The broader cryptocurrency market continues to struggle with uneven and choppy price action, a phase that began after the sharp sell-off on October 10. That correction dragged Ethereum (ETH) lower by nearly 25% over the past 60 days, keeping risk appetite muted across the altcoin space. Solana (SOL) has not been immune to this pressure, remaining under sustained selling as market participants stay cautious.

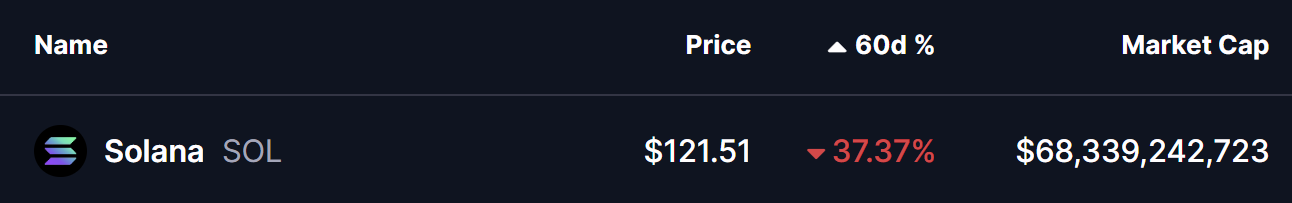

SOL is now down more than 37% over the same period. However, a closer look at the weekly chart suggests that the ongoing weakness may be part of a larger corrective structure rather than the start of a prolonged downtrend. Beneath the surface, the price action is beginning to form a technical setup that could lay the groundwork for a potential bullish reversal if key levels continue to hold.

Source: Coinmarketcap

Source: Coinmarketcap

Bearish Butterfly Pattern Taking Shape

On the weekly timeframe, Solana appears to be developing a Bearish Gartley Butterfly pattern. Despite its name, this harmonic structure often signals exhaustion of the downtrend and sets the stage for an upside reversal once the pattern completes its final leg.

The structure began at Point X near the $295 region, followed by a sharp decline toward Point A. From there, SOL staged a rebound into Point B before rolling over once again. The current decline has pushed price into the $113–$122 zone, an area that aligns with the projected completion region of Point C within the pattern.

Solana (SOL) Weekly Chart/Coinsprobe (Source: Tradingview)

Solana (SOL) Weekly Chart/Coinsprobe (Source: Tradingview)

This zone is technically significant, as it represents a confluence of harmonic projections and historical demand. If buyers are able to defend this range, it would increase the probability that Point C is forming, opening the door for the bullish CD leg — the phase that typically drives recovery rallies in harmonic setups.

What’s Next for SOL?

If the $113–$122 support zone holds firm, Solana could begin to stabilize and attempt a reversal toward the 100-period moving average on the weekly chart, currently sitting near $165.89. A successful reclaim of this level would act as early confirmation that bullish momentum is returning.

Beyond that, the harmonic projection points to more ambitious upside targets. A sustained recovery could eventually drive SOL toward the $349.30 to $418.38 region, which aligns with the 1.272 and 1.618 Fibonacci extension levels of the pattern. From current prices, such a move would represent a potential upside of over 240%, assuming broader market conditions turn supportive.

That said, the setup remains conditional. A failure to hold the $113–$122 zone would weaken the bullish thesis, allowing sellers to regain control and potentially push SOL toward new local lows before any meaningful recovery attempt. For now, patience remains critical, and buyers may want to wait for clear confirmation before positioning for a reversal.