Crypto investment in Brazil surged 43% this year, with the average user now investing over $1,000, according to a new report from Mercado Bitcoin. That’s a clear signal: retail investors are moving past hype and looking for undervalued crypto picks with real upside.

Brazil’s crypto surge fuels demand for cheap cryptos with potential

Crypto adoption in Brazil rose sharply in 2025, with total transaction volume up 43% and the average user investment surpassing $1,000, according to the “Raio-X do Investidor em Ativos Digitais 2025” report from Mercado Bitcoin.

The platform, Latin America’s largest crypto exchange, also noted a 108% spike in demand for lower-risk digital products. Meanwhile, 18% of users diversified across multiple assets, a sign that investors are maturing and increasingly interested in low-priced coins with long-term upside.

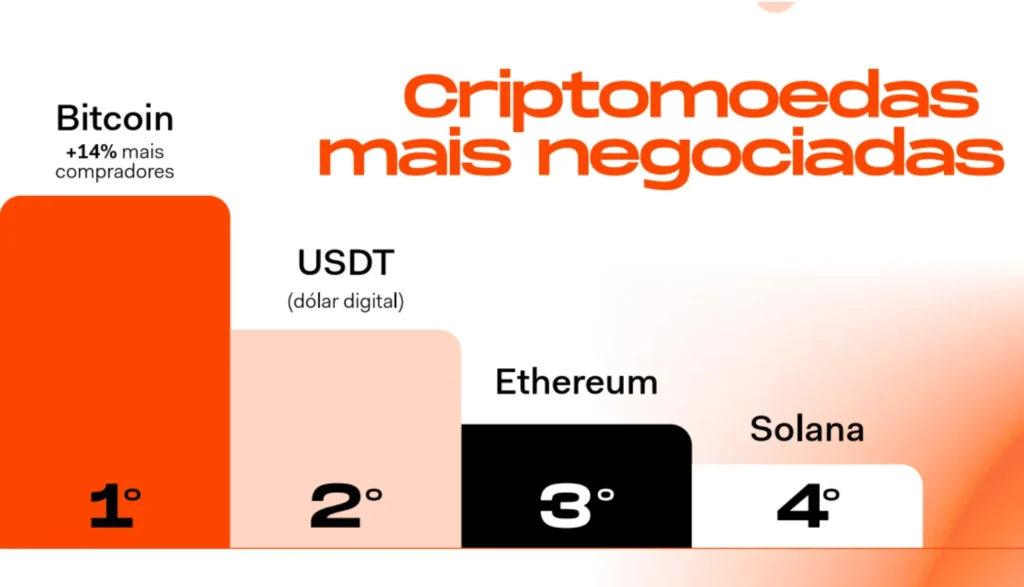

Bitcoin is the most traded asset in Brazil

Bitcoin is the most traded asset in Brazil

Bitcoin, USDt, Ether, and Solana remained Brazil’s top-traded assets. But Itaú Asset Management’s call for a 1–3% BTC portfolio allocation underlines growing institutional acceptance, further supporting the case for undervalued crypto picks.

As structured investing gains traction, retail and institutional players alike are hunting the best cheap crypto to buy now before broader adoption pushes prices higher.

Monad: Undervalued crypto pick falls 5.1% despite high trading volume and major integrations

Monad (MON) has drawn attention after launching its TGE on Coinbase and raising $296 million, but the price performance has been underwhelming in the short term. Over the past 7 days, MON is down 5.1%, trading around $0.02022 on December 22nd.

Despite the pullback, activity remains high, with $173 million in 24-hour trading volume and strong investor interest due to its high-speed, EVM-compatible Layer 1 design. Recent integrations with Chainlink and Gearbox aim to boost its DeFi security stack. Still, for many retail investors, Monad’s already large market cap of $219 million may limit its upside compared to lower-priced coins.

Next up on our list of best cheap crypto to buy now:

zkPass: zkPass jumps 14% after Binance Alpha launch, but upside may be priced in

zkPass (ZKP) surged over 14% in the past week, reaching $0.1616 on December 22nd following its official launch on Binance Alpha and multiple perpetual listing announcements.

With $91 million in 24-hour trading volume and a market cap of $32.5 million, zkPass is gaining traction for its decentralized oracle tech built on zkTLS, allowing on-chain proof generation from private internet data.

Despite the impressive breakout, some traders argue the pump could be front-loaded. Its fully diluted valuation of $161 million suggests much of the upside might be baked in unless broader adoption follows. Compared to undervalued crypto picks, zkPass may offer limited upside from current levels.

What’s the verdict?

While Monad and zkPass show promise, their current valuations limit the upside. In contrast, some cryptos remain among the best cheap options to consider now, with real-time utility and still-low market caps. Even a modest rally could deliver outsized returns.

FAQs

What crypto under $1 will explode?

Many believe projects with real AI utility and functional products already deployed show strong potential under $1.

Which crypto has 1000x potential?

While no asset is guaranteed to 1000x, some utility-driven projects with low entry prices and sustained momentum may offer unique upside for those seeking affordable options.

Which coin is best to buy now cheaply?

At present, leading low-priced coins are focusing on solving real user needs through innovative technologies and practical tools, leaving room for future growth as adoption increases.