A historic scale of options expiry meets thin holiday liquidity, making tonight's crypto market a true test of its authenticity. This Friday, the cryptocurrency market will witness an unprecedented derivatives event.

Approximately 300,000 bitcoin options contracts will expire on December 26, with a notional value of about $23.7 billions, accounting for more than half of the total open interest in bitcoin options on Deribit, the world's largest crypto options exchange.

Including ethereum options, the total notional value of contracts expiring this time reaches an astonishing $28.5 billions, double the scale of the same period last year, described as "record-breaking" by Deribit's Chief Commercial Officer.

1. Scale Peak

● This $28.5 billions expiry sets a new historical record for single-day crypto options settlement. Such a massive position being unwound in one day constitutes a strong volatility event in itself. Compared to this year's data, the scale this time shows explosive growth.

● At the end of August, Gate Research Institute once warned of a $14.5 billions monthly settlement, which was already the largest scale of 2025 at the time. Earlier, at the end of March, the market also faced a "century bet" worth about $14.3 billions.

● The market is no stranger to large-scale options settlements, but each new peak refreshes perceptions. From $5.8 billions, $14.3 billions, to today's $28.5 billions, the depth and breadth of the options market are expanding at a staggering pace.

2. Market Background

● The Christmas holiday casts a quiet shadow over global financial markets, and the crypto market is no exception. Traders are away, institutions are on vacation, resulting in significantly thin market liquidity. Liquidity is like the blood of the market; when supply is insufficient, any sizable buy or sell order can lead to sharp price swings. A thin liquidity environment amplifies market fragility.

● In addition to liquidity issues, macroeconomic factors and the performance of other asset classes are also diverting market attention. Some analysts point out that the recent surge in precious metals prices has drawn away some funds that might otherwise have flowed into cryptocurrencies.

● This creates a complex market sentiment: on one hand, record-breaking options data highlights market activity and maturity; on the other hand, the holidays and external competition have drained the market's short-term vitality.

3. The Max Pain Point

In the world of options, "max pain point" is a key concept. It refers to the price point of the underlying asset where all option buyers suffer the maximum overall loss, and sellers achieve the maximum overall profit.

● Settling near this price is most favorable for option sellers (usually market makers and large institutions). Therefore, it is often observed that prices are "magnetically attracted" toward the max pain point around expiry dates.

● Gate Research Institute, in its analysis of August options expiry, pointed out that the max pain price for BTC at that time was $116,000. In the large-scale expiry in March this year, bitcoin's max pain point was at $85,000.

● This "price magnetism" is not always the result of manipulation; more often, it is the natural outcome of collective behavior by market participants (especially market makers who need to dynamically hedge risk).

4. Potential Impact

Given the current environment, the impact of this record-breaking expiry may be concentrated in two areas: increased short-term volatility and clearer medium- to long-term directional choices.

● During the vacuum period between Christmas and New Year, as the market digests $28.5 billions in position adjustments, there is a high likelihood of brief, technical volatility. History has repeatedly shown that options expiry dates are catalysts for short-term volatility.

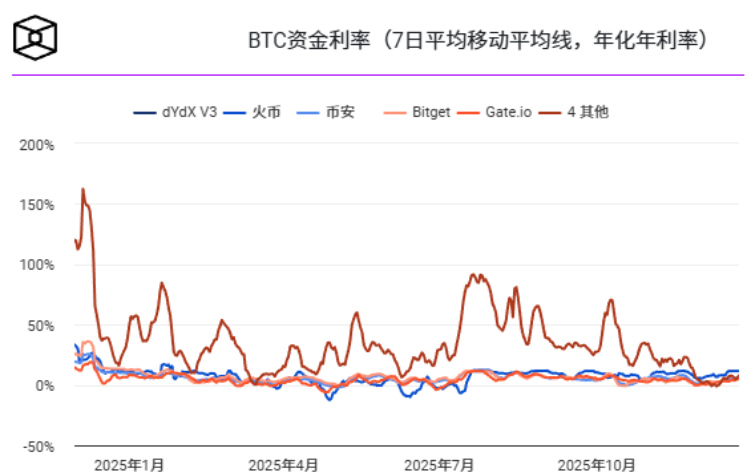

● The market's implied volatility is a window of observation. Before the August expiry event, BTC's volatility index (DVOL) saw a slight rebound, while short-term skew declined, indicating that traders were hedging risk by buying put options.

● Once the massive hedging positions are unwound after settlement, the true supply and demand forces of the market will be revealed. This means that the expiry event itself may not determine the long-term direction, but like a major exam, after it is over, the market trend often becomes clearer.

5. Post-Event Observation

For investors, post-event observation should go beyond the expiry event itself and focus on more fundamental changes in market structure.

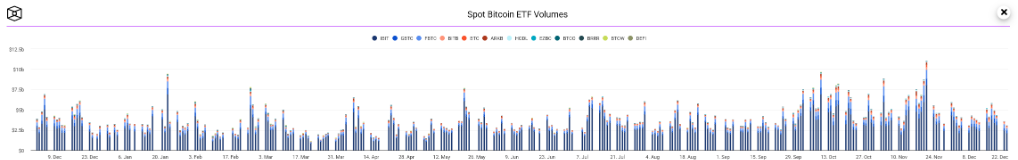

● The rapid development of the options market itself is the most direct evidence of deep institutional participation. Whether it is BlackRock, Fidelity, and other traditional asset management giants deploying complex options strategies, or CME Group continuously launching new bitcoin derivatives to meet institutions' more refined risk management needs, all mark that the crypto market has entered a new stage of development.

● This $28.5 billions settlement is both an extreme stress test and another proof of the market's maturity.

● Liquidity will eventually return, and the holidays will end. After the technical disturbances caused by options expiry subside, the market will once again seek its direction based on fundamentals such as macroeconomic expectations, regulatory trends, technological innovation, and capital inflows.

On options expiry day, every price movement in the market interprets the subtlety of the long-short game. Market makers lay out a precise hedging network near the max pain point, weaving a giant web like a spider, waiting for the passage of time value with stillness.

When $28.5 billions in notional value seeks to close positions in a thinly liquid holiday market, every tiny ripple in the market can be amplified. But after the huge waves, the sea will eventually return to its original direction, determined by deeper tidal forces.