Recently, several top institutions have intensively released their outlooks for crypto assets in 2026, with a clear consensus: the market’s driving logic is undergoing a fundamental shift. The traditional narrative centered on retail sentiment and the “four-year halving cycle” is fading out, and a new era of structural growth led by institutional capital, clear regulation, and real utility has already begun.

I. Market Paradigm Shift: From Cyclical Speculation to the Institutional Era

The core driving force of the future market is no longer the familiar rhythm.

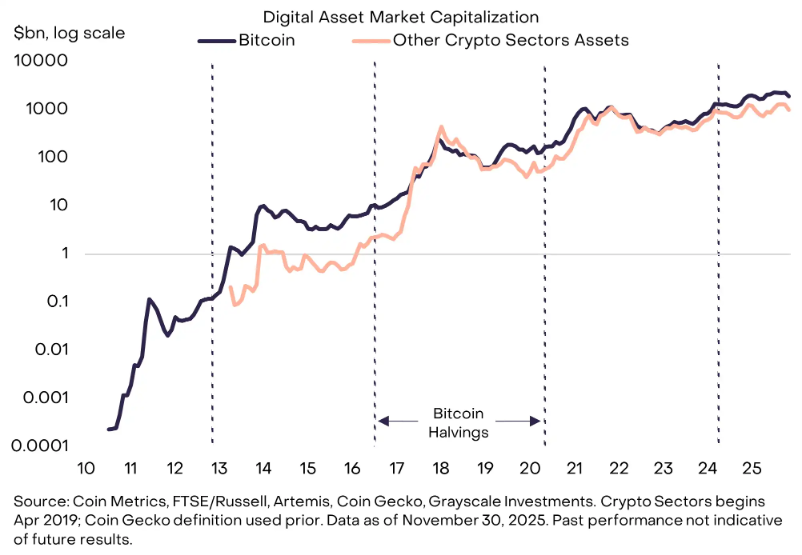

1. The End of the “Four-Year Cycle Theory”:

Grayscale clearly pointed out in its annual outlook that the traditional crypto “halving-boom-deep correction” cycle every four years is becoming invalid. The dominant force in the market is shifting from cyclical retail frenzy to the sustained inflow of compliant channels and long-term institutional capital.

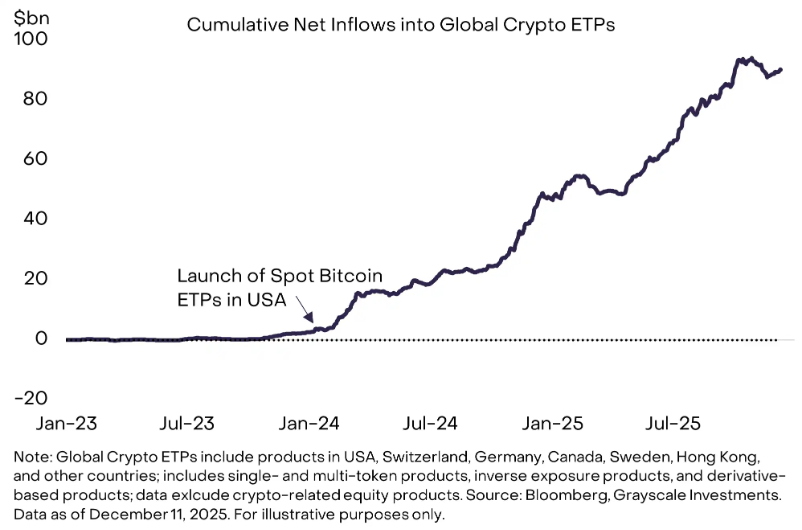

2. Structural Inflow of Institutional Capital:

Institutional entry is no longer an expectation, but an ongoing reality and the main theme for the future. The hallmark is the rapid development of crypto asset exchange-traded products (ETPs).

● According to Grayscale data, since the launch of US spot bitcoin ETPs at the beginning of 2024, global crypto ETP net inflows have reached about $87 billion.

● 21Shares predicts that by the end of 2026, the global crypto ETP assets under management (AUM) could reach $400 billion. This “steady buying” model changes the characteristic of sharp price volatility.

3. Regulation: From Obstacle to Cornerstone:

A clear regulatory framework is shifting from being the greatest uncertainty to becoming a key pillar of market development.

● Grayscale expects that by 2026, the US will pass bipartisan crypto market structure legislation, which will “institutionalize” the position of blockchain finance in US capital markets.

● Meanwhile, the EU’s MiCA framework and the US’s already passed GENIUS Act (targeting stablecoins) are building a clearer global regulatory environment, paving the way for large-scale participation by traditional financial institutions.

II. Core Growth Engines: Macro Narratives and Micro Implementation Together

Under the new paradigm, specific investment themes revolve around value storage and financial efficiency.

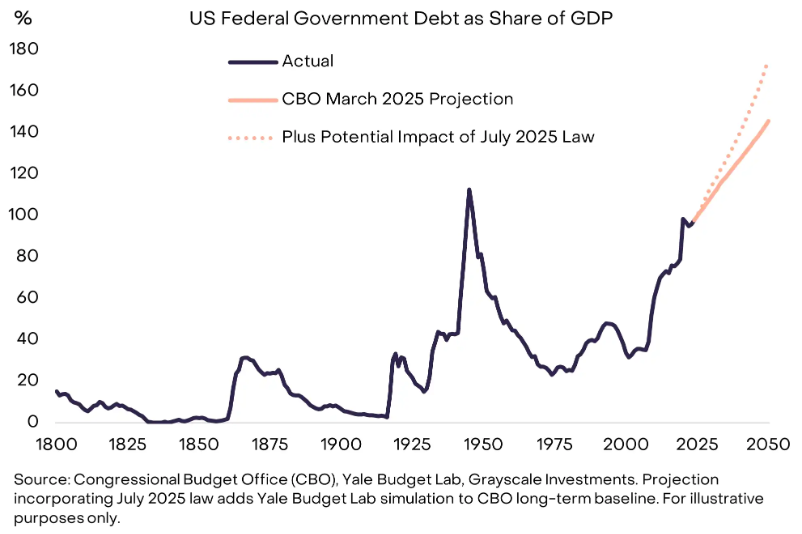

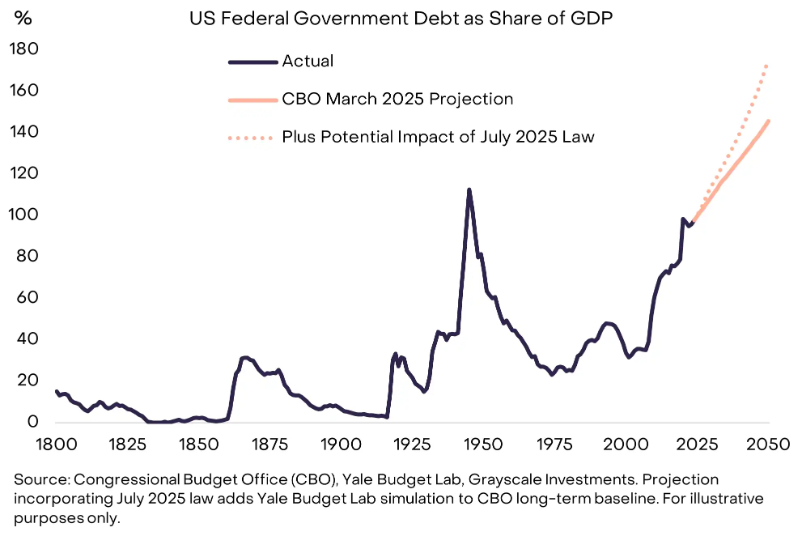

1. Macro Hedging Demand:

Rising public debt in major economies has triggered concerns over the long-term value of fiat currencies. Bitcoin and Ethereum, due to their transparency and programmable scarcity, are seen as “store of value” assets in the digital age, attracting macro allocation capital inflows.

2. Stablecoins: The Trillion-Dollar Foundational Layer:

Stablecoins have become the bridge connecting traditional finance and the crypto world.

● 21Shares predicts that their circulating market cap will exceed $1 trillion in 2026. Their role is upgrading from a trading tool to the “foundational settlement layer of the Internet.”

● a16z points out that last year, stablecoins processed about $46 trillion in transaction volume, nearly three times the scale of Visa. Their smarter on/off-ramp channels will drive explosive growth in the payments sector.

3. Asset Tokenization Reaches an Inflection Point:

Representing and trading real-world assets (such as government bonds, private equity) on-chain in the form of digital tokens is moving from proof-of-concept to scale.

● 21Shares predicts that the total value of tokenized real-world assets (RWA) will surge from $35 billion in 2025 to over $500 billion in 2026. This not only enhances asset liquidity but also lays the foundation for building programmable financial products.

4. Deep Integration of AI and Crypto:

Institutions such as a16z have foresightedly pointed out that by 2026, the combination of AI and blockchain will go beyond concepts. Core trends include:

a. Agent Economy: As AI agents autonomously conduct commercial activities, the demand for identity and credit systems for “Know Your Agent” (KYA) surges, requiring blockchain to provide trustworthy solutions.

b. Value Settlement Network: Micropayments between AI agents for data and computing power require instant, global settlement networks. Smart contracts and new protocols (such as x402) will support the vision of “the Internet itself becoming a bank.”

III. Pragmatic Implementation: Competition and Integration in Niche Tracks

The market’s focus will be on areas that can generate actual cash flow and user demand.

● Smart Contract Platform Competition Deepens: Ethereum, through Layer-2 expansion, is becoming institutional-grade tokenization infrastructure (such as BlackRock’s BUIDL fund). Solana, with its high throughput and low fees, is rapidly expanding in payments, DeFi, and other fields. The new generation of high-performance chains (such as Sui, Monad) will compete for market share through architectural innovation.

● Yield and Sustainability: Investors will pay more attention to protocols that can generate sustainable income. Earning yields through staking or sharing real protocol revenue will become a universal demand. DeFi, especially the lending sector, is expected to accelerate its development.

● Overestimated “Noise”: Grayscale’s report also clearly points out themes that are overhyped in the short term: quantum computing and Digital Asset Treasury companies (DATs) are not expected to have a substantial impact on market valuations in 2026.

IV. Risks and Divergence: Not Unanimously Optimistic

● Amidst the optimism, cautious views are equally noteworthy. Barclays points out that without new major catalysts, the crypto market in 2026 may face a “down year” of declining trading volumes and sluggish growth. The slowdown in the spot market is already putting revenue pressure on trading platforms mainly serving retail investors.

● This reminds the market that the inflow of institutional long-term allocation capital is a slow and continuous process. It may support valuation bottoms and smooth volatility, but may not instantly trigger a surge in prices.

In 2026, the crypto asset market will no longer be the “Wild West” of the past. Institutionalization, regulatory compliance, and real-world utility form the triple cornerstone of the new stage.

Although there are still divergences in short-term price trends, the consensus among mainstream financial institutions is: a crypto ecosystem with more manageable volatility, stronger infrastructure, and deeper connections to the traditional financial world is taking shape. This is no longer a sprint around narratives, but a marathon testing the real value of technology and the depth of financial integration.