Bitcoin today: BTC approaches US$88 after interest rate hike in Japan, and altcoins attempt to stay in positive territory.

Friday, December 19, 2025 – Bitcoin is currently trading at US$88.008,13, up 0,44% in the last 24 hours.After the Bank of Japan raised its short-term interest rate to 0,75%, BTC reacted with a surge, trading near the $88 mark, as the market digested the decision and signals regarding the next steps in the country's monetary policy.

Although an interest rate hike in Japan could theoretically generate risk aversion in global markets, the day was marked by an attempt at stabilization in the crypto sector. Some investors interpreted that, even with the tightening, the move still keeps Japanese interest rates below the levels seen in other economies, allowing for less linear fluctuations—and for occasional recoveries when selling pressure weakens.

Among the major cryptocurrencies today, Ethereum (ETH) is attempting to sustain its recovery, trading at $2.962,05, up 2,74% on the day. BNB is at $846,35 (+0,77%), while Solana (SOL) is trading at $125,93 (+1,17%), also looking to remain in positive territory.

Other top names are following the attempted turnaround: TRON (TRX) is up US$0,28 (+0,87%) and Dogecoin (DOGE) is at US$0,1287 (+1,22%). XRP and Cardano (ADA) are still fluctuating with slight pressure, at US$1,883 (-0,43%) and US$0,3663 (-0,70%), respectively, with traders monitoring whether Bitcoin's movement near US$88 opens up space for a more consistent improvement in the rest of the market.

In the short term, the focus remains on how Japanese monetary tightening may impact global exchange rates and interest rates — and whether this changes risk appetite in the coming sessions, especially for Bitcoin and altcoins.

Trader analysis: resistance at $88,5 and a "hinge zone" at $87.700

The analyst Michaël van de Poppe He assesses that Bitcoin is at a sensitive technical point, facing resistance at US$88,5, a range that has held the price in several recent attempts. He believes the dynamics of the trading session may depend on the opening of the US market, and historically, Fridays tend to be more "corrective." Even so, the trader's sentiment is more constructive, indicating that the set of macroeconomic data suggests a better backdrop and that the most likely scenario would be an upward breakout in the coming days.

“It’s almost time. $BTC is battling the $88,5 resistance zone and has been rejected there several times in recent days. Everything depends on the US opening, and Friday is usually corrective. However, with all the macroeconomic data pointing to a positive outlook, the trading cycle is poised to expand. I think the most likely scenario is that it will break upwards in the coming days.”

Yes, Merlijn The Trader He draws attention to $87.700 as the market's "hinge point"—a level that separates continued upward movement from a deeper correction. He highlights that the price did fall below this mark but reacted quickly, reinforcing the view that the market is carrying volatility. The trader's sentiment is one of caution regarding sharp movements, listing three possible paths: a clean breakout, a retest and breakout, or a sweep to $80 before a new impulse.

“BITCOIN $87.700: the hinge of this market. The price fell below. It quickly rebounded. Now these 3 scenarios are forming: clean breakout; retest and breakout; $80 sweep before takeoff. The next move will be violent. It's not time to blink.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pi Coin price rises after key DEX, AMM update, as a risky pattern forms

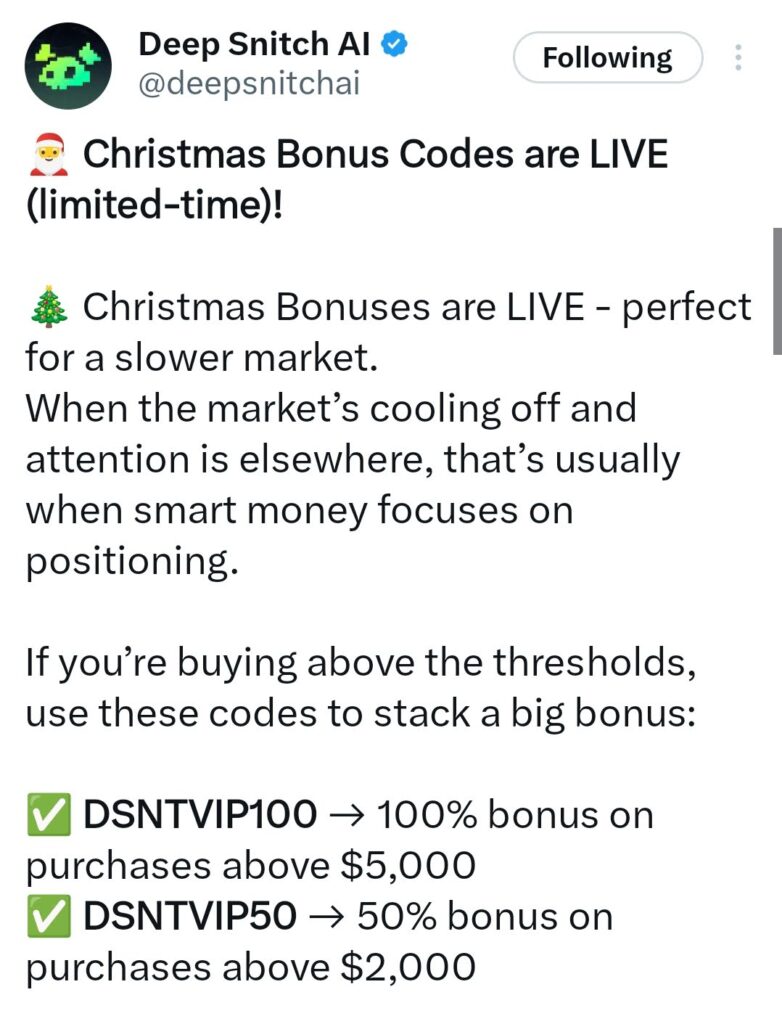

Bitcoin Hyper Price Prediction: DeepSnitch AI’s 300X Forecast Positions It as the Highest-ROI Opportunity In 2026

MocaPortfolio Goes Live with Magic Eden ($ME) Token Drop

Crypto market rally at risk as top Fed official warns on interest rates