U.S. Unemployment Rises to 4.6% in November: Historic Patterns Across Presidents and Major Midterm House Seat Losses

COINOTAG News reports that the latest unemployment rate data for November shows the metric edging higher. Market participants are closely watching the non-farm payrolls print and the broader labor-market trajectory as a key input for central-bank policy and risk assets, including crypto markets. The release underscores ongoing macro headwinds for investors, even as the data stops short of signaling a systemic shock.

Historical analyses cited by WSJ indicate that several U.S. presidents faced rising unemployment in the early period of their terms, a dynamic that has historically coincided with notable midterm outcomes. The link between the unemployment rate shifts and political events is nuanced, and the data do not imply a direct one-to-one correlation with market performance.

For crypto traders, the macro backdrop—comprising the jobs data, wage trends, and policy expectations—continues to shape liquidity and risk appetite. As the Federal Reserve assesses inflation and growth, the crypto sector remains sensitive to macro-policy shifts, with rate expectations likely to influence capital flows and token price dynamics.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

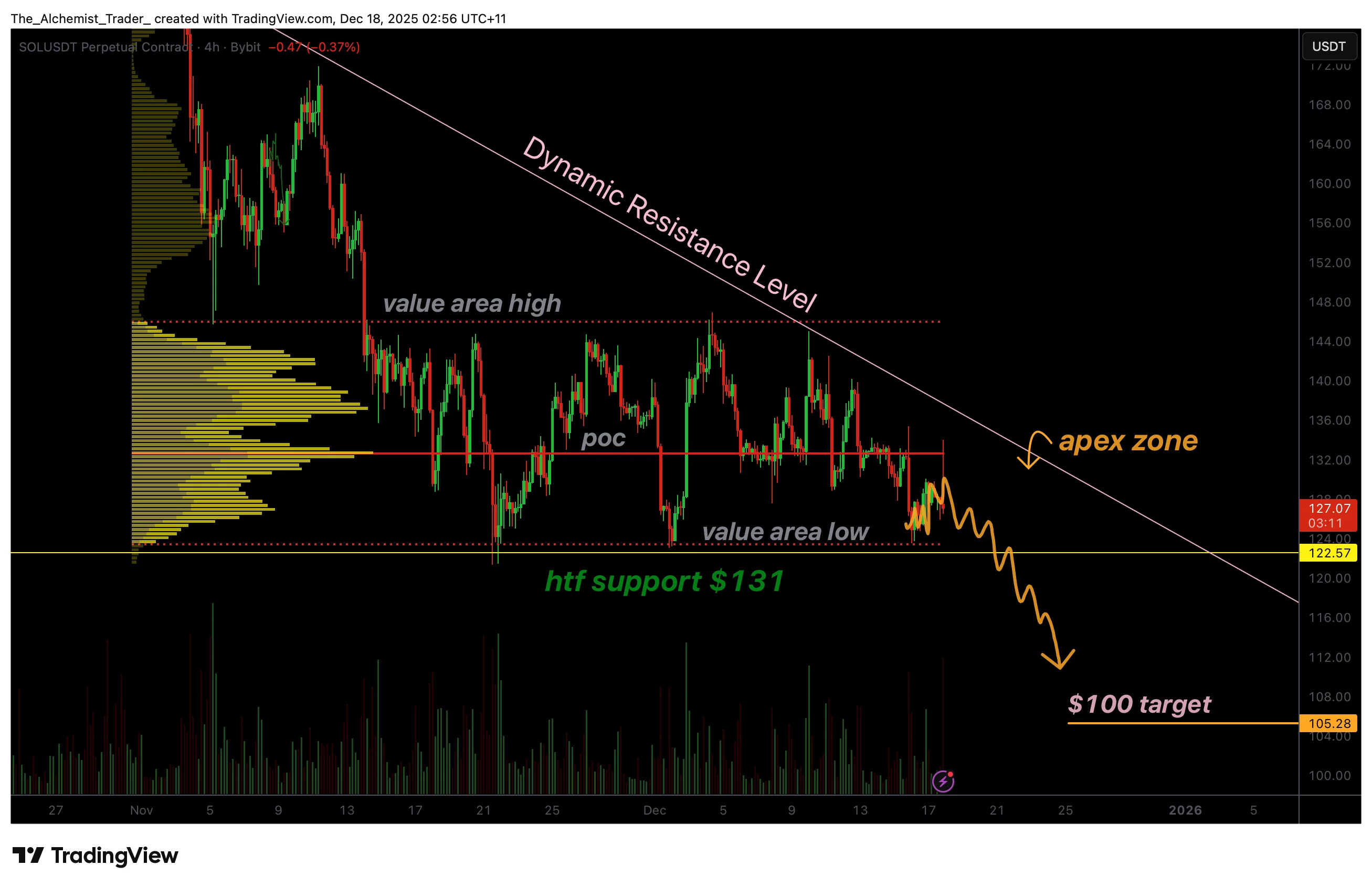

Solana price compresses into triangle apex, breakout risk builds

Ethereum price forms an ABCD correction pattern, putting $2,500 in focus

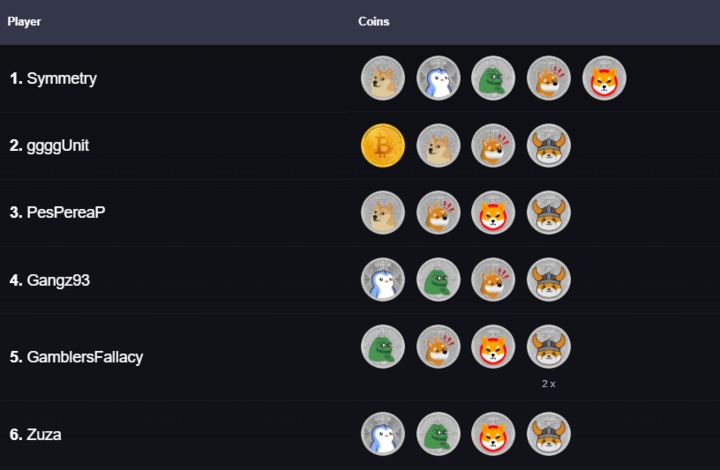

CoinPoker錦標賽|Symmetry成為首位集齊5枚CoinMasters硬幣的玩家

Saylor’s Long Bitcoin Bet Has Left Corporate Rivals Behind: Crypto Entrepreneur