Fed Rate Cuts Could Help a Weak Job Market as Inflation Cools and Expectations Stay Anchored

COINOTAG News reported on December 17 that Federal Reserve Governor Waller described the labor market as notably soft, with current job growth short of prior momentum and softer payroll dynamics weighing on near-term labor conditions.

He added that policy easing, in the form of rate cuts, could support the job market and broaden demand across sectors; although inflation remains above the target, officials expect it to ease in coming months, with inflation expectations anchored.

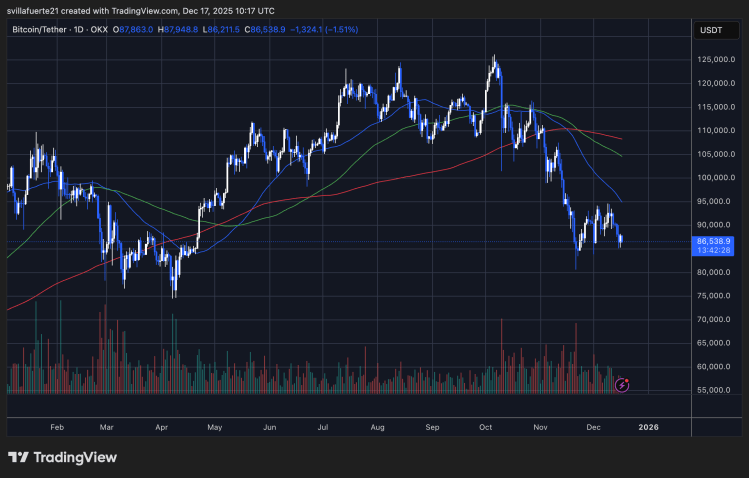

As markets digest the remarks, traders assess implications for risk assets, including cryptocurrencies, with the macro backdrop likely to shape sentiment and liquidity in the near term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Global gold market rally reshapes exploration, drill results and strategic M&A in 2025

Alliance for OpenUSD specification 1.0 sets universal language for scalable 3D world building

Bitcoin Structure Turns Bearish As Structural Indicators Flip Negative

Amazon appoints longtime AWS exec Peter DeSantis to lead new AI org