Date: Fri, Dec 19 2025 | 05:45 AM GMT

In a move that many had been anticipating for weeks, the Bank of Japan (BOJ) announced on December 19, 2025, that it was raising its key short-term interest rate by 25 basis points to 0.75%. This marks the highest level for Japan’s benchmark rate in nearly three decades, continuing Governor Kazuo Ueda’s gradual push toward normalizing monetary policy after years of ultra-low (and even negative) rates.

The decision wasn’t exactly a shock—markets had priced in a near-certain hike, with analysts citing persistent inflation above the BOJ’s 2% target, strong wage growth, and a resilient economy as key drivers. Real interest rates remain deeply negative, but the central bank signaled it’s prepared to keep tightening if inflation stays on track. For Japan, this is a big step away from the era of massive stimulus that defined its economy for so long.

Source: @TheMoneyApe (X)

Source: @TheMoneyApe (X)

Globally, though, rate hikes like this often spell trouble for riskier assets. Higher borrowing costs in Japan can unwind the famous “yen carry trade,” where investors borrow cheaply in yen to chase higher yields elsewhere—like in stocks or crypto. Past BOJ hikes in 2024 and early 2025 were followed by sharp crypto pullbacks, with Bitcoin dropping 20-30% each time as liquidity tightened.

So, you might expect today’s news to send Bitcoin and Ethereum tumbling. But here’s the interesting part: they didn’t. As of late trading on December 19, Bitcoin was holding steady above $86,800, even edging up slightly in the hours after the announcement. Ethereum was similarly resilient, hovering above $2,900 with both assets are in green .

Source: Coinmarketcap

Source: Coinmarketcap

Why the Calm?

A few factors seem to be at play. First, the hike was so widely expected that markets had already digested it—no big surprises from Ueda’s press conference, which stuck to a cautious, data-dependent tone without committing to aggressive future moves. This expectation was bolstered by the latest inflation data: Japan’s national headline CPI eased slightly to 2.9% year-on-year in November (down from 3.0% in October), while core CPI (excluding fresh food) held steady at 3.0%. Both figures remained comfortably above the BOJ’s 2% target for the 44th consecutive month, reinforcing the case for gradual normalization without signaling urgency for sharper tightening.

Second, the yen actually weakened a bit post-announcement, easing immediate pressure on carry trades.

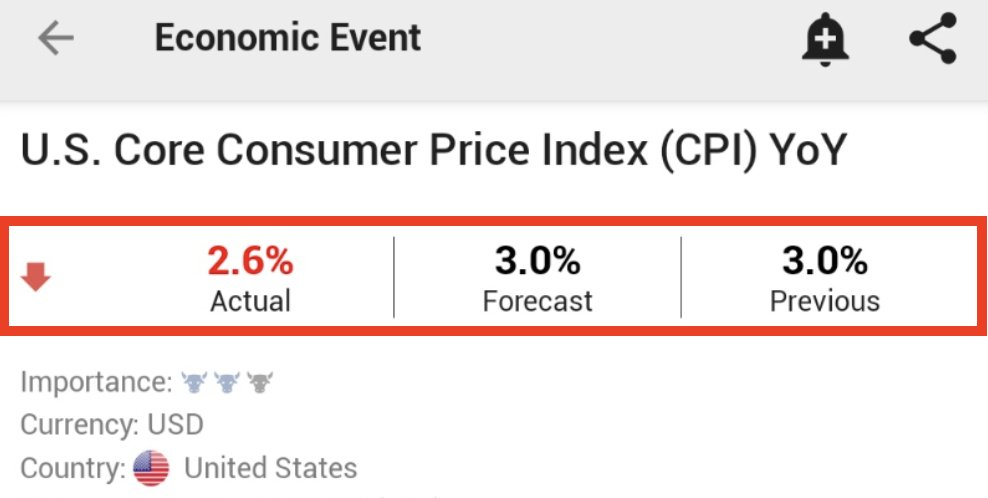

Adding to the supportive backdrop, U.S. inflation data released just yesterday (December 18) came in lower than expected, with headline CPI at 2.7% year-on-year and core CPI cooling to 2.6%—the lowest since early 2021. This softer reading (economists had forecasted around 3.0-3.1% for both) fueled hopes for continued Fed easing and reduced fears of rapid global tightening, helping buoy risk assets like crypto.

Source: @KobeissiLetter (X)

Source: @KobeissiLetter (X)

And broader crypto sentiment has been buoyed by ongoing institutional interest, ETF inflows, and the sense that global liquidity isn’t drying up as fast as feared (especially with other central banks in easing mode).

Of course, it’s early days. Crypto markets are notoriously volatile, and any delayed unwinding of positions could still hit prices in the coming sessions. Options expirations and year-end positioning might add some choppiness too. But for now, Bitcoin and Ethereum are standing their ground, reminding us once again that this market has a knack for defying expectations.