Crypto market tests support levels as liquidity gains focus for 2026

- Bitcoin loses support levels and puts pressure on the crypto market.

- Stablecoins indicate available liquidity for 2026.

- The CLARITY Act could redefine regulation in the US.

The cryptocurrency market entered a more cautious phase at the end of 2025, with investors reassessing expectations after the loss of relevant technical levels and the worsening annual performance of most digital assets. This correction occurs amidst growing bets that global liquidity may only regain strength in 2026.

Bitcoin retreated from recent highs following the release of the US Consumer Price Index and the Bank of England's decision to cut interest rates. As a result, the total cryptocurrency market capitalization approached a symbolic level of one trillion dollars before showing a slight recovery, according to market data.

Among the top 50 digital assets with a full year-to-date history, few managed to maintain positive performance. Privacy-focused tokens, such as Monero and Zcash, as well as BNB, are among the exceptions. Bitcoin has accumulated losses this year, while other relevant cryptocurrencies have registered more significant losses in the same period.

In the fourth quarter, the price of Bitcoin broke through an important technical support level and began to fluctuate below that level, reinforcing more conservative readings for the medium term. Analyst Peter Brandt believes that the current movement follows a pattern observed in previous cycles, marked by diminishing returns and corrections after rapid advances. In his view, the break of the parabolic advance opens the way for a deeper pullback throughout 2026.

The macroeconomic environment adds complexity to the scenario. While the United States and the United Kingdom have adopted interest rate cuts, the Bank of Japan has raised rates to their highest level in five years. This divergence puts pressure on global markets and affects strategies such as carry trades in yen, with indirect repercussions on risk assets, including cryptocurrencies.

Geopolitical factors also weigh on sentiment. The protracted conflict in Ukraine and recent tensions involving the United States and Venezuela amplify the perception of risk, according to market observers.

Despite the price pressure, one indicator stands out: the market capitalization of stablecoins has grown consistently over the past 12 months. Analysts interpret this movement as a sign of latent liquidity in the ecosystem, ready to be mobilized when macroeconomic conditions improve.

In the United States, the Federal Reserve has already implemented several interest rate cuts in 2025, and the market is pricing in further reductions. Historically, periods of quantitative easing have coincided with phases of greater expansion in the crypto market.

In the regulatory field, the White House confirmed that the Digital Asset Market Clarity Act will be reviewed by the Senate in January. The bill proposes separating the powers of the SEC and the CFTC, offering a clearer framework for cryptocurrency companies and replacing the practice of regulation via litigation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

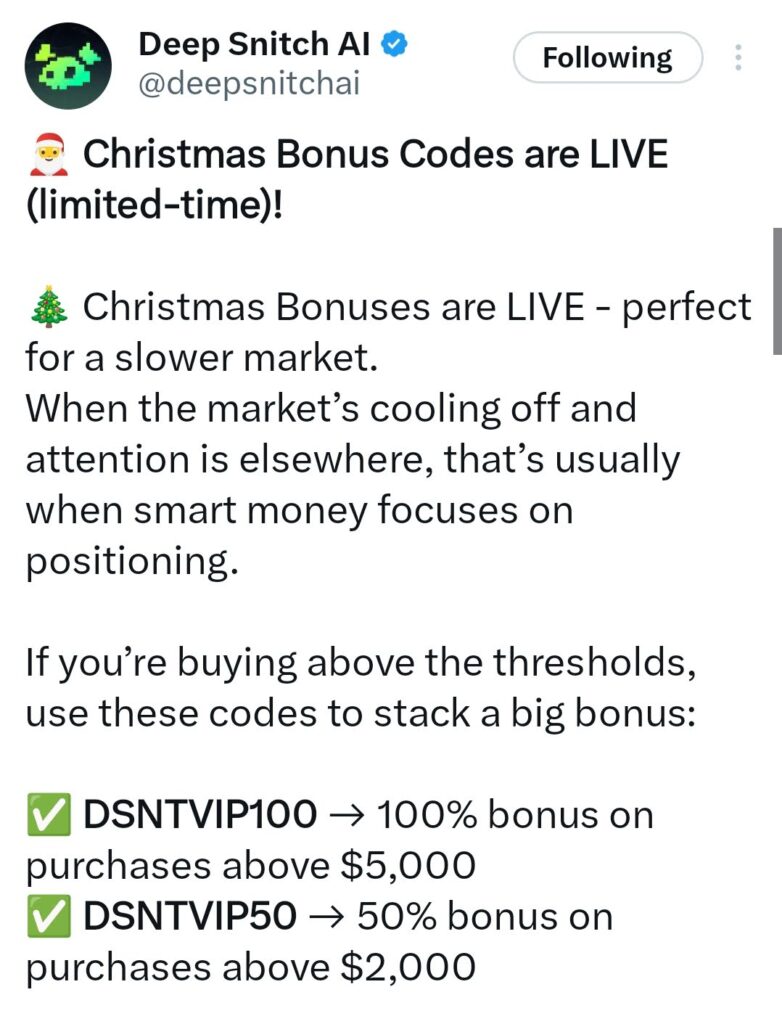

Bitcoin Hyper Price Prediction: DeepSnitch AI’s 300X Forecast Positions It as the Highest-ROI Opportunity In 2026

MocaPortfolio Goes Live with Magic Eden ($ME) Token Drop

Crypto market rally at risk as top Fed official warns on interest rates

Fed seeks public input on 'skinny master account' for limited access to the central bank