US Treasury Secretary reveals! The "ultimate criteria" for the next Federal Reserve Chair: reducing power, cutting staff, ending permanent QE

US Treasury Secretary Bessent sharply criticized the Federal Reserve for exacerbating the wealth gap, calling for the central bank to implement structural "downsizing" and step into the background, completely reversing the era of loose monetary policy over the past 15 years.

Source: Golden Ten Data

US Treasury Secretary Bessent confirmed that the government is actively interviewing candidates for the next Federal Reserve Chair. The government seeks a Fed Chair who is committed to reducing the scope of the Fed’s functions and ending the era of "permanent quantitative easing" (QE).

In the annual economic review on the "All-In" podcast, Bessent stated that the monetary policy of the past 15 years will undergo a dramatic shift. He believes that the Fed’s "functional expansion" experiment—especially the large-scale asset purchase programs since 2008—must be rolled back to restore economic fairness.

Bessent criticized the post-financial crisis monetary policy, calling the Fed an "engine of inequality." He argued that while the Fed is not responsible for creating equality, it should not actively worsen the wealth gap.

Bessent pointed out: "We have ultimately fallen into this two-tiered economy: either you are an asset holder, or you are not." He noted that by artificially suppressing interest rates and purchasing trillions of dollars in assets, the Fed has boosted the investment portfolio values of the wealthy while leaving ordinary people behind.

Bessent mentioned that the Fed has engaged in "modern monetary practices," namely the monetization of government debt. He emphasized that the next Chair must treat quantitative easing as an emergency tool only, not as a standard operating procedure.

In addition to monetary policy, Bessent also called for structural layoffs at the Fed. He criticized the institution’s lack of budget oversight, pointing out that the Fed "prints its own money" and lacks the fiscal discipline required of other government agencies in its operations.

When discussing the candidates currently under review, Bessent said: "Everyone wants to see a smaller institution and greater predictability."

He emphasized that the Fed should step into the background, rather than making markets "nervous about every word the Chair says."

Bessent confirmed that he has conducted in-depth interviews with several leading candidates, including Kevin Warsh, Kevin Hassett, and Fed Governor Waller.

He hinted that the final shortlist all agree with the government’s vision for a "traditional" Fed: focusing on price stability rather than managing the entire economy.

Bessent concluded: "I probably know better than anyone... what needs to be done." This indicates that as the government prepares for 2026, the nomination announcement is imminent.

Despite facing a series of policy and economic headwinds, the US stock market remained resilient in 2025, with all three major benchmark indices posting gains for the year. The S&P 500 rose 17.74%, while the Nasdaq Composite and Dow Jones indices increased by 22.20% and 14.27%, respectively.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How Mill closed the deal with Amazon and Whole Foods

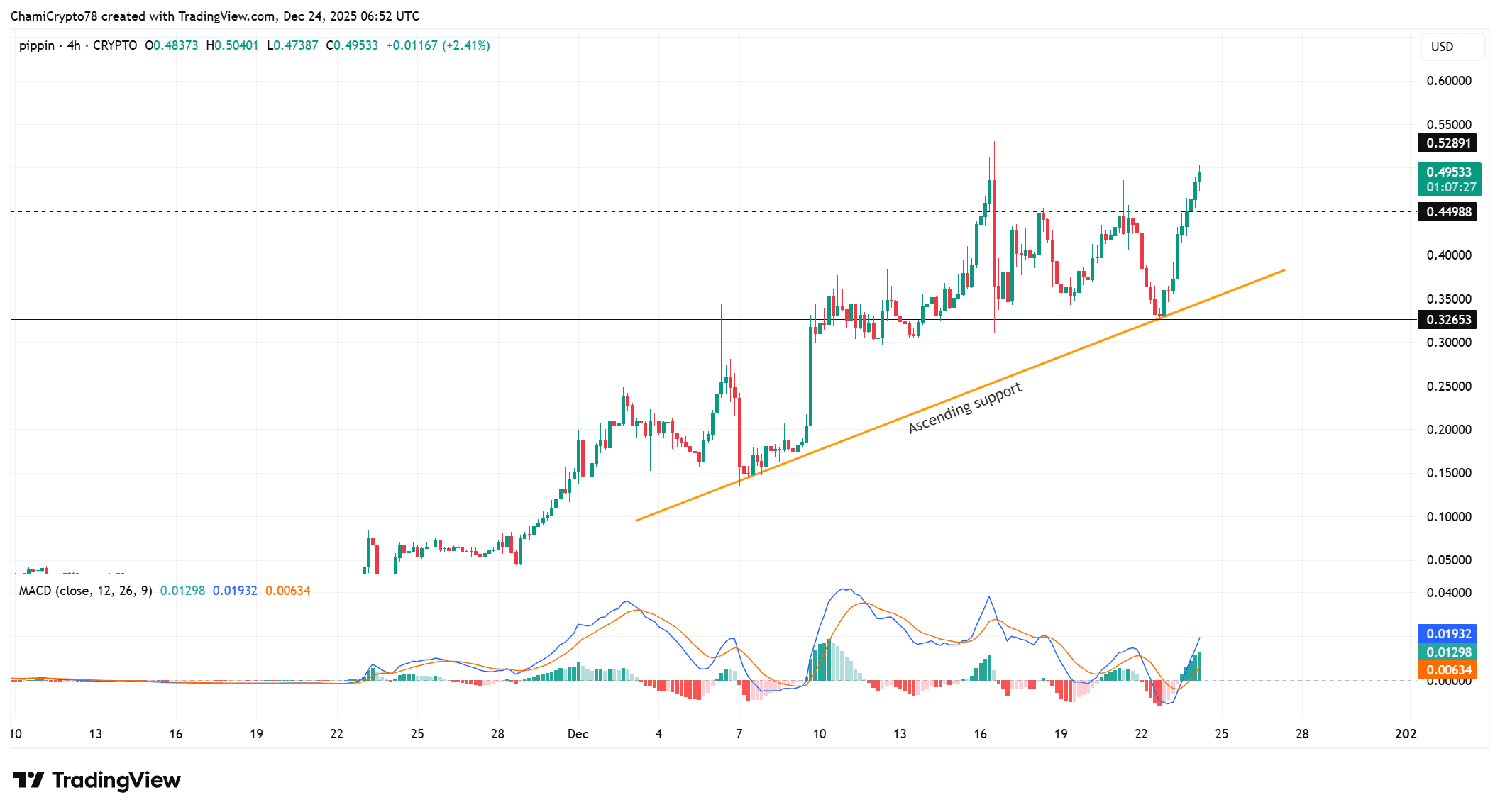

Pippin’s 32% surge meets rising leverage – Can bulls sustain the rally?

Upexi Files $1B Shelf Registration, Shares Slide on Solana Treasury Signal

Crypto Analytics Company CryptoQuant Announces the Crypto Market is Undergoing a Reset! Here Are the Details