From related-party transactions to infiltrating Wall Street and the White House, what kind of power game is Tether playing?

Author: Chloe, ChainCatcher

Recently, Tether's holding subsidiary Northern Data announced the sale of its bitcoin mining division, Peak Mining, for $200 million. This transaction not only reflects the complex relationships within Tether's power structure but also raises strong market concerns about related-party transactions involving Tether.

Tether's Asset Transfers Are Incredibly Complex, a Typical "Left Hand to Right Hand" Transaction Strategy

According to corporate registration documents from the British Virgin Islands, the United States, and Canada, the three companies acquiring Peak Mining are Highland Group Mining, Appalachian Energy, and 2750418 Alberta ULC. The actual controllers behind these companies are Tether co-founder Giancarlo Devasini and CEO Paolo Ardoino. Both names appear on the board of Highland Group, Alberta is solely directed by Devasini, while the controller of Appalachian Energy remains undisclosed.

Since Tether itself holds about 54% of Northern Data's equity and the two parties have financing ties totaling 610 million euros, their financial bond is exceptionally close. Against this backdrop, selling major assets to companies controlled by Tether's top management essentially constitutes a related-party transaction.

However, Northern Data is currently listed on a secondary market in Germany with relatively loose regulation, where disclosure requirements are much lower than in the primary market. Therefore, the company did not need to publicly disclose the buyer's identity or label the transaction as a related-party deal at the time of sale. The true identities of these acquiring entities only became clear weeks after the transaction, through corporate filings in the British Virgin Islands, the US, and Canada.

Additionally, the timing of the transaction is also under scrutiny. The sale of Peak Mining occurred just days before video platform Rumble announced a $760 million acquisition of Northern Data, and Tether happens to hold nearly 48% of Rumble's equity.

This move is seen as Tether deliberately divesting the highly volatile mining division ahead of the acquisition, allowing Northern Data to be integrated into Rumble as a pure AI cloud computing provider, thereby achieving a higher market valuation and reducing acquisition risk.

In this complex asset transfer process, the 610 million euro loan previously provided by Tether to Northern Data became a core tool for financial maneuvering. In the Rumble acquisition, this loan will be restructured: half will be repaid to Tether by Rumble in the form of shares, while the other half will be converted into a new loan to Rumble, secured by Northern Data's assets.

This multi-layered financial design creates a self-circulating internal capital ecosystem among the holding company, the acquired party, and enterprises managed by top executives, further consolidating Tether's senior management's control over the overall structure while transferring mining assets into private hands.

Tether's Subtle Relationships with Wall Street and the US Cabinet

In addition to internal asset maneuvering, Tether's relationship with Wall Street investment bank Cantor Fitzgerald is equally complex. Especially after Cantor CEO Howard Lutnick was nominated and confirmed as US Secretary of Commerce, the market and judiciary have scrutinized the matter even more closely. Tether's alliance with Howard Lutnick dates back to 2021, when Tether, to quell market concerns over reserve transparency, entrusted tens of billions of dollars in US Treasuries backing USDT to Cantor, making Lutnick the most important credibility endorser for Tether in the traditional financial system.

According to a Wall Street Journal report from November last year, Lutnick personally participated in negotiations for an investment agreement that was originally expected to give Cantor about 5% equity in Tether, valued at up to $600 million. This transaction drew strong criticism from federal senator Elizabeth Warren, who stated that Tether has long been seen as a tool for financial crime, and having the head of its main asset custodian serve as Secretary of Commerce poses a serious conflict of interest risk.

Facing overwhelming doubts, Lutnick clarified details of the cooperation with Tether at a hearing, stating that Cantor's final investment was in the form of "convertible bonds" rather than direct equity, arguing that they do not currently hold equity. The financial industry generally believes that such convertible bonds grant Cantor the right to convert debt into equity in the future, essentially a delayed ownership interest that could even allow the holder to exercise substantial control if necessary.

Even though Lutnick stated at the hearing that issuers should not be held responsible for their products being used by criminals, he also promised that after becoming Secretary of Commerce, he would require stablecoin issuers to undergo more independent audits and be subject to US law enforcement oversight. It can be said that after Lutnick officially takes charge of the Commerce Department, Tether's relationships with Wall Street and the US Cabinet will become even more unfathomable.

Tether Earned $15 Billion in Profits This Year, with a Profit Margin as High as 99%

Moreover, Tether's business landscape has long surpassed its role as a stablecoin issuer. From crypto payments, digital asset lending, and mining layouts, to AI robots, brain-computer interfaces, media platform investments, and even recent attempts to acquire the Italian Juventus Football Club.

Nate Geraci, president of The ETF Store, once said: "While US politicians are debating whether stablecoins should be allowed to pay interest, it is worth noting that Tether will earn $15 billion in profits this year, with a profit margin as high as 99%."

Is the capital accumulated from such ultra-high profits creating value for the crypto industry, or is it building a closed wealth cycle for the internal top management?

With Northern Data's asset divestiture, Rumble's acquisition integration, and its relationship with Wall Street, Tether seems to have built a closed and powerful business ecosystem. While ensuring the privatization of core assets by its top management, it is also pushing its empire toward the core of US power through the entry of traditional financial giants and senior US Cabinet officials.

Every seemingly independent business decision by Tether is, in fact, closely linked under the same power structure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SEI Network Holds $0.10 Support as Traders Eyes $0.115 Breakout

Watch Cryptocurrency Titans Clash in 2025: TRON Vs. Zcash Showdown

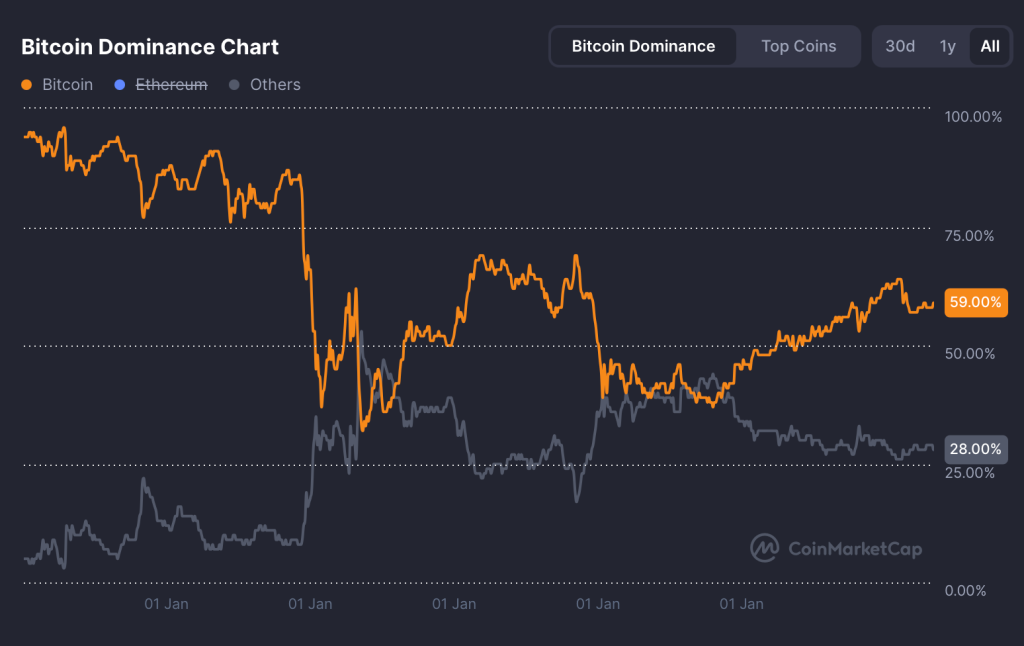

BTC Price Holds Firm as Altcoins Bleed—Is the Capital Rotating Back to Bitcoin?

Grayscale Sees Chainlink as Key Infrastructure for RWA Tokenization