- Curve captured 44% of Ethereum DEX fees as crvUSD and BTC pools fueled renewed demand.

- Whales add 8% of the CRV supply while exchange balances drop, tightening sell-side liquidity.

- CRV rebounded from channel support, but significant resistance levels still limit upside momentum.

CRV pushed higher on Tuesday as traders took a second look at a token that has spent months grinding lower, weighed down by relentless selling and wavering sentiment. The move wasn’t dramatic, but it was enough to draw attention back to a project whose fundamentals have quietly shifted while the price chart remained stuck in reverse.

A mix of stronger fee generation, coordinated whale activity, and a mild shift in technical signals helped fuel the rebound, though the broader trend still leans heavily bearish. Curve’s fee dominance has been the most striking development.

Why is CRV’s price up today?

Fee Growth Reinforces Curve’s Core Metrics

Over the past month, the protocol captured roughly 44% of total fees generated across Ethereum-based DEXs, according to DeFiLlama, a stark jump from around 1.6% a year earlier. That translated to about $15.1 million in revenue before dipping to $9.81 million, putting Curve second only to Uniswap during the period.

The jump is largely tied to rising activity in crvUSD pairs and a resurgence in liquidity in Bitcoin-linked pools, both of which have become important pillars of Curve’s ecosystem. Historically, high fee share often signals sticky usage, deeper liquidity, and stronger incentives across governance and staking systems tied to CRV.

Source: DefiLlama

It also shapes expectations around the token’s value capture in the months ahead. Still, not everyone is convinced the surge can last. Some desks are watching closely to see whether crvUSD demand holds or if the recent spike in Bitcoin pool liquidity fades just as quickly as it arrived.

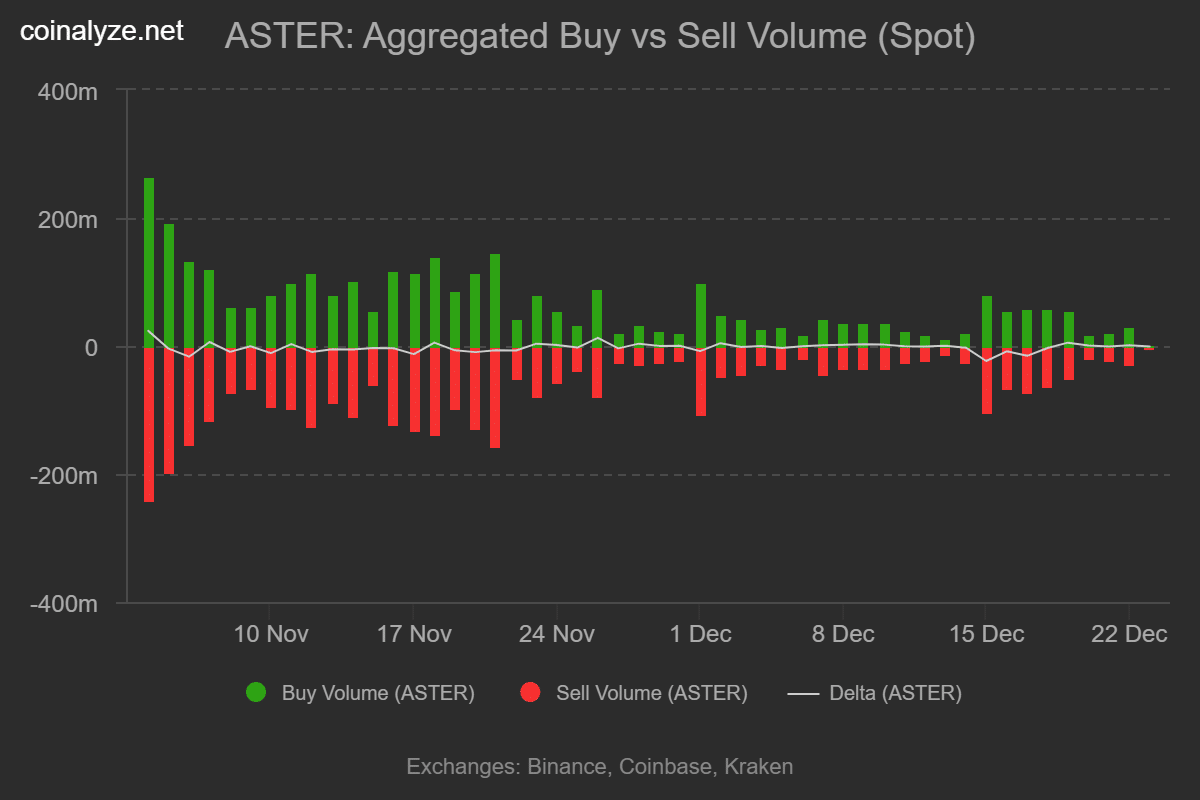

Whales Tighten CRV’s Liquid Supply

Whale activity tells its own story. On-chain data shows the top 100 wallets added roughly 8% of CRV’s circulating supply since September, while exchange balances fell about 23%, based on Nansen figures shared on X.

Source: X

This thinning of liquid supply tends to heighten the impact of any pickup in demand, a dynamic that often exaggerates the magnitude of price swings. The timing of the accumulation, right after a brutal 48% drawdown over 90 days, suggests that some large holders were positioning for value rather than momentum.

But there’s a double edge. Concentrated ownership means any reversal by these same wallets could ripple through the market faster than traders expect, especially in a token with already thin spot liquidity.

CRV Price Action: Recovery Stalls Under Bearish Pressure

Technically, CRV remains stuck inside a five-month descending channel, indicating bearish sentiment persists in the long term. Similarly, both the 20-day and 50-day moving averages sit above the price, near $0.37 and $0.40, keeping pressure on any attempt at a sustainable breakout.

However, price has stabilized in the $0.36–$0.33 support range, a zone that has repeatedly absorbed selling pressure. The latest bounce originated close to the middle boundary of the descending channel, suggesting short-term exhaustion among sellers rather than a confirmed trend reversal.

Source: TradingView

Momentum indicators support this interpretation. The 14-day RSI has rebounded to around 45 after emerging from oversold conditions, signaling improving buying interest but still below the neutral 50 level. This places CRV in a recovery phase rather than a clear bullish regime.

For upside continuation, CRV must reclaim the 20-day and 50-day moving averages and push RSI above 50. A decisive breakout above the descending channel would be required to validate a broader reversal. Until then, resistance remains layered between $0.41 and the 23.6% Fibonacci zone, coinciding with the $0.52–$0.59 resistance range.

Related: BNB Faces Short-Term Pressure as Long-Term Outlook Stays Strong

Curve Sees a Surge in On-Chain Usage

On-chain data adds context to the recent price lift. Active addresses jumped from 827 to 1,121 in a single day, marking a notable surge in network participation. Rising active addresses during a base-building phase often reflect renewed user engagement rather than purely speculative trading.

Source: CryptoQuant

At the same time, the exchange supply ratio has declined to about 0.18 and has trended lower since Dec. 13. Fewer CRV tokens held on exchanges typically signal reduced immediate sell pressure.

Source: CryptoQuant

This behavior is often associated with accumulation by long-term holders or whales positioning ahead of potential volatility. Together, rising address activity and falling exchange balances suggest improving on-chain health, even as price remains structurally constrained.