After making a profit of $580,000, I went all in again with $1 million to short ETH

Compiled & Translated by: Deep Tide TechFlow

Podcast Source: Taiki Maeda

Original Title: Why I’m Shorting $1M of ETH (Again)

Broadcast Date: December 18, 2025

Key Takeaways

Taiki returns to the market, shorting $1 million worth of ETH. In this video, Taiki reviews the bearish arguments about ETH from the past few months and explains why he decided to re-enter the short market.

Highlights

-

We should welcome bear markets because that's when the real money is made; true wealth is accumulated by buying at the lows.

-

When Tom Lee pours a lot of money into ETH, you can choose to sell assets; and when they might stop buying, you can start shorting.

-

Whenever ETH's price rises, OGs tend to sell, making ETH more of a primary exit liquidity tool rather than a long-term holding asset.

-

I believe the real fair value of ETH might be between $1,200 and $2,200.

-

The crypto market currently lacks new marginal buyers, the bubble has burst, and the market is in an unstable phase after the excitement.

-

Some investors don't really want to hold ETH long-term; they just want to make quick profits.

-

The crypto market is currently in a PvP (player versus player) state, lacking obvious advantages.

-

Tom Lee's strategy is not just to push up ETH's price but also to maximize personal and company interests.

-

Once the funds run out or market demand weakens, ETH's price may fall rapidly.

-

Tom Lee's goal is to increase ETH's market share to 4% or 5% within six months.

-

January 15, 2026, is not only the date when Bitmine's board decides on bonuses but also the deadline for a possible MSTR delisting. If MSTR is delisted, it will trigger billions of dollars in outflows, causing massive selling pressure on the market.

-

I once fantasized that ETH's price would rise to 10,000 and held on, only to see it drop from 4,000 to $900.

-

My way of analyzing the market is more based on numbers and capital flows, not just drawing charts or lines to predict price trends.

-

Almost no one is actually using ETH.

-

The maturity of the crypto market lies in understanding: technically it may be excellent, but that doesn't mean it's a good investment.

-

The current market phase can be summarized as: DATs pushed up the price, and people are gradually realizing that this frenzy may have gone too far, and the real value of ETH may be much lower. This is exactly the direction of my current bet.

-

Shorting ETH is a simple and effective strategy.

Shorting $1 Million Worth of ETH

-

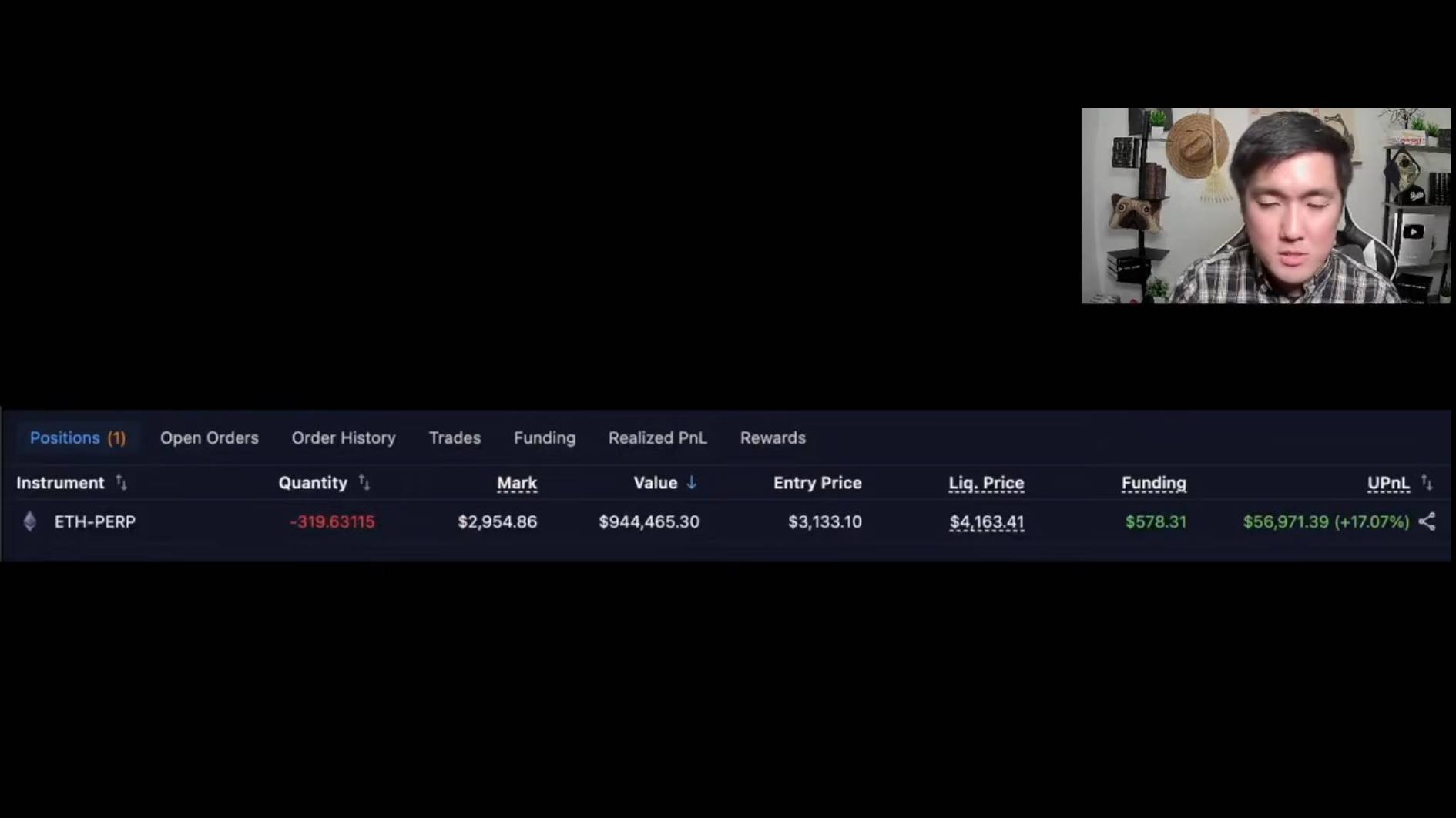

In the past two months, I made over $500,000 by shorting ETH and altcoins at market highs. In this video, I will explain why I decided to short $1 million worth of ETH again, because I believe ETH's price will fall further.

-

For the past two months, I have been very bearish on the market. I expressed my views by shorting ETH and altcoins and have returned to trading. About ten days ago, I re-established my ETH short position. A few weeks ago, when ETH's price dropped to around $2,650, I closed my position once, but after the price rebounded, I shorted again.

-

Since I posted that tweet on Twitter, I have increased my position. Currently, my average entry price is $3,133, with a total value of about $1 million and an unrealized P&L of about $56,000.

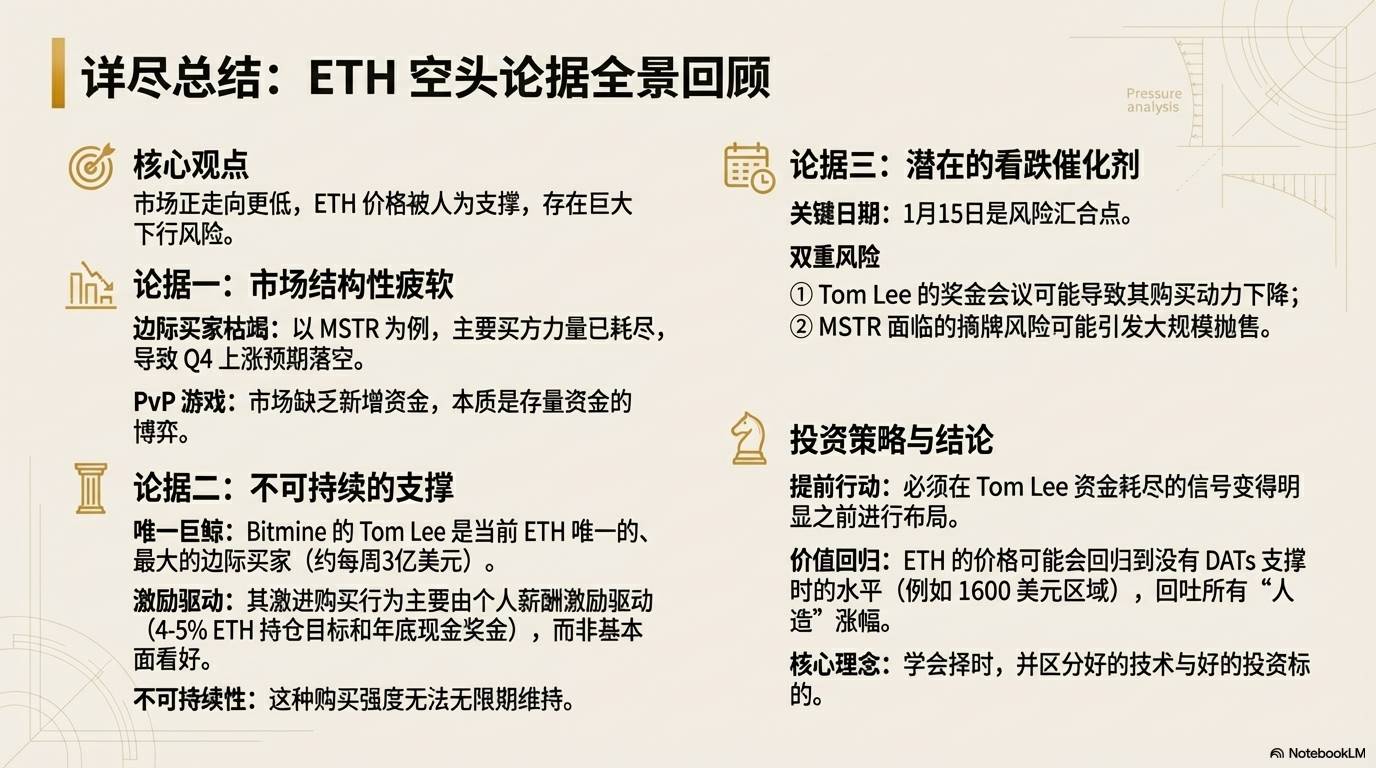

Reviewing Bearish Arguments for ETH

-

Now let's review my summary of the bearish arguments for ETH. The first part of my ETH short was based on the following understanding: MSTR and Michael Saylor's funds have been exhausted, so the possibility of a rally in Q4 is very low, especially after the liquidation event on October 10. Therefore, shorting ETH above $4,000 was reasonable, a fairly simple trade.

-

MSTR's net asset value (MNAV) continues to shrink, reminiscent of the market top in the last cycle. If Saylor can't buy, we lose one of the biggest marginal bitcoin buyers, which is not good. The question I posed to the audience was: If the guaranteed Q4 rally doesn't happen, what will happen to ETH and altcoins? Everything will fall, right? That's exactly what happened.

-

October 10 was a great catalyst. Once altcoins drop, you should expect the fundamentals of ETH, Solana, and all these narrative coins to worsen. This is because the purpose of deploying funds on-chain is to earn yields, and yields come from altcoins, so DeFi TVL is expected to decrease. In a sense, the drop in altcoins is like aleading indicator of on-chain adoption, because after a major liquidation event, people withdraw funds.

-

-

Now I think we are in the second part, which is somewhat similar to the first. Tom Lee has always been a reason for me to short ETH, because I think he pushed the price above fair value. So it makes sense to short the price back down. But I still think he is propping up ETH, which provides an interesting opportunity. Because I think once he runs out of funds or starts to run out of money, ETH will really return to fair value.

-

I do think ETH will fall lower, but Tom Lee is preventing it from falling further, but at some point he will run out of funds. The problem with DATs is that I don't like them; no one enters crypto to study DATs. But in my view, they control the market, control the marginal capital flow in crypto, so we have to study them.

-

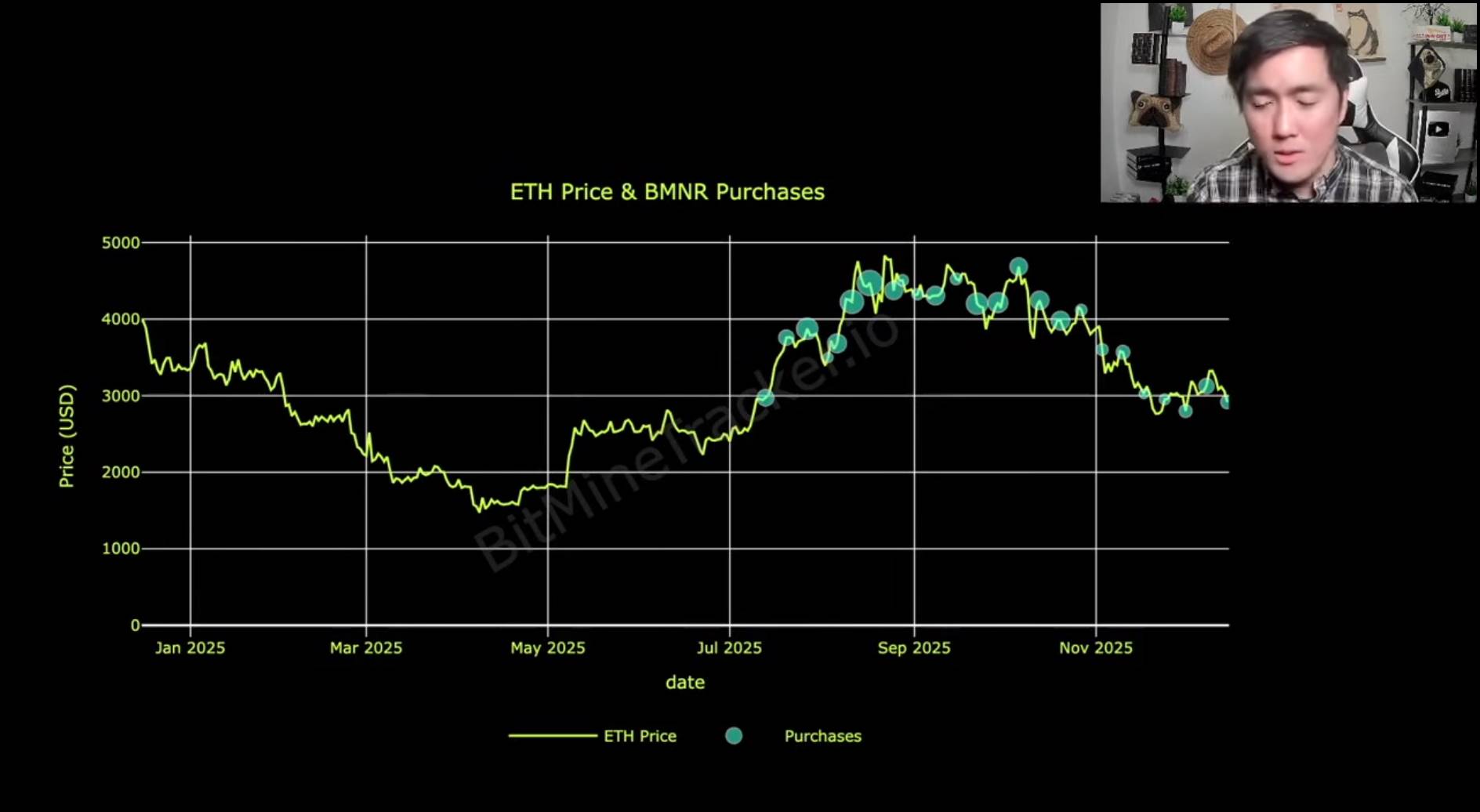

I think Tom Lee has pumped ETH's price a lot, and now the amount of ETH he buys is decreasing over time. I think ETH will converge to fair value. I don't know what fair value is, but it could be much lower. You can see, this is Tom Lee's activity; he bought a lot above $4,000, but if you understand how DATs work, when crypto rises, people flock to these assets because the market is reflexive. So these DATs buy heavily during the rally, and once the market falls for a long time, they can't keep buying.

-

-

Saylor has accumulated over 3% of bitcoin over the past 5 years, which pushed bitcoin's price from about $10,000 all the way up to $85,000. In contrast, Tom Lee bought over 3% of ETH in just 5 months, but during this period ETH's price only rose slightly from $2,500 to $2,900. Whenever ETH's price rises,OGs tend to sell, making ETH more of a primary exit liquidity tool rather than a long-term holding asset, which is a point I've been emphasizing for the past few months.

Tom Lee's Impact on ETH

-

In the crypto market, holding a contrarian view often pays off, because you can validate your judgment through capital trading. If your prediction is correct, the market rewards you with more capital, which you can then reallocate elsewhere.

-

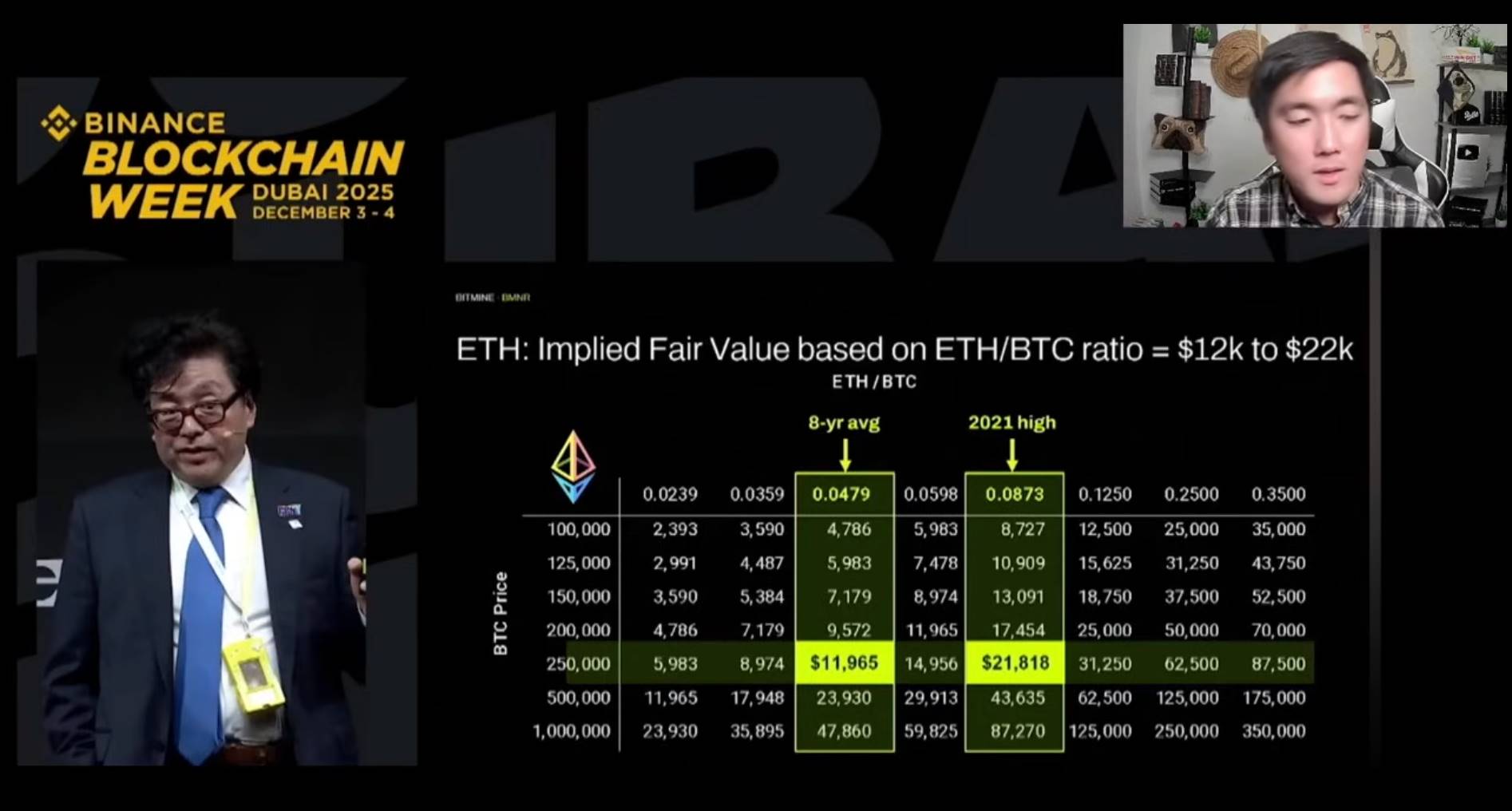

Recently, Tom Lee has been buying about $300 million worth of ETH per week, which is particularly striking in the current market environment. He publicly stated at Binance Blockchain Week that ETH's price has bottomed and that he is increasing his purchases. His exact words were: "We believe ETH has bottomed, so we are buying more." To time the buys precisely, they even hired Tom Demar—a highly paid but capable advisor. Tom Lee predicts ETH's price could reach $22,000 and gave a fair value range of $12,000 to $22,000. However, I personally think this prediction may be wrong, and the real fair value may be $1,200 to $2,200.

-

In recent weeks, Tom Lee's public statements show they are heavily accumulating ETH, making ETH outperform other altcoins lacking marginal buyers, such as Solana. From the charts, ETH's price action is clearly stronger. However, from a market game theory perspective, I think the crypto market currently lacks new marginal buyers. Most potential buyers have already entered, and the market is in an unstable phase after the excitement, the bubble has burst, and we are trying to figure out how low these assets might go.

-

If Tom Lee continues to buy $200–$300 million worth of ETH per week in the short term, the market may be influenced by him. In this case, whenever ETH's price drops, short-term traders may choose to buy, expecting Tom Lee's funds to push the price up, and then sell for profit. For short-term traders, Tom Lee's buying undoubtedly provides liquidity support. Psychologically, I call this the "perceived Tom Lee safety effect". Knowing he is buying makes people more willing to hold ETH in the short term rather than bitcoin or Solana. If you are waiting for a market rebound to trade, holding ETH may be a more reasonable choice.

-

Although I am currently shorting ETH, I still think that in the short term, ETH is more suitable to hold than other assets, simply because of Tom Lee's continuous buying. However, we need to be aware that once Tom Lee's funds run out, ETH's price may drop sharply. This phenomenon is similar to when Saylor announced a $1 billion bitcoin purchase, but bitcoin's price actually plummeted. The market understands that he can't buy indefinitely, so each purchase reduces future buying power.

-

In addition, there is a Chinese whale named Garrett Bullish, who is said to manage other people's funds. Before the October 10 market crash, he was shorting, but then bought over $500 million worth of ETH on-chain on the Hyperliquid platform and is currently down about $40 million. I think his investment logic may be partly influenced by Tom Lee. However, this behavior is more like trying to make "quick money"; these investors don't really want to hold ETH long-term, just want to profit quickly.

-

The crypto market is currently in a PvP (player versus player) state, lacking obvious advantages. Although there is still capital flowing in the market, the overall trend is that funds are gradually flowing out of the ecosystem. This may also be why we've seen recent price volatility. As market participants, it's important to understand Tom Lee's buying power, purchase size, and when he might stop buying. Personally, I think his funds may run out soon, which is why I've recently increased my short positions.

Tom Lee's ETH Strategy

-

Let's analyze Bitmine's current financial situation. A month ago, they held about 3.5 million to 3.6 million ETH and $600 million in cash. According to yesterday's latest announcement, their ETH holdings have increased to nearly 4 million and cash reserves have grown to about $1 billion. Clearly, Tom Lee's operations are bold and efficient. He keeps expanding his ETH holdings through purchases while raising more cash.

-

Tom Lee's strategy includes using media publicity to attract investor attention to Bitmine and Ethereum. He showcases the company's assets and market potential to attract people to buy Bitmine stock. Then, he issues more shares and uses some of the funds to buy ETH. Reportedly, he recently sold about $500 million worth of stock to Bitmine shareholders, of which about $300 million was used to buy ETH. This method maintains Bitmine's market demand and trading volume, allowing him to continue raising funds.

-

However, this strategy also carries risks. Although Tom Lee's brand effect and market reputation may attract investors, Bitmine's stock price performance is not optimistic. Personally, I think this model is hard to sustain long-term and may eventually stop due to exhausted funds. After all, fundraising is not unlimited, and the market won't remain irrational forever.

-

Tom Lee, as a well-known market figure, has been a crypto bull for the past decade, and most of the time his predictions have been accurate. His business model is also very successful, such as selling newsletter services. But why would he risk his reputation to push ETH's price to a high point? I think the answer lies in incentives. As Charlie Munger said: "Show me the incentive, and I'll show you the outcome." If we analyze Bitmine's incentive structure, we can better understand his behavior.

-

According to Bitmine's Schedule 14A filing with the SEC, Tom Lee's compensation is closely tied to company performance. His performance rewards are linked to bitcoin revenue, ETH holding ratio, bitcoin price, and company market cap. In addition, the board can vote annually to grant him a cash bonus of $5 million to $15 million. More importantly, the equity incentive mechanism stipulates that if Bitmine's ETH holdings reach 4%, Tom Lee will receive 500,000 shares, worth about $15 million to $20 million at current prices; and when holdings reach 5%, he will receive 1 million shares, doubling the reward.

-

It is worth noting that Bitmine's revenue mainly comes from asset management fees. For example, if Tom Lee buys $10 billion worth of ETH and charges a 2% management fee, the company's revenue will reach $200 million. This model is simple but very effective.

-

Tom Lee's strategy is not just to push up ETH's price but also to maximize personal and company interests. However, the sustainability of this strategy is worth watching; once funds run out or market demand weakens, ETH's price may fall rapidly. As market participants, it's important to understand his capital size, purchase plans, and when he might stop buying.

Bearish Factors for January 15, 2026

-

Tom Lee's goal is to increase ETH's market share to 4% or 5% within six months, a very bold and noteworthy move. His incentive mechanism gives him motivation to keep investing in ETH before the end of the year, as there is a potential annual cash bonus. He hopes to show outstanding performance at the January 15 board meeting, such as: "I bought so much ETH, give me a $15 million bonus." This reward mechanism explains why he will accelerate ETH purchases before year-end.

-

Once Tom Lee reaches the 4% or 5% market share target, his motivation to buy may weaken as themarginal benefitof the incentive decreases. Of course, he may still need to keep buying to maintain ETH's price, but the motivation to push the price up will decrease. It is clear that he has a stronger incentive to push up the price before year-end.

-

Tom Lee's strategy has indeed benefited ETH holders greatly. He pushed ETH's price from $2,500 to $4,900 with bold capital investment and is still buying. However, this strategy also carries risks. If ETH's price falls sharply in the future, retail investors may be disappointed, especially those who bought Bitmine stock because of Tom Lee's statements.

-

It is worth noting that January 15, 2026, is not only the date when Bitmine's board decides on bonuses but also the deadline for a possible MSTR delisting. If MSTR is delisted, it will trigger billions of dollars in outflows, causing massive selling pressure on the market. MSTR's leadership is clearly worried about this; they even set up a page on their official website calling on investors to support them in avoiding delisting. If delisting occurs, it may cause market panic because MNAV may fall below 1. Although Saylor once said that if MNAV falls below 1, he may sell bitcoin to buy back shares, the market may stress test this.

-

Tom Lee's incentive mechanism before January 15 gives him motivation to keep buying ETH. But if MSTR is delisted and Tom Lee has already exhausted his funds buying ETH, the market may crash. Although this scenario is extreme, it is worth watching. Studying incentive mechanisms can help us better understand the behavioral logic of market participants.

The Situation Could Get Worse

-

I think in crypto trading, we should always ask ourselves two questions: Who is the marginal buyer? Who is the marginal seller? I raised this question a few months ago. At that time, the market generally believed that Q4 would see a rally and an "altcoin season." But I kept asking: If everyone is ready for a rally, who will be the marginal buyer? Clearly, they couldn't answer this. So I realized these people are actually the marginal sellers. Because if the market doesn't rally as expected, they will turn to sell, which provides a great opportunity to short.

-

Recently, I have to admit a fact: there are currently no real "structural buyers" in the crypto market. Although this may change in the future, for now, the market is more like a PvP (player versus player) game. Digital Asset Treasury companies (DATs) support the market to some extent, but their funds are limited. If you agree with this view, the market trends of the past few months are relatively easy to understand. For example, when Tom Lee pours a lot of money into ETH, you can choose to sell assets; and when they might stop buying, you can startshorting.

-

Take Tom Lee as an example; he may make large purchases in December, but after the new year, he may slow down and keep some cash to protect the stock, as he will eventually need to build cash reserves. The current market is somewhat similar, with funds mainly flowing into ETH, keeping its price supported at a high level. Once Tom Lee slows down his purchases, the market's long positions may be quickly unwound. As I mentioned before, ETH's price could have been lower, but Tom Lee's actions have temporarily prevented this. Once he exits the market, ETH's price could fall rapidly.

-

Tom Lee's Bitmine was announced when ETH was priced at $2,500. I think this increase may eventually be completely retraced. Last time bitcoin traded at $85,000, ETH's price was around $1,600. Although this could be attributed to factors like tariffs causing price anomalies, the fact is that at similar bitcoin price levels, ETH's price was once lower. I think ETH's price is still around $2,900 mainly because of continuous DATs buying. These funds do provide support, but they will obviously run out. If you just wait for the funds to run out before shorting, it may be too late. You need to anticipate the market trend in advance, because by the time the funds are exhausted, ETH's price may have already dropped sharply.

-

Although my view sounds bearish, if you are familiar with my trading style, you know I am usually bullish. I have made mistakes in the past, always reinvesting all my profits into the market. Whenever there is obvious risk, I choose to take profits. Shorting is a strategy I have only recently adopted; usually, I still prefer to go long. If you think carefully, we should welcomebear markets, because that's when the real money is made. Many people only think about profiting during the Q4 "altcoin season," but true wealth is accumulated by buying at the lows. For example, anyone who bought bitcoin at around $20,000 is now looking at $85,000—a 4x return.

-

I hope everyone understands that the market can always get worse. And unless you sell, you can't really realize profits. You need cash reserves and must sell decisively when the market is quiet. I'm not saying you must sell now, just sharing my trading thoughts. In the last bear market cycle, ETH fell for 11 consecutive weeks. At the time, I thought the market would rebound after the sixth week, but it didn't—it kept falling for five more weeks. So the market can always get worse.

-

I want to remind everyone not to be content with simply holding crypto, as it can drop sharply in a short time. Even in the recent market, no one foresaw it would fall so quickly, but it did. Unless you sell, you can't profit in the crypto market. Of course, you can choose to hoard bitcoin or ETH long-term. Personally, I don't think ETH is a good investment, but if your investment horizon is long enough, say 20 years, and you don't care about short-term fluctuations, maybe that's acceptable. But most people don't have the conditions to become wealthy bitcoin or ETH whales; at the very least, we need to catch market tops and bottoms through trading, or else we'll just bear the risk of asset shrinkage.

Taiki vs ETH Supporters

-

Recently, I received some attacks from ETH maximalists, which is understandable to some extent. For these people, their identity seems to revolve entirely around their early ETH purchases, while I openly state on YouTube that ETH's price may fall further, and I provide data and facts to support my view. However, I respect ETH supporters like Ryan Burkeman because he truly believes in ETH's value. Of course, sometimes I correct some of his math errors.

-

I want to clarify that I'm not someone who blindly worships ETH. In fact, if you check my on-chain trading records, I use the ETH ecosystem (such as ETH L2s) more frequently than most ETH maximalists. Whether on Twitter or YouTube, I might be one of the most active on-chain participants; I use blockchain frequently and have participated in mining.

-

Many people are not critical enough about ETH. They may simply buy ETH and expect the price to rise, but I make these videos not to attack ETH, because I think ETH is a great tech product, but we must learn to distinguish between "asset" and "tech product"—they are two different things. Although technical superiority may affect asset prices, that doesn't mean ETH's price will always rise. At the very least, we need to think critically about what factors are driving ETH's price changes.

-

The 2022 bear market caused me heavy losses. Although I sold near the market top, I kept buying lower lows afterward because I firmly believed ETH's price would eventually go higher. Four or five years ago, I was a delusional ETH bull. I believed DeFi would change the world, ETH was the future of finance, and even thought ETH would surpass bitcoin as a better currency. But now, I find far fewer people hold these views. I once fantasized that ETH's price would rise to 10,000 and held on, only to see it drop from 4,000 to $900—a very brutal experience.

-

On my channel, I always try to share my trading strategies. I don't always get trades right, but at least I strive to be honest and real. My way of analyzing the market is more based on numbers and capital flows, not just drawing charts or lines to predict price trends. For example, ETH's rally is due to Tom Lee's large-scale buying, and ETH's drop may be due to exhausted funds. If Tom Lee is still buying, I will choose to short his buys and position myself in advance for the market changes after his funds run out.

Good Tech, Bad Asset?

-

Maybe my view is wrong, but I'm putting my own money on the line to test it, and all my trades can be verified on-chain. Looking at the current situation, almost no one is actually using ETH. Of course, the ETH mainnet is expanding, on-chain transaction costs are lower, and user activity may shift to L2 (Layer 2), but just based on this data, you can't simply conclude that "the world is adopting ETH." At least in my view, that interpretation doesn't hold.

-

ETH's market cap is currently about $350 billion, and this valuation is more like a castle in the air, such as "if all global financial activity moves to ETH, then ETH's market cap will keep rising." But does this logic really stand up? No matter how good the technology, it may not drive asset prices up. Some people keep tagging me, saying: "JPMorgan is issuing stablecoins on-chain, ETH's market cap will reach $10 trillion." But I think the maturity of the crypto market lies in understanding: technology may be excellent, even net positive for some companies and regions, but that doesn't mean they're good investments.

-

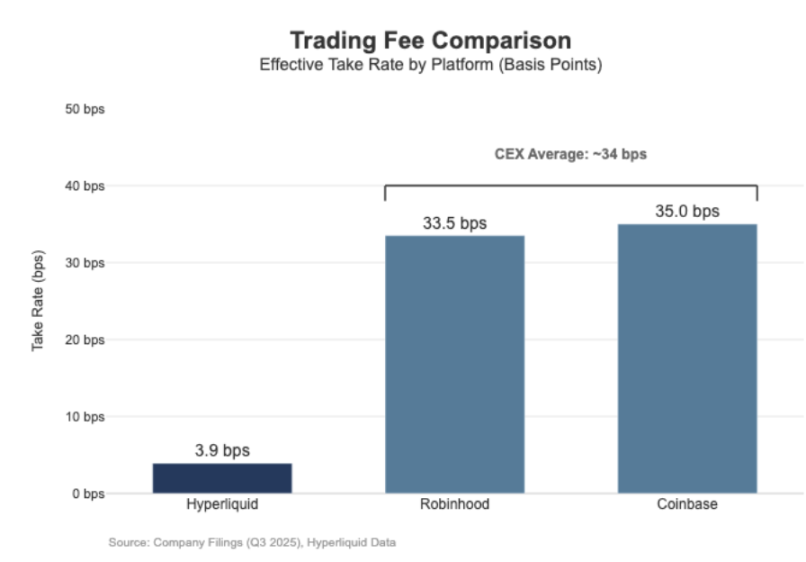

For example, Robinhood is using the Arbitrum Orbit stack to build its own blockchain. Maybe this decision is good for Robinhood's equity, but not necessarily for Arbitrum's token. So is it possible that companies using blockchain technology all profit, but the underlying infrastructure doesn't see significant gains? It might benefit a little, but not much. This situation is also hard to accept, but at least it's worth thinking about.

Summary

-

Once Tom Lee stops buying or exits the market, things could get even worse. As I mentioned before, last time bitcoin was at a similar level, ETH's price was much lower. I think the current market overvaluation is mainly driven by Digital Asset Treasury companies (DATs), and these long positions need time to unwind. At the same time, market participants also need time to realize that this price may not be reasonable.

-

The current market phase can be summarized as: DATs pushed up the price, and people are gradually realizing that this frenzy may have gone too far, and the real value of ETH may be much lower. This is exactly the direction of my current bet. Of course, I'm not a doomsayer, but a long-term supporter of crypto. My loyal viewers all know that I'm currently just denominating in cash. I think the way to accumulate more cash is by shorting ETH, participating in airdrop mining, and staying calm. I recently participated in a trading competition; to pass the time, I chose to short Solana and ETH, eventually won the competition, and made $50,000.

-

I believe that shorting ETH is a simple and effective strategy. Although sometimes ETH's price rises due to random factors like Tom Lee, once their buying peaks and the market's dependence on them gradually weakens, ETH's price will start to slowly fall. Unfortunately, I think the current market is in such a phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

VivoPower Plans $300M Ripple Labs Share Vehicle in South Korea

Revealing: Kevin Hassett’s Bold Call for an Interest Rate Cut and What It Means for Crypto

Changpeng Zhao’s Crucial Mission: Talks with 10 Governments on Crypto Regulation

Hyperliquid at a Crossroads: Follow Robinhood or Continue the Nasdaq Economic Paradigm?