Pepecoin (PEPE) vs $0.035 DeFi Coin: Which Has the Cleaner Long-Term Setup as Market Conditions Shift?

Market conditions are beginning to shift as investors look beyond short bursts of speculation and search for projects with clearer long-term setups. Meme tokens that once dominated attention are slowing down, while a new DeFi altcoin priced at $0.035 is gaining traction as traders prepare for the next crypto cycle. Many are now comparing Pepecoin (PEPE) to Mutuum Finance (MUTM) to see which one holds the stronger runway into 2026.

Pepecoin (PEPE)

Pepecoin (PEPE) delivered one of the fastest meme coin surges of its cycle. It climbed from near-zero levels to a multi-billion-dollar valuation as viral posts and heavy speculation pushed it into major exchange listings. The token became a centerpiece of meme-driven trading. Early buyers saw large returns, and PEPE briefly captured the same excitement once held by Dogecoin and Shiba Inu.

But the environment has changed. PEPE now carries a large market cap that limits its ability to rally further. Large caps move slowly because they require heavy inflow to climb. Analysts also point to PEPE’s lack of internal utility as a barrier to long-term growth. Without a clear economic model or revenue engine, the token depends on sentiment cycles. When hype cools, movement slows. Several forecasts show mild growth for PEPE and place its upside far lower than early expectations. This is why many traders who once supported the token are now looking toward smaller and more structured new crypto projects.

Mutuum Finance (MUTM)

Mutuum Finance (MUTM) is developing a decentralized lending protocol designed around on-chain activity and sustainable yield. It uses a dual lending structure where users can lend assets such as ETH or USDT and receive mtTokens. These mtTokens increase in value as borrowers repay interest. For example, if a user lends $500 of ETH, their mtTokens will grow as borrowing activity increases. This creates a yield system that depends on real usage rather than sentiment.

Borrowers interact with interest rates that shift according to liquidity. When liquidity is high, borrowing remains cheaper. When liquidity tightens, borrowing costs rise. Loan-to-value rules support safe borrowing and reduce liquidation risk. If collateral drops too far, liquidators repay part of the debt and receive discounted collateral. This structure creates long-term efficiency and stability inside the protocol.

Mutuum Finance confirmed through its official X account that the V1 testnet will launch in Q4 2025. It will include the lending pool, mtTokens, the debt-tracking module and the liquidation system. ETH and USDT will be supported at launch. Halborn Security is reviewing the contract suite to ensure performance and safety before the testnet goes live. These updates have helped pull more attention from traders following top crypto opportunities under $0.05.

Project Progress and Community Activity

Mutuum Finance has already shown early traction. It has raised $19.4M and has more than 18,600 holders. The token sale started at $0.01 and now sits at $0.035, marking a 250% rise during development. More than 820M tokens have been purchased so far. Out of the full supply of 4B, 1.82B tokens were allocated to early supporters. Phase 6 now sits above 99% allocation, showing that supply at the current price is becoming limited.

Community engagement remains active due to the project’s 24-hour leaderboard, where the top contributor each day earns $500 in MUTM. This creates steady interest and encourages new users to join. Mutuum Finance also supports card payment, which makes onboarding simple and fast for users who are new to crypto or prefer direct payment routes.

Why Investors Expect MUTM To Outperform

Top crypto investors studying both assets highlight several differences that may shape long-term performance. PEPE is a meme asset with a large market cap that now moves slowly. Its early surge was built purely on sentiment. Without utility or a revenue model, the token struggles to produce consistent growth. Many traders say PEPE already passed its explosive phase and now sits in a zone where upside will be limited.

Mutuum Finance sits at the opposite end of the spectrum. It is early, priced low and built around yield, collateral logic and structured lending mechanics. The mtToken system gives users real APY based on protocol usage. The buy-and-distribute model uses a portion of platform revenue to buy MUTM from the market and distribute purchased tokens to users who stake mtTokens. This creates long-term buy pressure tied to actual economic activity.

Timing plays a major role. Many early DOGE and PEPE investors are rotating into smaller-cap DeFi tokens because they want early-stage growth rather than slow movement from meme assets. Mutuum Finance is in this early zone, and its steady progress has helped build confidence. The project also recorded a $115K whale allocation, which reduced the remaining supply and increased visibility among retail traders. Whale entries often signal deeper belief in long-term growth.

Phase 6 is moving quickly, and the small amount of allocation left has added urgency for investors who see the project moving closer to its launch price of $0.06.

Roadmap Alignment

Mutuum Finance is preparing a USD-pegged stablecoin supported by borrower interest. Stablecoins help expand DeFi markets by offering predictable value for borrowing and liquidity management. They often attract deeper participation and help platforms scale faster.

The protocol plans to use Chainlink feeds for accurate pricing. Backup oracle layers and aggregated data protect users from liquidation mistakes. Lending markets depend on accurate price inputs, and analysts note that reliable oracle design is an important difference between successful lending protocols and those that fail early.

Pepecoin’s ability to grow today is limited by size and lack of utility. Mutuum Finance is at a much earlier stage, priced at $0.035, supported by mtToken yield, buy pressure from revenue, strong audits, expanding participation and a confirmed Q4 V1 testnet.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

'Bitcoin Senator' Cynthia Lummis Will Not Run for Reelection

Pi Network Price Prediction 2026-2030: The Shocking Truth Behind Pi Coin’s Drop

Analyst: XRP May Sweep Into Deeper Liquidity Pockets. Here’s What It Means

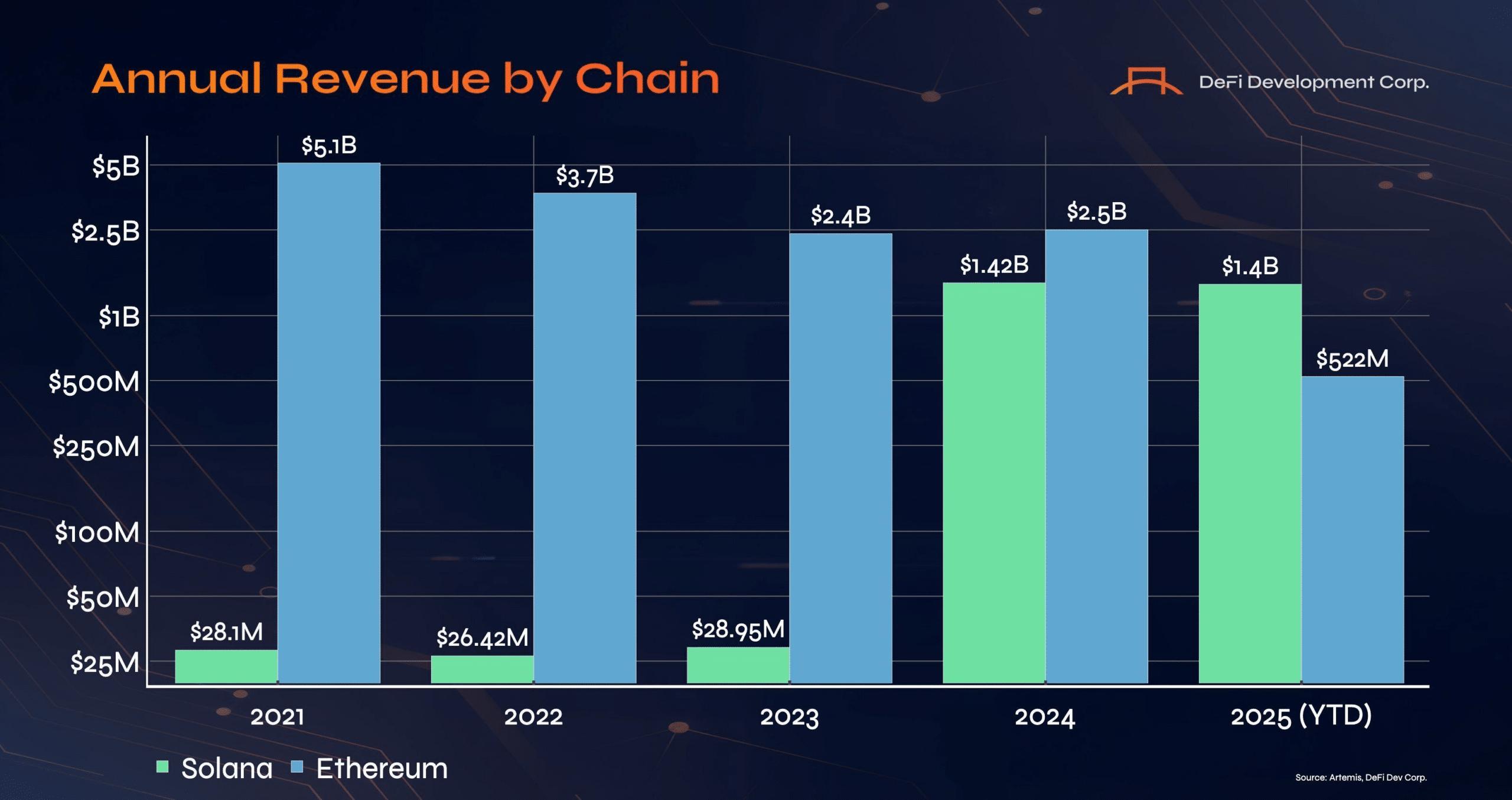

Solana vs. Ethereum heats up – Is the ‘ETH killer’ narrative finally real?