Bitcoin’s [BTC] price hasn’t kept up with equities, but something important is happening.

More BTC is being moved off exchanges, which often means people plan to hold it rather than sell. Smaller investors are stepping away, and big investors are buying.

The market may not be as uncertain as it looks.

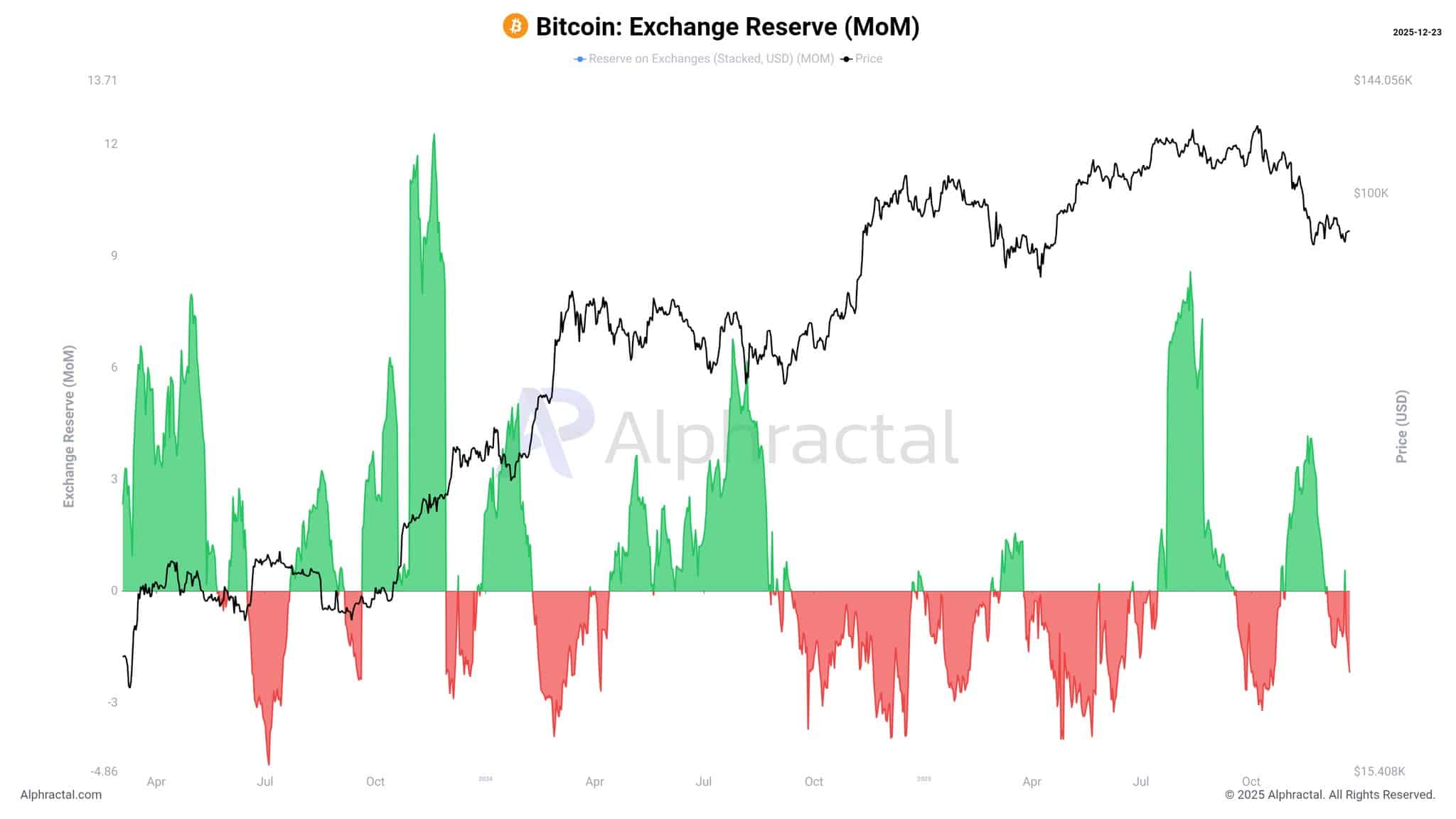

BTC is leaving exchanges

Monthly changes in Bitcoin exchange reserves have turned negative, meaning more BTC is being withdrawn than deposited. This trend has stayed consistent even with weak price action.

Source: Alphractal

When coins leave exchanges, investors are choosing to hold rather than trade in the short term. this doesn’t guarantee a price rally.

Outflows can occur during both bullish and cautious periods. However, when withdrawals persist, they reduce liquid supply and signal confidence in Bitcoin’s long‑term value.

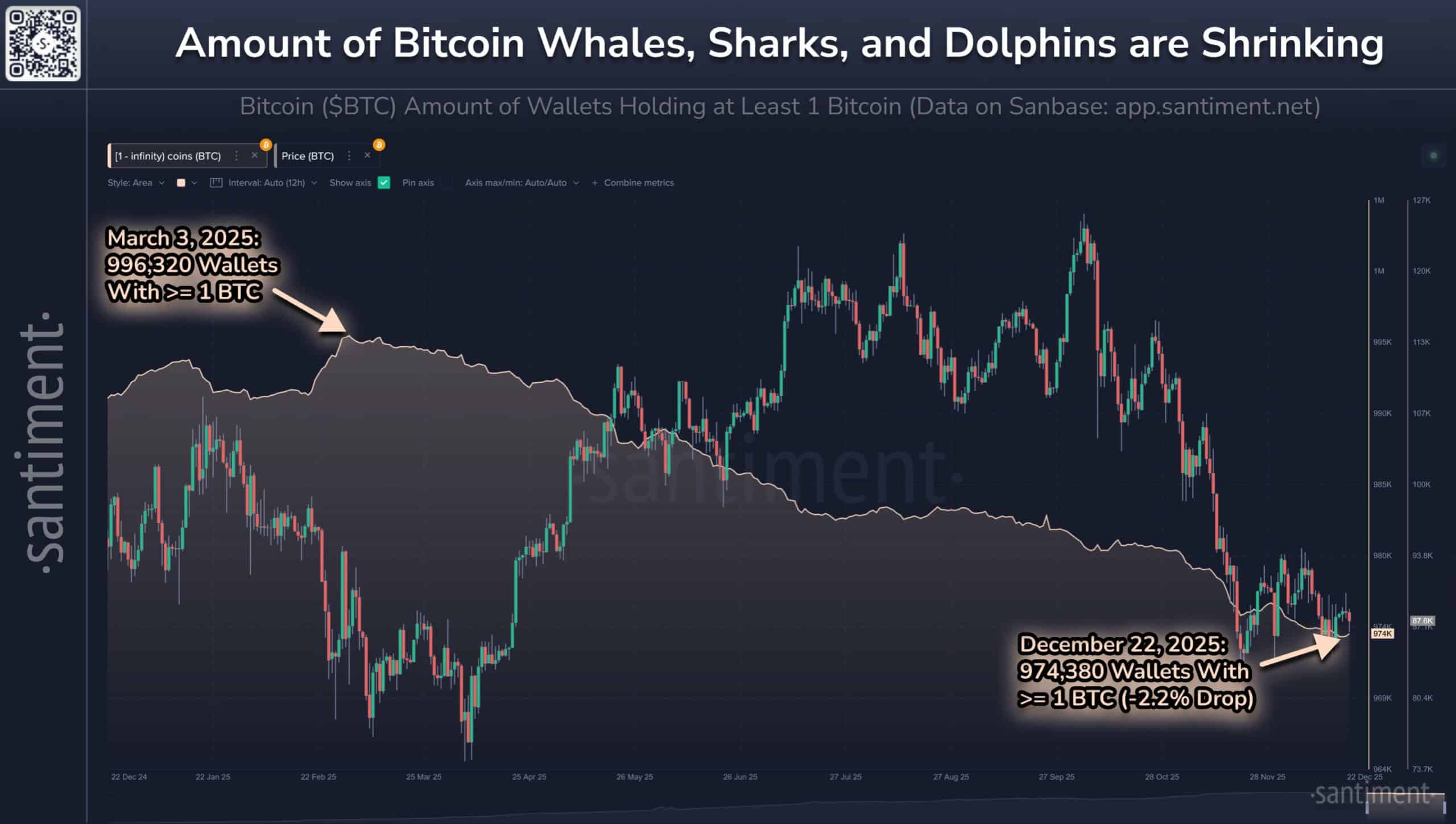

Fewer wallets, greater confidence

While Bitcoin is leaving exchanges, ownership patterns are also changing. Santiment data shows that wallets holding at least 1 BTC have fallen by 2.2% from their March peak.

Source: Santiment

That looks like weak belief, but here’s what’s interesting. Larger holders have been buying, adding more than 136,000 BTC over the same period.

Smaller participants are stepping away, and whales are increasing exposure. This doesn’t change prices right away, but it usually shows firm long-term confidence.

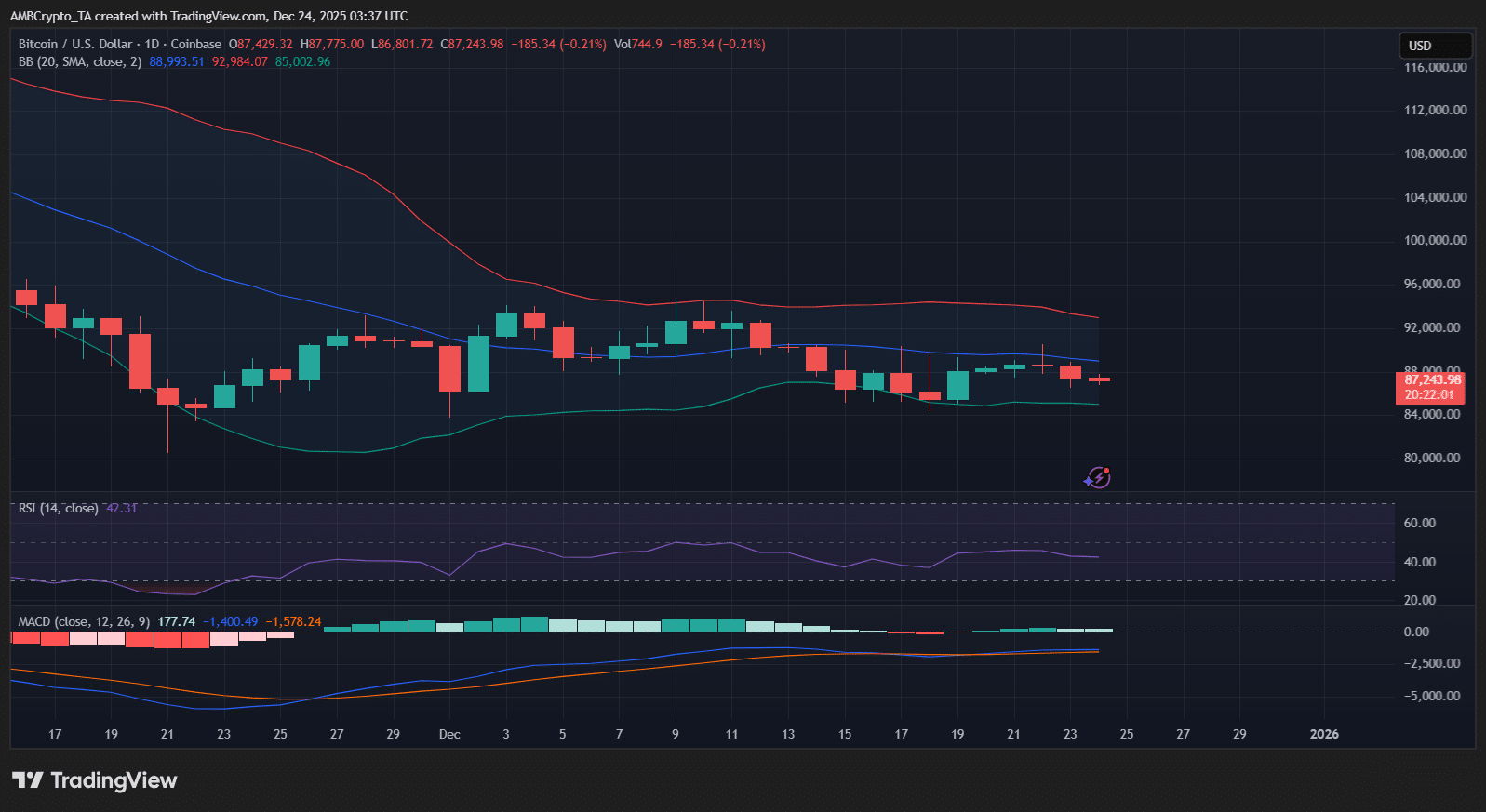

Lag today, gains tomorrow

Bitcoin has been stuck in a narrow range, with pace looking subdued.

Source: TradingView

That underperformance becomes clearer when compared to equities.

According to David Schassler, Head of Multi Asset Solutions, VanEck, Bitcoin has lagged the Nasdaq 100 by nearly 50% this year. But that gap may matter more going forward than it does today.

“Today’s weakness reflects softer risk appetite and temporary liquidity pressures, not a broken thesis.”

If liquidity improves, Bitcoin could respond better than stocks in 2026.

Final Thoughts

- Bitcoin supply is tight as exchange balances fall.

- Whales added 136K BTC, so there’s long-term confidence despite the boredom right now.