Things to know: Recently, some well-known market analysts have dismissed the concept of bitcoin's four-year cycle and the almost certain bear market it implies. However, Fidelity's Jurrien Timmer states that this market's performance is almost entirely consistent with previous four-year cycles, and the current bear market action is expected to last deep into 2026.

Recently, denying bitcoin's BTC$88,242.84 four-year cycle—and the inevitable boom and bust that follows—has become fashionable.

Just in the past week, Matt Hougan from Bitwise and Cathie Wood from ARK Invest have both strongly supported the view of rejecting the four-year cycle. They point out that ETFs, as well as regulatory and institutional acceptance, have integrated bitcoin into the traditional financial system. Bitcoin is no longer a fringe asset, and there is no reason for it to follow the same patterns as years ago.

Defining the Cycle

The four-year cycle refers to the price pattern associated with bitcoin halving events, which occur roughly every four years. These halving events reduce the number of bitcoins rewarded for mining a block by 50%. This 50% cut is believed to cause a supply shock, which in turn forces prices to rise sharply.

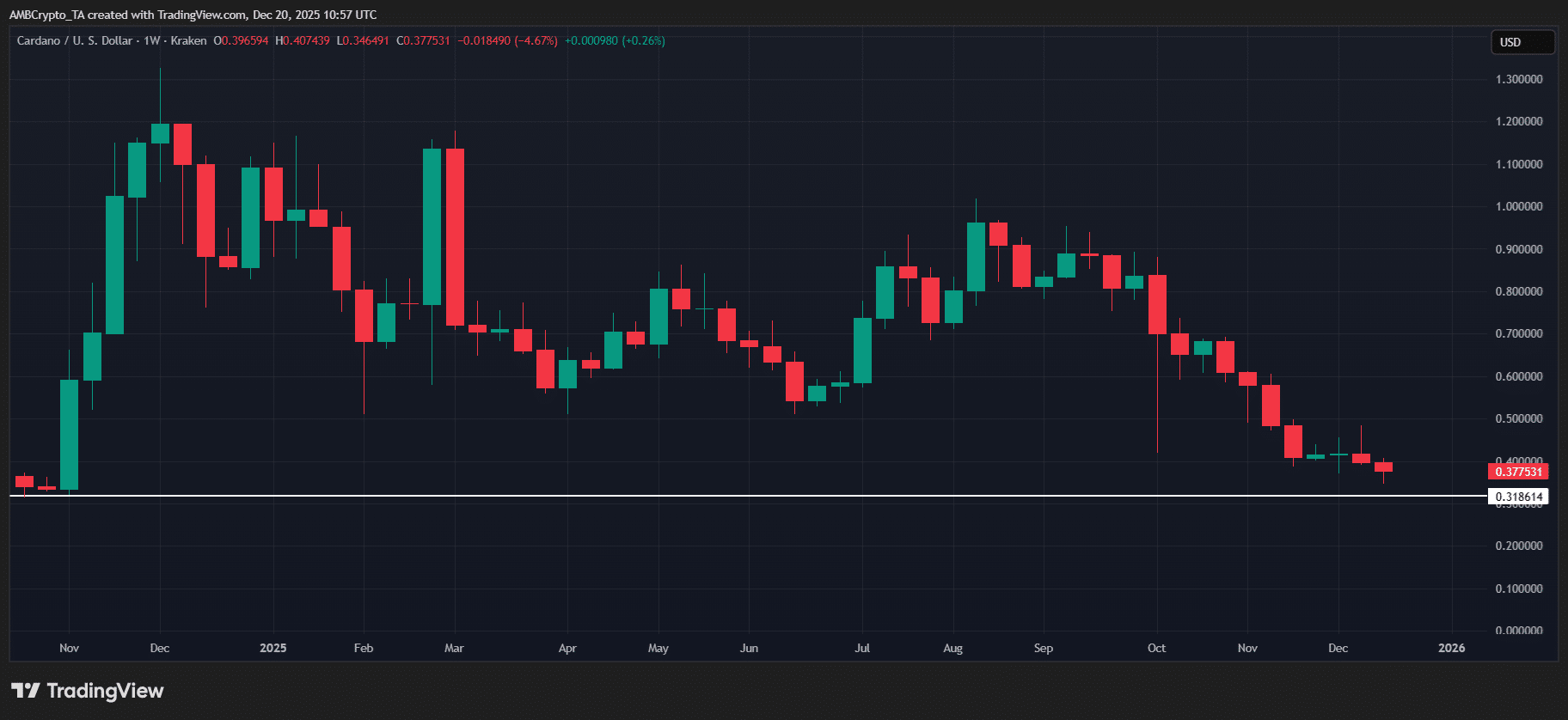

After a major bull market, there is typically a crash of about 80%, followed by a steady rise until the next halving event.

Chart analysts like to point out the bull markets (and subsequent crashes) that followed the 2012, 2016, and 2020 halvings, and claim that the 2024 event is unfolding in the same way: a sharp rise, eventually surpassing $125,000 in October 2025, followed by a bear market—which is exactly where the market currently stands.

Fidelity's Timmer Weighs In

As an early bitcoin believer in traditional finance, Jurrien Timmer, Head of Global Macro at Fidelity, does not see any signs in his charts that the four-year cycle has ended.

“If we visually compare the peaks of all bull markets, we can see that after 145 weeks of gains, the $125,000 peak in October aligns quite well with expectations,” Timmer said earlier this week.

As for what happens next, that will be winter. Timmer points out that the subsequent bear market typically lasts about a year. “I feel that 2026 could be a ‘rest year’ (or ‘down year’) for bitcoin.” He concluded that support lies between $65,000 and $75,000.