Cardano price prediction: ADA price hovers below key moving averages as selling pressure persists.

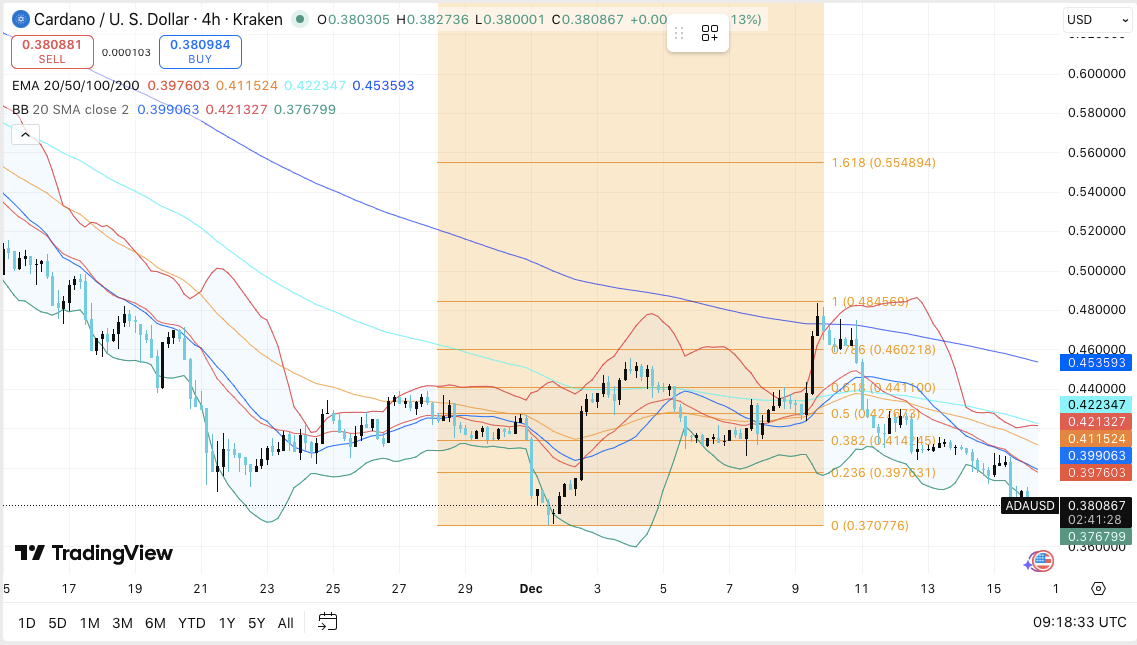

On the four-hour chart, Cardano's price continues to be under pressure, with buyers struggling to regain control of the short-term trend. After failing to hold the mid-term resistance level earlier this month, ADA is now trading near $0.38.

The market is currently focused on whether the existing support levels can hold amid weakening momentum, cooling derivatives trading activity, and continued outflows from spot funds. Therefore, the short-term trend depends on the price reaction near the key demand area, while traders remain cautious.

Price Structure Signals Cautious Consolidation

ADA's price action remains fragile, consistently staying below major moving averages on the four-hour chart. The token's price is still capped below the 100-period and 200-period exponential moving averages, further limiting its upside potential. In addition, the recent rebound has fallen well short of previous resistance levels, indicating that sellers still dominate at higher price points.

Currently, the price is hovering above the $0.38 support area, which has previously served as a short-term demand zone. As such, this area now becomes a key turning point for recent price action. If the price decisively breaks below $0.37, attention may shift to deeper support levels near $0.36 and $0.35. These levels previously absorbed selling pressure during consolidation phases.

Related: Ethereum Price Prediction: ETH Price Consolidates, Open Interest Declines…

On the positive side, ADA must reclaim the $0.40 to $0.41 range to improve its short-term outlook. In addition, there are strong resistance levels near $0.42 and $0.43, where trend indicators also align. If the price breaks through this area, it may test the broader $0.45 to $0.48 supply zone. However, the market has yet to confirm such strength.

Derivatives Data Reflects Lower Risk Appetite

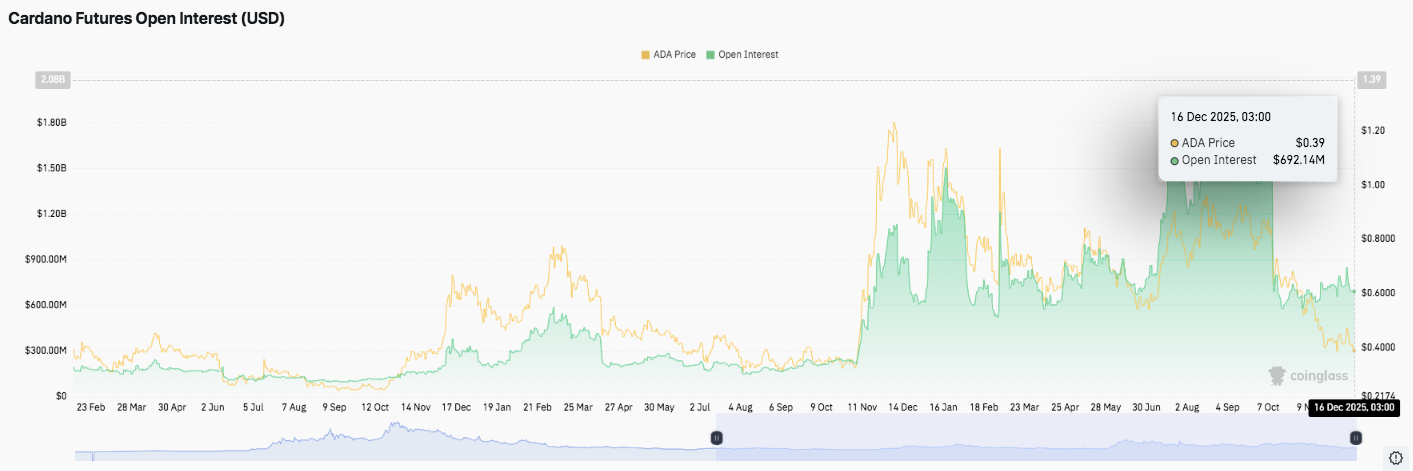

Source: Coinglass

Source: Coinglass Futures market data shows a significant reduction in speculative positions. Open interest expanded sharply during the early session rally, then contracted as prices reversed. Notably, the peak in leveraged exposure coincided with local price highs, followed by a rapid pullback.

Currently, open interest is close to $690 million, with ADA trading around $0.39. This pullback suggests that traders have reduced leverage following recent market volatility. In addition, the contraction in contracts indicates a more tempered directional view, rather than aggressive positioning. Therefore, derivatives data supports a wait-and-see approach in the market.

Spot Flows Highlight Ongoing Distribution

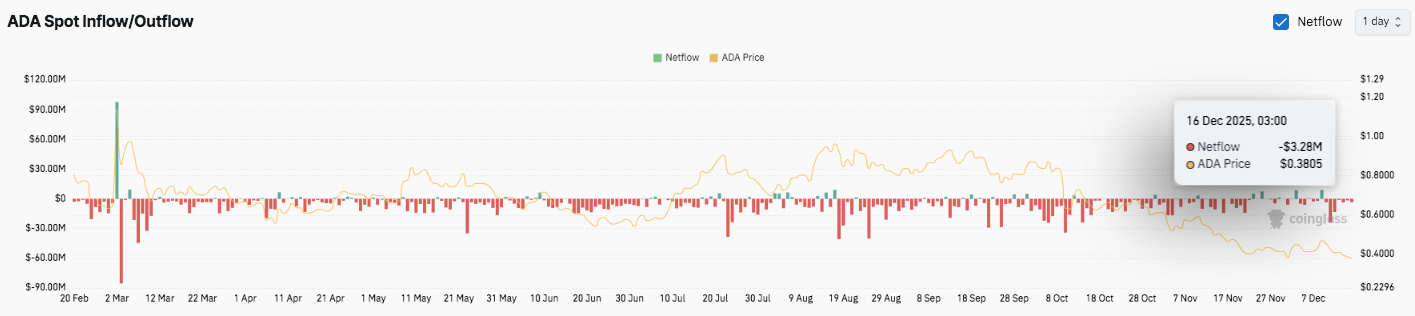

Source: Coinglass

Source: Coinglass Spot fund flow trends further reinforce the cautious sentiment. ADA has continued to record net outflows, indicating that funds are leaving exchanges. Despite brief peaks in inflows, the overall trend has not changed.

Related: Bitcoin Price Prediction: Treasury Purchases Fail to Shift Market Sentiment

Notably, outflows intensified during the recent period of price weakness, indicating that risk aversion continues to spread. The latest data shows net outflows of about $3.28 million, consistent with ADA's current trading range. Therefore, spot fund flows indicate limited interest in accumulation, with most positions being defensive in nature.

Technical Outlook for Cardano (ADA) Price

Cardano's key price levels remain clear, with the price fluctuating near critical areas on the four-hour chart.

Upside targets include $0.40 and $0.42 as immediate resistance levels, followed by $0.45 and $0.48 as higher resistance targets. If the price continues to break above $0.42, it may retest the $0.45 to $0.48 supply zone.

On the downside, $0.38 remains the first support level to watch, followed by $0.37 and $0.35 if selling pressure intensifies.

Resistance near $0.42 to $0.43 coincides with the 100-day moving average, which remains a key turning point for short-term rebound momentum. Technically, after a downtrend, ADA appears to be compressed within a narrow consolidation range, suggesting that volatility may expand in the future.

Will Cardano Rise?

Cardano's price action depends on whether buyers can hold the $0.37 support area and challenge the $0.40 to $0.42 range. The narrowing technicals and weakening momentum suggest a decisive move is imminent.

If inflows strengthen and the price returns to $0.42, ADA could once again challenge $0.45 or even higher. However, if it fails to hold $0.37, it could fall to $0.35 and extend the correction phase. For now, ADA remains at a key turning point, requiring further confirmation to determine the next move.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

1.18 Billion XRP In Four Weeks. Here’s What Whales Are Doing

PancakeSwap, YZi Labs Announce Zero-Fee Prediction Market on BNB Chain

Bitcoin derivatives point to a wide trading range between $85,000 and $100,000