On-Chain Financing Backed by U.S. Treasuries Tested

Leading financial institutions conducted the first-ever transaction that provides financing backed by U.S. Treasuries fully on-chain with instant settlement in USDC and outside trading hours, on a Saturday.

Digital Asset announced the completion of the industry’s first operation carried out entirely on the Canton Network blockchain, in which U.S. Treasuries and USDC were used as collateral and cash margin. The transaction achieved near-instant atomic settlement and demonstrated the possibility of continuous access to liquidity without the limitations typical of traditional markets.

U.S. Treasuries held in client accounts at The Depository Trust Company (DTC), a DTCC subsidiary, were tokenized and converted into on-chain assets on the Canton Network. This enabled their use as fully functional digital collateral assets with real-time, unrestricted mobility.

To support settlement, USDC was minted and redeemed directly on the Canton Network, confirming the feasibility of providing native on-chain liquidity and minimizing delays between fund transfers and collateral placement. The transaction took place on a Saturday, demonstrating the system’s ability to provide financing beyond global settlement windows, including weekends.

Tradeweb executed the transaction, providing access to deep liquidity in the U.S. Treasury market and a high level of automation. All stages of the deal were conducted without disclosing the individual roles of participants, ensuring confidentiality while confirming multi-institution involvement.

A series of follow-up transactions is scheduled for the end of the year.

The working group also includes Bank of America, Circle, Citadel Securities, Cumberland DRW, DTCC, Hidden Road, Société Générale, and Virtu Financial. Participants emphasize that this event marks a fundamental step in advancing the Global Collateral Network, a new layer of infrastructure connecting traditional and digital markets.

Initiative participants highlighted the project’s significance:

- Circle noted that the use of tokenized Treasuries and USDC settlement demonstrates the efficiency of combining traditional and digital finance;

- DRW emphasized that the industry moved from theoretical discussions to real on-chain financing available around the clock;

- DTCC pointed to the goal of developing scalable infrastructure that meets market needs;

- Digital Asset stressed that the transaction proved the ability to mobilize collateral instantly and build a more accessible global financial system;

- Virtu Financial stated that the new solution significantly improves the efficiency of collateral usage;

- Bank of America highlighted the potential of distributed ledger technology (DLT) in modernizing financial operations.

Overall, the initiative lays the foundation for creating a unified digital ecosystem in which real-world assets can move freely and be used as collateral 24/7/365, paving the way for more efficient, stable, and flexible global capital markets.

Two months earlier, the Canton Network announced a collaboration with Chainlink Labs to advance an ecosystem of institutional blockchain solutions that bridge traditional and decentralized financial markets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Oil Shock That Could Reprice XRP Overnight

Fed Payment Accounts: A Game-Changer for Crypto Firm Access?

U.S. Politicians Demand Stricter Measures Against Crypto Trading

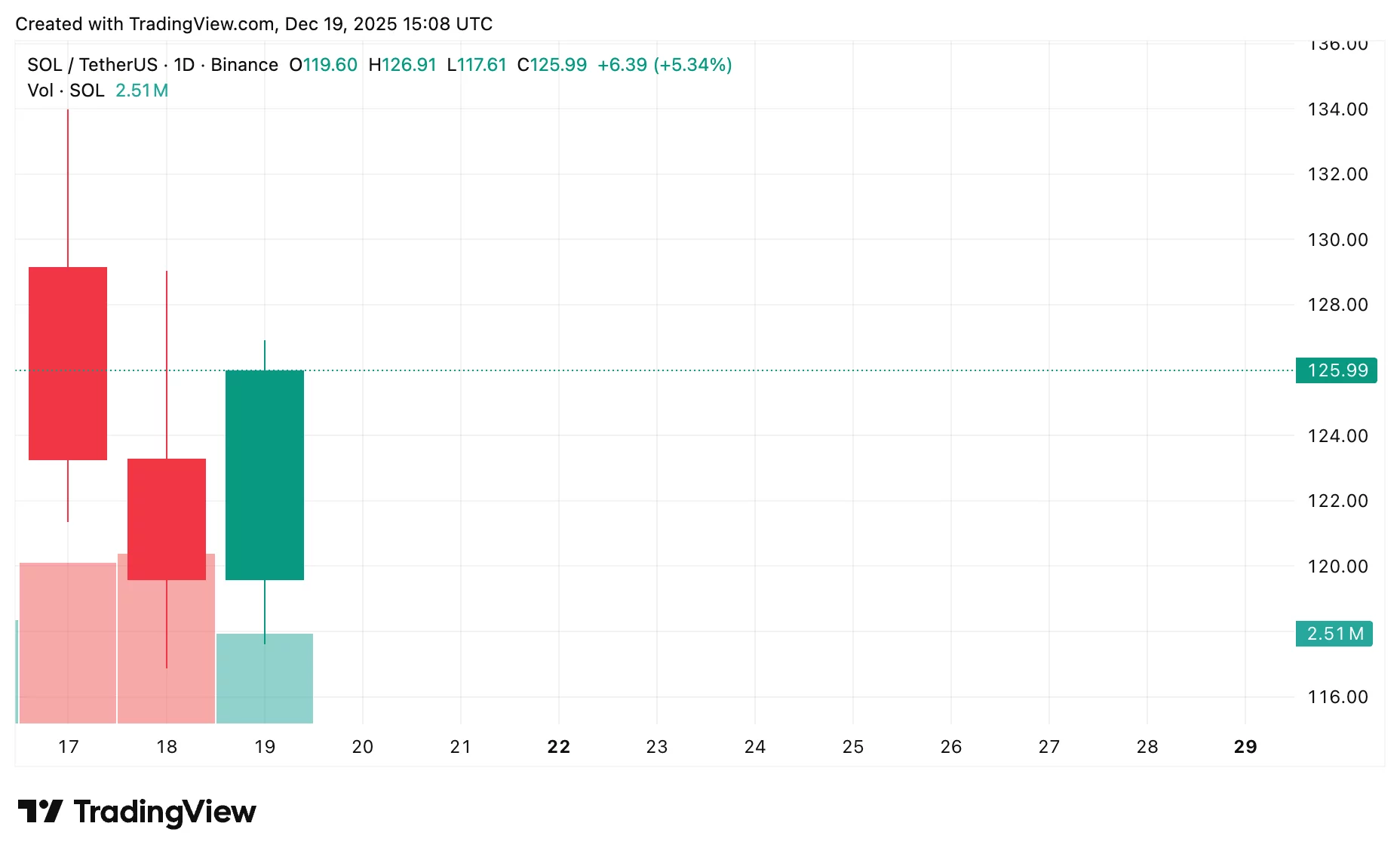

Solana price prediction: Will SOL hold $125 in late 2025?