutional purchases have far exceeded miner output. Data shows that in 2025, institutions accumulated about 944,330 bitcoins, while miners produced only 127,622 new coins this year. Institutional purchases were 7.4 times the new coin supply.

● This structural shift means that the dominant force in the bitcoin market has shifted from miner economics and retail FOMO to ETF cost basis psychology and fund manager performance pressure.

4. New Driving Logic: The Formation Mechanism of the Institutional Cycle

● The bitcoin market is forming a new two-year institutional cycle, driven by the ETF cost basis and fund performance evaluation mechanisms. The average cost basis of U.S. spot ETF holders is currently around $84,000, which has become the most important price anchor in the bitcoin market.

● Professional funds are evaluated on a 1-2 year time frame, with fees and performance bonuses settled on December 31. This creates a strong behavioral anchor: as year-end approaches and managers lack sufficient "locked-in" gains or losses as a buffer, they tend to sell the riskiest positions.

● This mechanism leads to a typical behavioral pattern: the first year is a period of accumulation and price increase, with new funds flowing into ETFs and prices leading the cost basis; the second year is a period of distribution and reset, with performance pressure driving profit-taking and price corrections until a new, higher cost basis is established.

5. Liquidity Dilemma: The Repricing of Macro Factors

● In addition to changes in market structure, the macro liquidity environment has also had a significant impact on bitcoin prices. In 2025, the real "boss" of bitcoin is not institutions or whales, but the Federal Reserve. The market generally expected the Fed to gradually start a rate-cutting cycle from the second half of 2024 to early 2025, and this expectation was once an important driver of the previous rally.

● However, a series of recent economic data and official statements have led to a repricing of this expectation. Although U.S. employment and inflation have slowed, they have not yet reached levels that support aggressive easing; some officials have even signaled "cautious rate cuts."

● The cooling of rate-cut expectations directly reduces the discounted value of future cash flows, thereby compressing the valuations of risk assets, with highly elastic sectors such as bitcoin bearing the brunt.

6. Market Structure: Chip Redistribution and Sentiment at a Freezing Point

● On-chain data at the end of 2025 reveals deeper structural changes in the bitcoin market. The market is not experiencing a full exit, but rather a rapid redistribution of chips—from short-term, emotional capital to entities with greater patience and risk tolerance.

● Medium-sized whales holding 10-1,000 BTC have continued to be net sellers in recent weeks, clearly early entrants with substantial profits choosing to cash out. Meanwhile, super whales holding more than 10,000 BTC have been increasing their holdings, with some long-term strategic entities buying against the trend during the decline.

● Retail behavior is also diverging: some of the most emotional novice users may be panic selling, but other more experienced long-term retail investors are seizing the opportunity. This combination means that selling pressure mainly comes from weak hands, while chips are concentrating in strong hands.

7. Technical Signals: The Battle for Key Price Levels

From a technical analysis perspective, bitcoin is at a critical crossroads at the end of 2025. Analysts unanimously believe: if bitcoin fails to hold the $92,000 level, the bull market rally may be over.

That level is like a bottleneck: either it breaks through and drives the entire crypto market up, or it falls and returns to test the lows.

● Technical charts show that bitcoin is currently forming an ascending wedge pattern, a bearish pattern that appears after a downtrend. If the price breaks below this pattern, it may retest the November low of $80,540, and further declines could test the 2025 intrayear low of around $74,500.

● Derivatives market data is also key: as of the end of November, there were a large number of open positions concentrated in $85,000 put options and $200,000 call options. This extreme positioning suggests huge disagreement in the market about the future direction.

8. The Spillover Effect of the AI Bubble

● Another important feature of the bitcoin market in 2025 is the transmission of external risks. Artificial intelligence (AI) has overwhelmingly become the core force in global risk asset pricing, and its volatility directly affects the bitcoin market through risk budgets and liquidity conditions.

● A deeper impact comes from the competition of narrative systems. The grand framework of the AI narrative directly suppresses the narrative space of the crypto industry, making it difficult for the crypto sector to regain valuation premiums even when on-chain data is healthy and the developer ecosystem is active.

● When the AI bubble enters an adjustment phase, the fate of crypto assets may usher in a decisive opportunity, as AI will release liquidity, risk appetite, and resources back to the market.

The average cost basis of bitcoin ETF holders has replaced miner output as the new price anchor. The year-end performance pressure and calendar cycle of professional fund managers are shaping bitcoin's price rhythm every two years instead of every four years.

As the market shifts from mechanical miner selling to spreadsheet-driven fund manager decisions, the key to forecasting bitcoin prices is no longer calculating halving dates, but tracking the tides of global liquidity and the red and black numbers on institutional P&L statements. The collective failure of bitcoin forecasts in 2025 is essentially a collective late realization of this profound transformation.