In 2025, Ethereum wins, but ETH fails to keep up

What drives the Ethereum ecosystem are encapsulation tools and corporate treasuries, not token prices.

Written by: Prathik Desai

Translated by: Chopper, Foresight News

As a staunchly bullish ETH investor, I’ve developed an annoying habit this year. Every day, I open the ETH price chart and silently calculate how much my portfolio has lost. After finishing the math, I close the market page, hoping it won’t be too long before I break even.

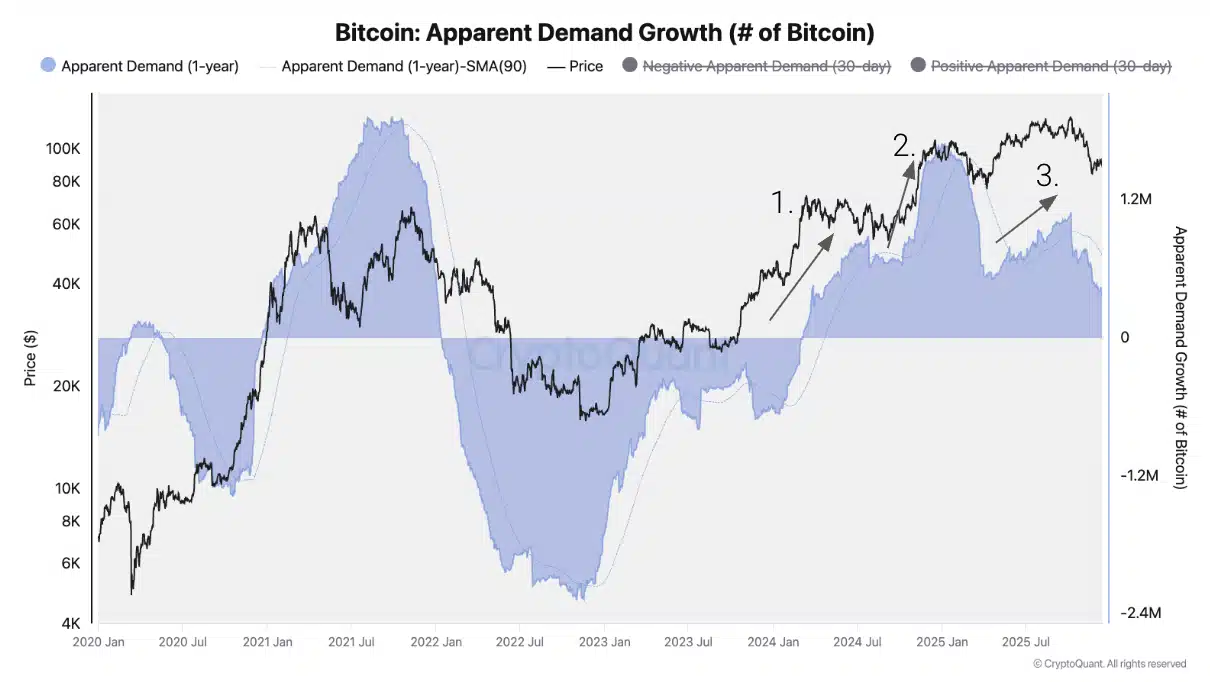

As the year draws to a close, I think most investors who bought ETH at the beginning of the year are inevitably disappointed. However, over the past 12 months, despite ETH’s lackluster price performance and wealth effect, the Ethereum blockchain has stood out among its competitors.

If “making money” is the benchmark, 2025 is undoubtedly a bad year. But if you look beyond token returns, holding ETH in 2025 has become much more convenient, mainly thanks to the rise of market-driven tools such as ETFs and crypto corporate treasuries (DAT). In addition, Ethereum completed two major upgrades this year—Pectra and Fusaka—which have made the public chain more capable and efficient in supporting large-scale applications.

In this article, I’ll reveal why the development trajectories of the Ethereum network and the ETH token diverged in 2025, and what this means for their future.

Ethereum Finally Goes Mainstream

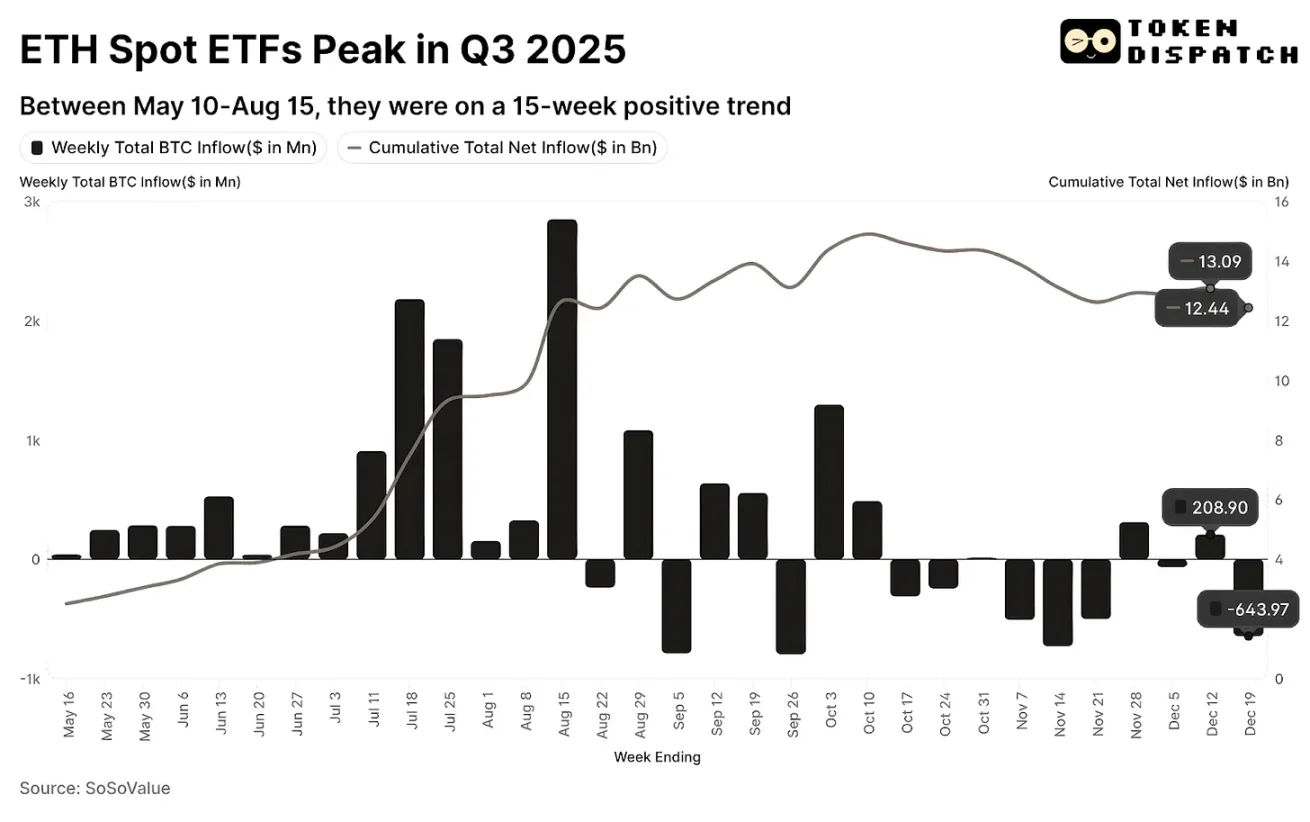

For most of the past two years, “institutional-grade ETH investment” seemed like an unattainable dream for many. As of June 30, cumulative inflows into ETH ETFs since their launch a year ago had just barely surpassed $4 billion. At that time, public companies were only beginning to consider adding ETH to their corporate treasuries.

The turning point quietly arrived in the second half of this year.

Between June 1 and September 30, 2025, cumulative inflows into ETH ETFs grew nearly fivefold, breaking the $10 billion mark.

This ETF capital frenzy not only brought in a flood of funds, but also triggered a psychological shift in the market. It dramatically lowered the threshold for ordinary investors to buy ETH, expanding ETH’s audience from blockchain developers and traders to a third group—ordinary investors looking to allocate the world’s second-largest crypto asset.

This brings us to another major industry transformation that emerged this year.

Ethereum Welcomes New Buyers

Over the past five years, influenced by the investment strategy proposed by the CEO of Strategy, bitcoin corporate treasuries seemed to have become the only paradigm for putting crypto assets on the balance sheet. Before this model’s flaws were exposed, it was once considered the simplest path for companies to allocate crypto assets: public companies buy scarce crypto assets, push up the coin price, which in turn boosts the company’s stock price; then, the company can issue more shares at a premium to raise additional funds.

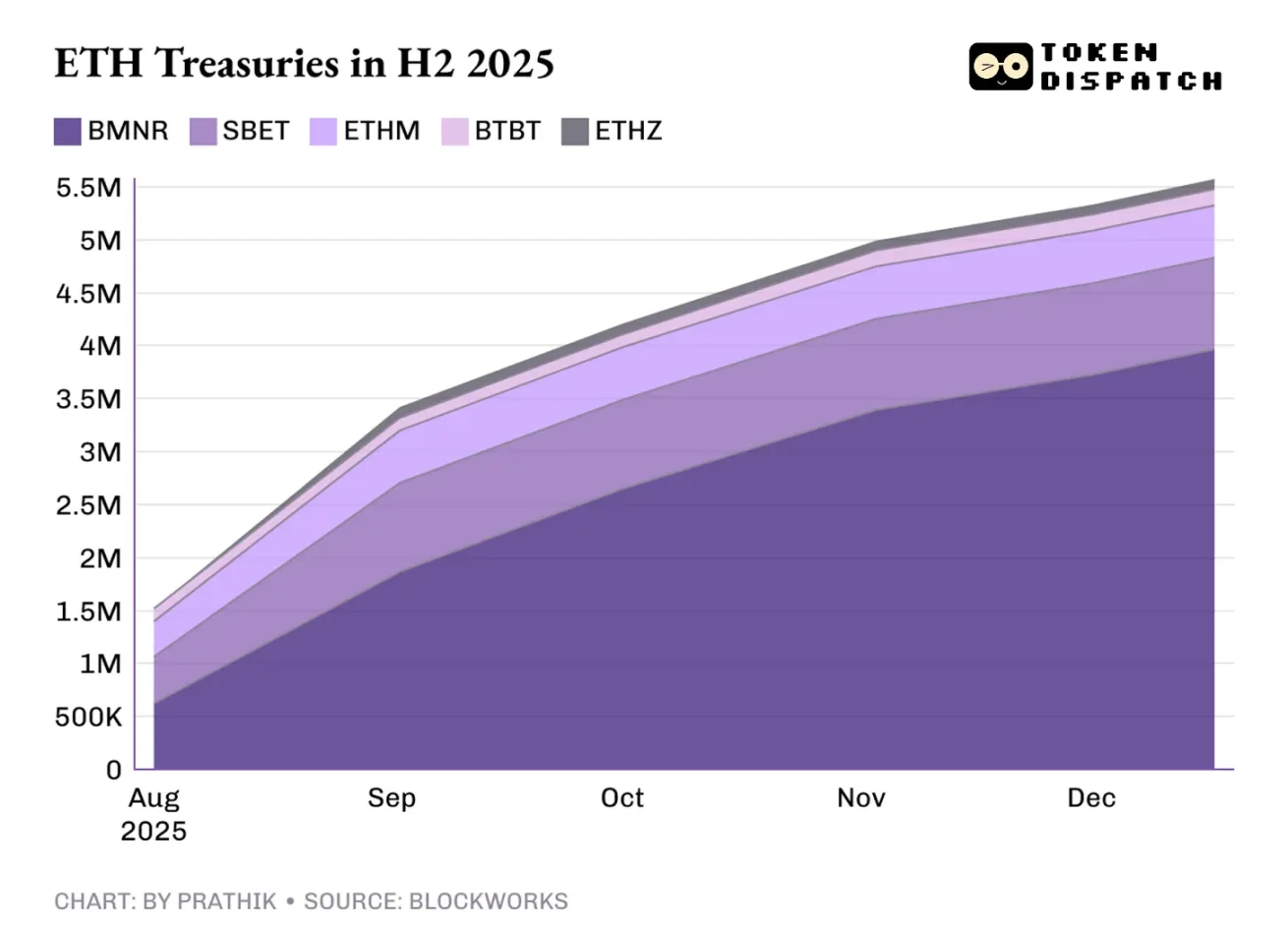

That’s why, when ETH corporate treasuries became a hot topic in June this year, many people were puzzled. The core reason ETH corporate treasuries have risen to prominence is that they can achieve functions that bitcoin treasuries cannot. Especially after Ethereum co-founder and ConsenSys CEO Joe Lubin joined the board of SharpLink Gaming and led its $425 million ETH treasury investment strategy, the market realized the foresight of this move.

Soon after, many companies followed SharpLink Gaming’s example.

As of now, the top five ETH treasury companies collectively hold 5.56 million ETH, accounting for more than 4.6% of total supply, worth over $16 billion at current prices.

When investors hold an asset through encapsulation tools such as ETFs or corporate treasuries, the asset gradually becomes more like a “balance sheet item.” It is included in the company’s governance framework, requiring regular financial disclosures, special board discussions, quarterly performance updates, and oversight by risk committees.

ETH’s staking feature gives ETH treasuries an advantage that bitcoin treasuries can hardly match.

Bitcoin treasuries can only generate income for companies when they sell bitcoin for a profit; ETH treasuries are different. Companies only need to hold ETH and stake it to provide security for the Ethereum network, and they can earn more ETH as staking rewards.

If companies can combine staking rewards with their main business income, the ETH treasury business can become sustainable.

It was from this point on that the market truly began to recognize Ethereum’s value.

The “Low-Key” Ethereum Finally Gets Attention

Those who have followed Ethereum’s development for a long time know that Ethereum has never been good at proactive marketing. In the absence of external events (such as the launch of asset encapsulation tools, market cycle shifts, or new narratives), Ethereum often remains low-profile until these external factors appear and people are reminded of its potential.

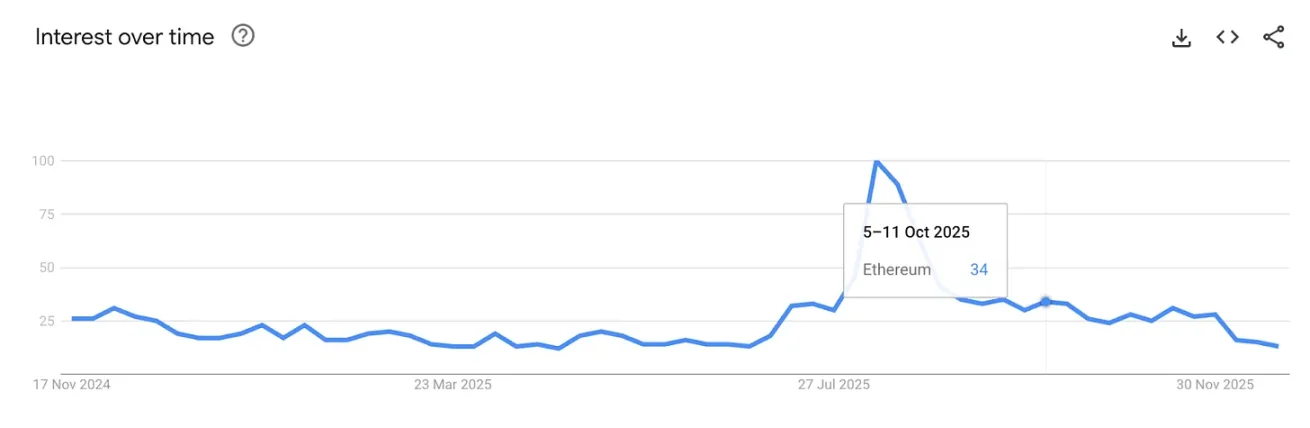

This year, the rise of ETH corporate treasuries and the surge in ETF inflows finally put Ethereum in the market spotlight. I measured this change in attention in a very intuitive way: by observing whether retail investors who usually have no interest in blockchain technology roadmaps have started discussing Ethereum.

From July to September this year, Google Trends data showed a sharp surge in Ethereum search popularity, a trend that closely matches the momentum of ETH corporate treasuries and ETFs. It is these traditional asset allocation channels that have sparked retail investors’ curiosity about Ethereum, which in turn has translated into market attention.

But hype alone is far from enough. Market attention is always fickle, coming and going quickly. This leads to another important reason why Ethereum supporters see 2025 as a “year of great victory”: a key factor often overlooked by outsiders.

On-Chain Dollars Powering the Internet

If you look beyond short-term price charts and extend the time horizon, the ups and downs of crypto prices are merely the result of market sentiment swings. But stablecoins and real-world asset tokenization (RWA) are fundamentally different. They have solid fundamentals and serve as a bridge between the traditional financial system and decentralized finance (DeFi).

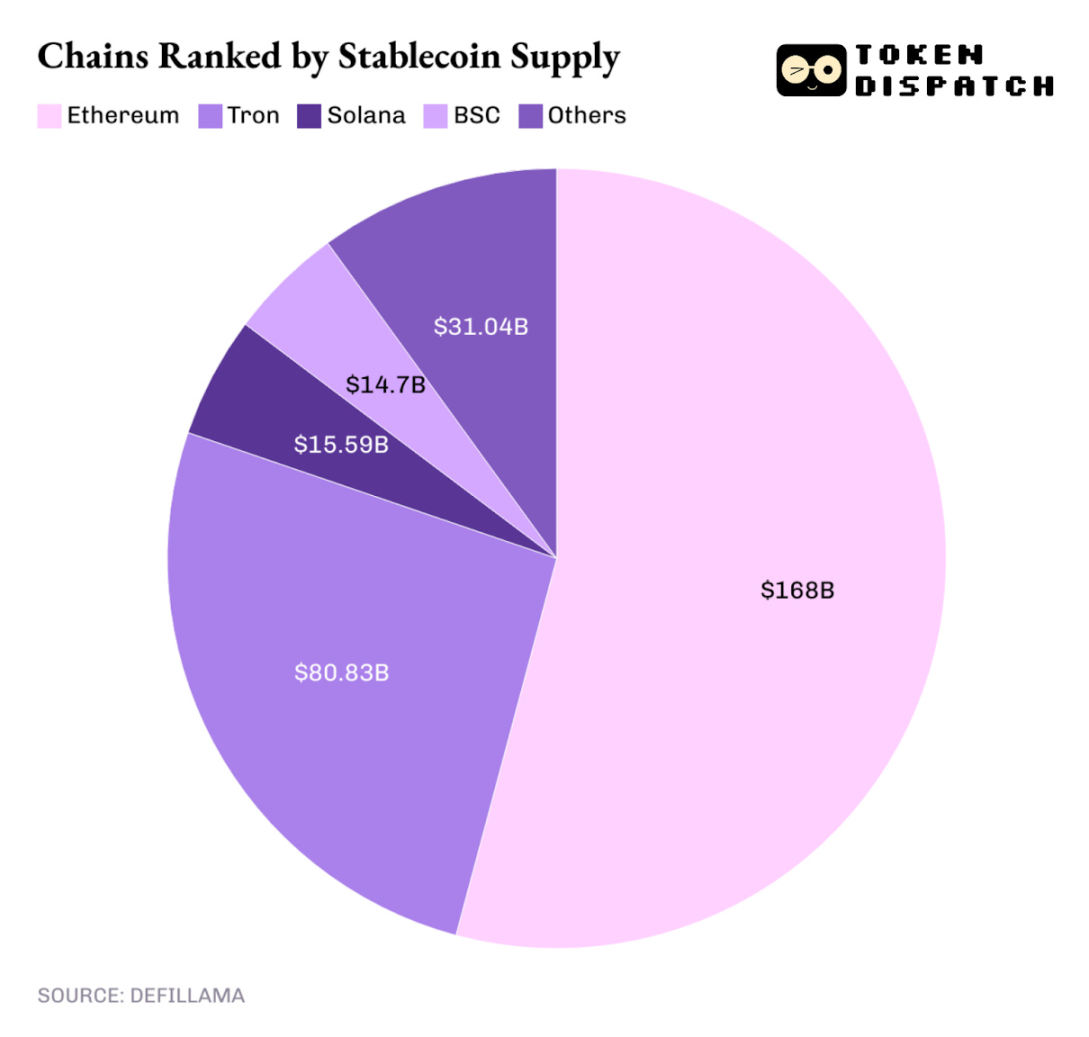

In 2025, Ethereum remains the top platform for on-chain dollars, continuously supporting stablecoin circulation.

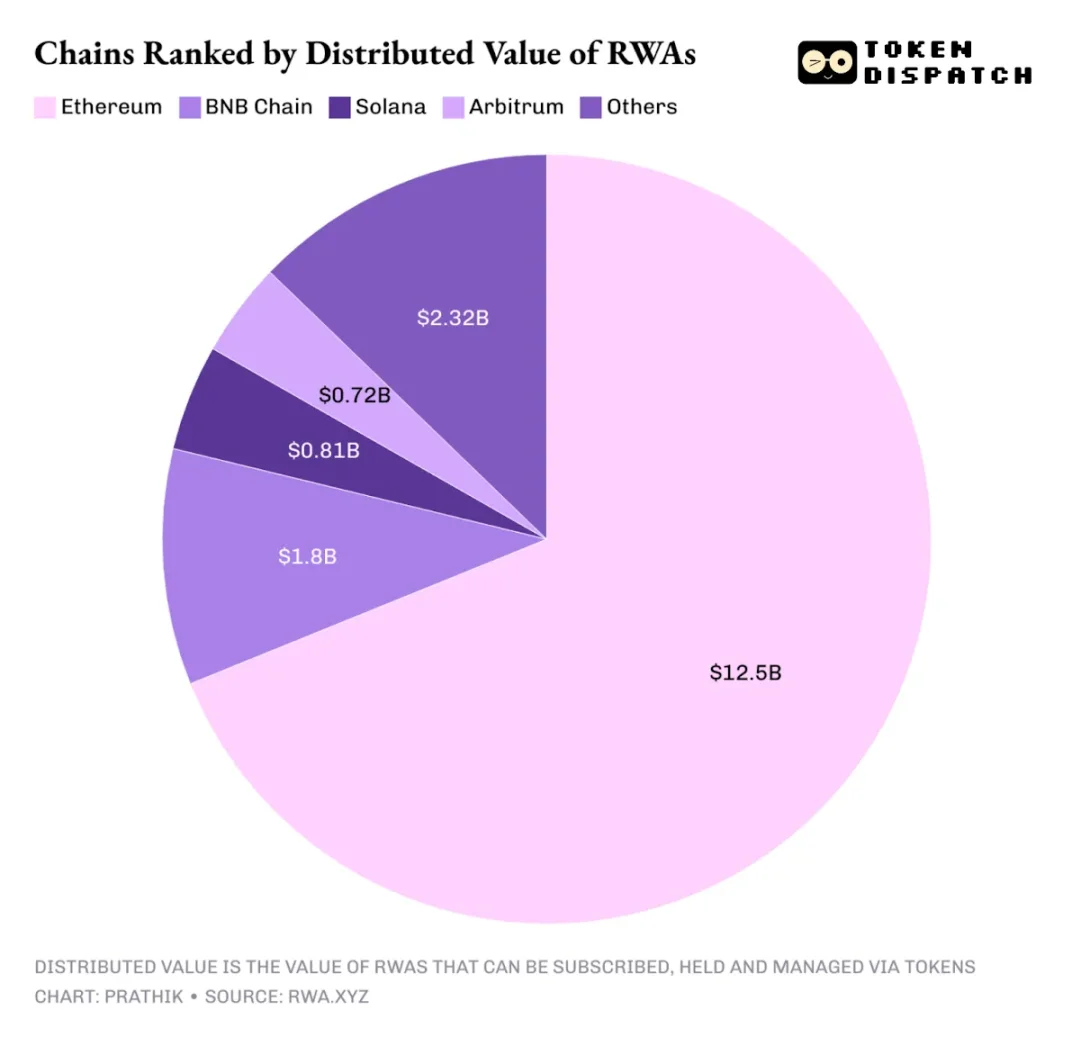

In the field of real-world asset tokenization, Ethereum also maintains an absolute dominant position.

As of this writing, tokenized assets issued on the Ethereum network still account for half of the global total value of tokenized assets. This means that more than half of the world’s real-world asset tokens available for holders to buy, sell, and manage are issued on the Ethereum network.

As can be seen, ETFs have lowered the threshold for ordinary investors to buy ETH, while corporate treasuries provide investors with a compliant Wall Street channel to hold ETH, allowing them to gain leveraged ETH exposure.

All these developments are further promoting the integration of Ethereum with traditional capital markets, enabling investors to allocate ETH assets with confidence in a familiar, compliant environment.

Two Major Upgrades

In 2025, Ethereum completed two major technical upgrades. These upgrades greatly alleviated network congestion, improved system stability, and significantly enhanced Ethereum’s utility as a trusted transaction settlement layer.

The Pectra upgrade officially launched in May this year, expanding data sharding (Blob) to improve Ethereum’s scalability and providing more compressed data storage space for Layer 2 networks, thereby reducing Layer 2 transaction costs. This upgrade also increased Ethereum’s transaction throughput, sped up transaction confirmation, and further optimized the efficiency of applications centered on Rollup scaling solutions.

Following the Pectra upgrade, the Fusaka upgrade quickly followed, further enhancing Ethereum’s network scalability and optimizing user experience.

Overall, Ethereum’s core goal in 2025 is to optimize and evolve toward reliable financial infrastructure. Both upgrades prioritized network stability, transaction throughput, and cost predictability. These features are crucial for Rollup scaling solutions, stablecoin issuers, and institutional users who need on-chain value settlement. Although these upgrades have not created a strong short-term correlation between Ethereum network activity and ETH price, they have indeed strengthened Ethereum’s reliability in large-scale application scenarios.

Outlook

If you want to draw a simple and crude conclusion about Ethereum’s development in 2025—“Ethereum succeeded” or “Ethereum failed”—it’s hard to find a clear answer.

On the contrary, the market in 2025 has given a more thought-provoking, yet somewhat helpless fact:

In 2025, Ethereum successfully entered the portfolios of fund issuers and the balance sheets of public companies, and maintained market attention thanks to continuous institutional capital inflows.

However, ETH holders endured a disappointing year, as the token price trend was seriously out of sync with the booming development of the Ethereum network.

Investors who bought ETH at the beginning of the year are still facing at least a 15% unrealized loss. Although ETH hit an all-time high of $4,953 in August this year, the good times didn’t last, and its price has now fallen back to its lowest point in nearly five months.

Looking ahead to 2026, Ethereum is expected to continue leading the industry with solid technical upgrades and a massive scale of stablecoins and real-world asset tokenization. If the Ethereum network can capitalize on these advantages, it may be able to convert the momentum of ecosystem development into long-term upward price momentum for ETH.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s Christmas blues – Why BTC’s Santa rally can be cancelled

Market Panic or Contrarian Signal? Strategy’s 65% Slide Stokes Bitcoin Debate

Navigate Crypto’s Twists and Turns with Real-Time Insights

The European startup market’s data doesn’t match its energy — yet