U.S. President Trump drew a red line on social media: Anyone who disagrees with the view of cutting interest rates when the economy is performing well will never become the Chairman of the Federal Reserve.

The contest between the White House and the Federal Reserve has escalated again due to Trump’s direct pressure. On December 10 local time, the Federal Reserve announced a 25 basis point cut in the federal funds rate target range to 3.5%-3.75%. This marks the third consecutive rate cut this year, with a total reduction of 75 basis points.

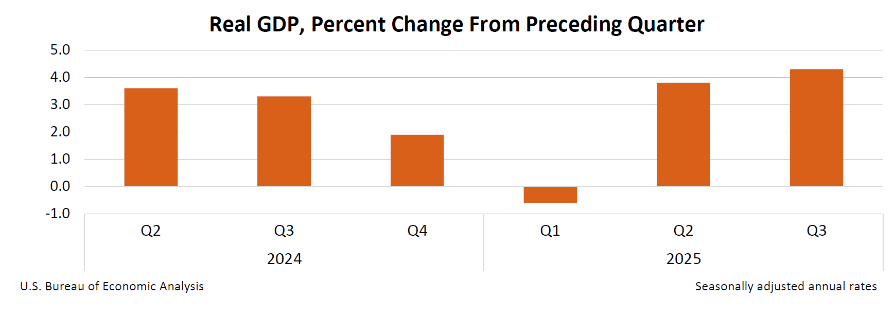

The next day, data released by the U.S. Department of Commerce showed that the U.S. GDP grew by an annualized rate of 4.3% quarter-on-quarter in the third quarter of this year.

Faced with the parallel of stronger-than-expected economic growth and continued rate cuts, Trump criticized on social media: “In the past, when there was good news, the market would rise. Now, when there is good news, the market falls, because everyone thinks rates will be raised immediately to deal with ‘potential’ inflation.”

1. Latest Pressure

Since Trump returned to the White House, his conflict with the Federal Reserve has hardly ceased. Recently, this dispute has become more specific and acute due to a piece of news and an economic data release.

● On December 23, preliminary data released by the U.S. Department of Commerce showed that the U.S. GDP grew by 4.3% annualized quarter-on-quarter in the third quarter of this year. This figure exceeded most economists’ expectations, indicating that the U.S. economy still maintains strong growth momentum.

● The day after the economic growth data was released, Trump once again pressured the Federal Reserve on social media. He hopes the Fed will “cut rates when the market is performing well, rather than destroying the market for no reason,” and made it clear: “Anyone who disagrees with my view will never become Chairman of the Federal Reserve!”

● This is not the first time Trump has publicly pressured the Federal Reserve. He has previously criticized Fed Chairman Powell as “terrible” on multiple occasions and has repeatedly threatened to “fire” Powell. Trump believes Powell’s rate cuts are too slow and do not align with his policy orientation of stimulating economic growth through low interest rates.

2. Levels of Pressure

Trump’s pressure on the Federal Reserve is not a momentary impulse, but rather a step-by-step escalation, forming a complete political pressure system.

● The most public and direct is public opinion pressure. Trump continuously criticizes the Fed’s interest rate policy through social media and public statements. He has repeatedly stated that even without rate cuts, the U.S. is doing well, but with rate cuts, the U.S. would do even better.

● A deeper level is personnel arrangements. Trump has repeatedly expressed his intention to break the recent market trend and is eager to nominate a chairman committed to lowering borrowing costs. According to the Financial Times, Trump has narrowed the list of candidates to three or four people, including former Fed Governor Kevin Warsh, Treasury Secretary Scott Besant, White House National Economic Council Director Kevin Hassett, and Fed Governor Christopher Waller.

● The most radical step is legal challenges. According to the New York Times, Trump once drafted a letter to dismiss Federal Reserve Chairman Jerome Powell. Although Trump later denied this, the move was seen as the most direct challenge to the Fed’s independence by a U.S. president in history.

3. Political Divisions

This contest between the White House and the Federal Reserve has triggered polarized reactions in U.S. politics, directly reflecting deep contradictions within the U.S. economic governance system.

● Within the Republican Party, lawmakers in charge of financial and budget affairs are clearly reserved about this. Banking Committee member Thom Tillis stated bluntly: “Ending the Fed’s independence would be a huge mistake,” and warned that if the chairman were really removed, the Senate would “respond quickly.”

● On the Democratic side, it is generally believed that this move undermines the U.S. economic governance mechanism and international credibility, and is a dangerous signal of “political interference in finance.” Several Democratic senators have made it clear that Trump’s actions undermine the Fed’s independence.

● Wall Street and the financial community have expressed widespread concern. Analysts at several financial institutions believe this move will lead to market volatility and may trigger investor concerns about the creditworthiness of the U.S. dollar and U.S. Treasury bonds.

4. Economic Dilemma

The current decision-making dilemma facing the Federal Reserve stems from the contradictory situation of “stagnation” and “inflation” coexisting in the U.S. economy.

● Strong growth vs. sticky inflation form a contrast. U.S. GDP grew by 4.3% in the third quarter, but inflationary pressure has not eased. The Fed’s preferred PCE index rose 2.8% year-on-year in September, slightly below expectations but still well above the 2% policy target.

● Meanwhile, the job market has shown signs of cooling. In October, U.S. employers laid off and dismissed 1.854 million people, the highest since January 2023. This combination of “declining employment + sticky inflation” puts the Fed in a dilemma between “protecting jobs” and “controlling inflation.”

● The voting results of the Fed’s latest policy meeting also reflect this internal contradiction. Of the 12 voting members, 9 supported a rate cut and 3 opposed, marking the first time since September 2019. This “stagflation-style” contradiction will test policymakers for a long time. The Fed’s “wait and see” stance may become the norm for central banks worldwide, and the lag in policy response will intensify market volatility.

5. The Race for Successor

With Powell’s term set to end in May 2026, the race for the next Fed chairman has quietly begun.

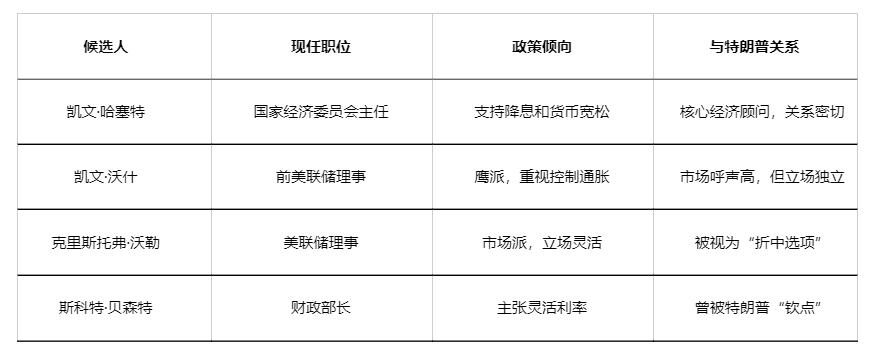

Trump has narrowed the list of candidates to “three to four people.” Among the many possible candidates, several key figures each have their own characteristics:

● Kevin Hassett, as Director of the National Economic Council, is Trump’s core economic advisor and supports rate cuts and monetary easing.

● Kevin Warsh, former Fed Governor, is regarded in public opinion as a “hawkish representative,” emphasizing inflation control and financial stability.

● Christopher Waller, current Fed Governor, has a “market-oriented” policy stance, is relatively flexible between tightening and easing, and is seen as a “compromise option.”

● Scott Besant, current Treasury Secretary, has a market-oriented style, advocates flexible interest rates and fiscal coordination, and was once “handpicked” by Trump.

Below is a comparison of the policy stances of possible Fed chairman candidates:

Whoever is ultimately nominated, the new chairman will face the huge challenge of finding a balance between political pressure and professional judgment.

After the GDP data was released, the S&P 500 index rose for the fourth consecutive day and hit a record high. This market reaction contradicts Trump’s “good news is bad news” paradox, suggesting that the market is self-adjusting.

At the beginning of December, Trump stated that he had narrowed the list of Fed chairman nominees to “three to four people” and expected to make a decision soon, to be announced “in the coming weeks.” Kevin Hassett and Kevin Warsh are considered frontrunners for the position, while Christopher Waller has also been interviewed and praised by Trump.