FOMC Year-End Rate Cut Fails to Ignite Crypto Market Rally

Quick Breakdown

- FOMC cuts interest rates by 25 bps, maintaining a cautious stance for January 2026.

- Crypto markets show muted reactions; BTC and ETH options remain skewed toward bearish OTM puts.

- Limited leveraged trading and open interest indicate weak year-end momentum, dampening Santa rally hopes.

The Federal Open Market Committee’s (FOMC) final meeting of 2025 delivered a 25-basis-point rate cut, marking the third reduction of the year, in line with market expectations. Chair Jerome Powell maintained a moderately hawkish stance during the press conference, leaving both a pause and a potential rate cut on the table for January 2026.

https://t.co/SC7MVvb0SO

— Bybit (@Bybit_Official) December 15, 2025

FOMC year-end rate cut fails to spark crypto rally

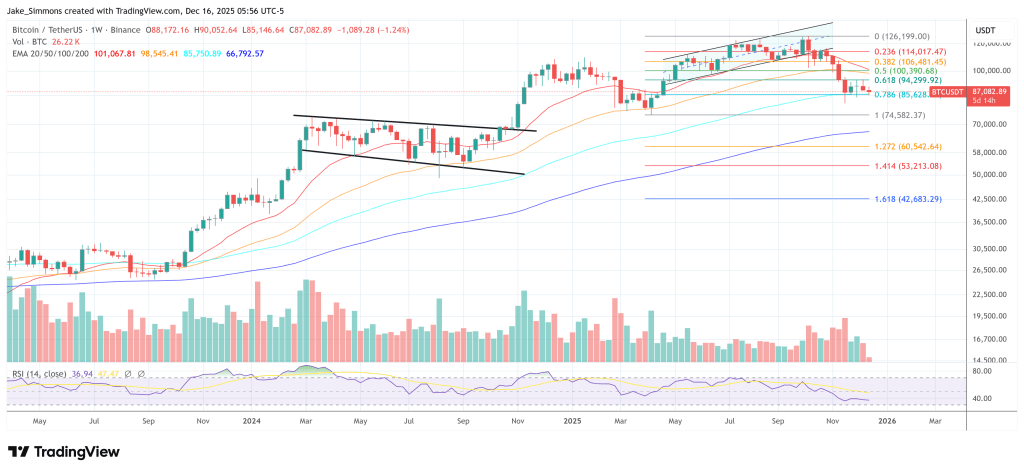

Despite the Fed’s action, cryptocurrency markets showed little response. Open interest in perpetual swap contracts mainly remained flat throughout the week, hovering around $8 billion, while BTC spot prices edged down from $94,500 to $90,000 following Powell’s remarks. Leveraged traders displayed limited appetite to re-enter positions, reflecting a cautious market environment. Funding rates on perpetual contracts and overall trade volumes suggest retail participation remains subdued, signalling little likelihood of significant liquidations in the short term.

Options market remains bearish amid year-end expectations

Derivatives markets also suggest muted optimism for a typical year-end “Santa rally.” Volatility smiles for both BTC and ETH options remain skewed toward out-of-the-money (OTM) puts, reflecting bearish sentiment across short- and long-term horizons. Short-tenor BTC and ETH options show 4.4% and 4.8% premiums for OTM puts, while 90-day contracts reflect 5.3% and 5.0% premiums, respectively.

The FOMC’s Summary of Economic Projections indicates that most policymakers expect only one rate cut in 2026, though markets still price in two. Chair Powell noted that the effects of the 75bps cumulative cuts in 2025 will continue to influence the economy. For crypto traders, this cautious outlook and persistent bearish signals in derivatives markets suggest that any year-end price surge is unlikely, keeping market participants on edge as they enter 2026.

Meanwhile, with official U.S. labour reports suspended during the ongoing government shutdown, market participants are relying on alternative data to gauge economic strength, subtly shaping crypto sentiment heading into 2026, according to Bybit Research.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Yen carry trade unwinding impacts global markets, putting pressure on bitcoin.

Do Kwon’s Sentence: Could a Shorter Prison Term Await in South Korea?