- Wallets with 1+ BTC dropped 2.2% since March

- Remaining holders added 136,670 more BTC

- Signals growing confidence among strong hands

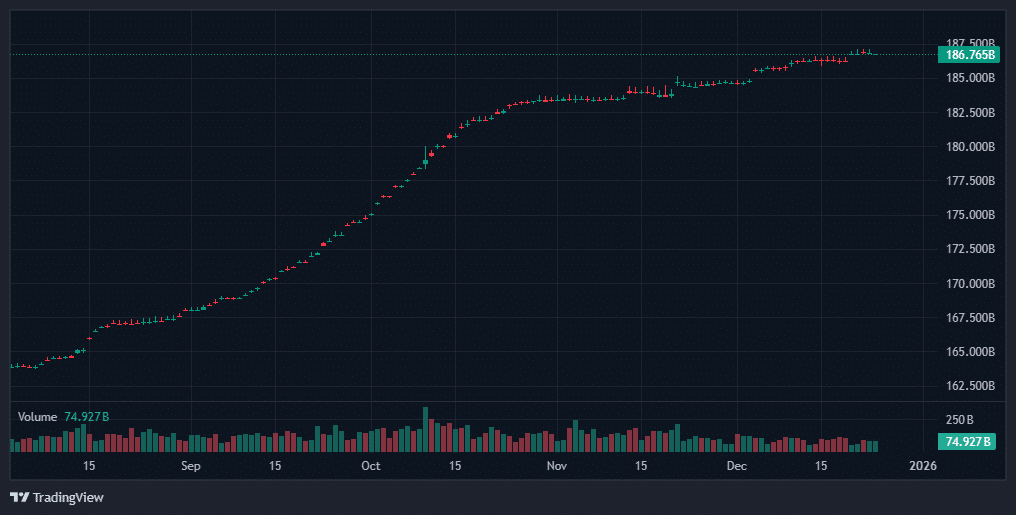

Since March 2025, the number of wallets holding at least 1 full Bitcoin has declined by 2.2%, according to blockchain analytics firm Santiment. At first glance, this dip may seem like a bearish signal. However, the deeper data tells a different story. Despite fewer wallets crossing the 1 BTC threshold, those that remain have been actively accumulating.

In total, these wallets have added 136,670 BTC during this period. This suggests that while some smaller holders may have sold off or been shaken out, long-term investors—often referred to as “strong hands”—are doubling down on their conviction in Bitcoin’s future.

What This Means for the Market

The decrease in wallets with 1 or more Bitcoin doesn’t necessarily indicate waning interest in the crypto asset. Instead, it points to a possible consolidation phase, where wealth is flowing into fewer but more committed hands. These larger holders are typically less likely to sell during market volatility and often take a long-term view of their investments.

This pattern of Bitcoin wallet accumulation often precedes major bullish moves, as seen in past cycles. It’s a sign that savvy investors are preparing for future growth, especially with Bitcoin’s halving now behind us and institutional interest on the rise.

Looking Ahead

As Bitcoin continues to mature as an asset class, tracking wallet behavior offers unique insights into market sentiment. While price movements get most of the headlines, underlying metrics like accumulation trends can provide a clearer picture of what’s happening beneath the surface.

For retail investors, the data reinforces a common crypto adage: “Follow the smart money.” And right now, the smart money seems to be accumulating more Bitcoin—even if the number of wallets is shrinking.