Anchorage Digital Acquires Securitize For Advisors to Expand Crypto Wealth Management

Quick Breakdown

- Anchorage Digital acquires Securitize For Advisors, integrating its tech and team to expand digital asset wealth management.

- SFA achieved 4,500% growth in AUM over the past year, strengthening Anchorage Digital’s RIA-focused offerings.

- Partnership with Mantle enables secure institutional custody of $MNT tokens, bridging regulated finance with on-chain assets.

Anchorage Digital, the first federally chartered crypto bank in the U.S., has acquired Securitize For Advisors (SFA), a leading digital asset wealth management platform for registered investment advisors (RIAs). The acquisition will integrate SFA’s technology, product vision, and team into Anchorage Digital’s platform, enhancing its crypto wealth management offerings.

Source

:

Anchorage Digital

Source

:

Anchorage Digital

Driving crypto adoption among RIAs

Since its launch in 2021, the SFA platform has enabled RIAs to offer seamless digital asset exposure to clients, achieving over 4,500% growth in net new deposits and assets under management (AUM) in the past year, far exceeding the broader RIA industry’s 16% expansion. With 99% of SFA client assets already custodied at Anchorage Digital Bank, the acquisition strengthens an existing partnership. It delivers a fully unified wealth management solution that combines trading, custody, and client interfaces under a single platform.

Nathan McCauley, Co-Founder and CEO of Anchorage Digital, highlighted the strategic importance:

“

By bringing together Anchorage Digital’s federally regulated custody platform with SFA’s technology and expertise, we’re building the premier solution for wealth managers and their clients.”

Carlos Domingo, Co-Founder and CEO of Securitize, added that joining Anchorage Digital enables SFA to scale further while Securitize continues to focus on tokenizing capital markets.

Expanding institutional-grade crypto solutions

The acquisition underscores the growing institutional adoption of digital assets and reinforces Anchorage Digital’s commitment to providing regulated, secure, and integrated solutions for wealth managers. By combining custody, trading, and client-facing technology, the platform aims to accelerate crypto adoption in mainstream wealth management.

Anchorage Digital continues to offer a comprehensive suite of services, including staking, settlement, stablecoin issuance, and self-custody wallets, while maintaining compliance through its federal charter and international licenses.

In a related development, Mantle, a leading Ethereum Layer-2 platform for real-world asset (RWA) distribution, has partnered with Anchorage Digital to enable secure institutional custody of its native token, $MNT, on Ethereum, marking another step in bridging regulated finance with on-chain ecosystems.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

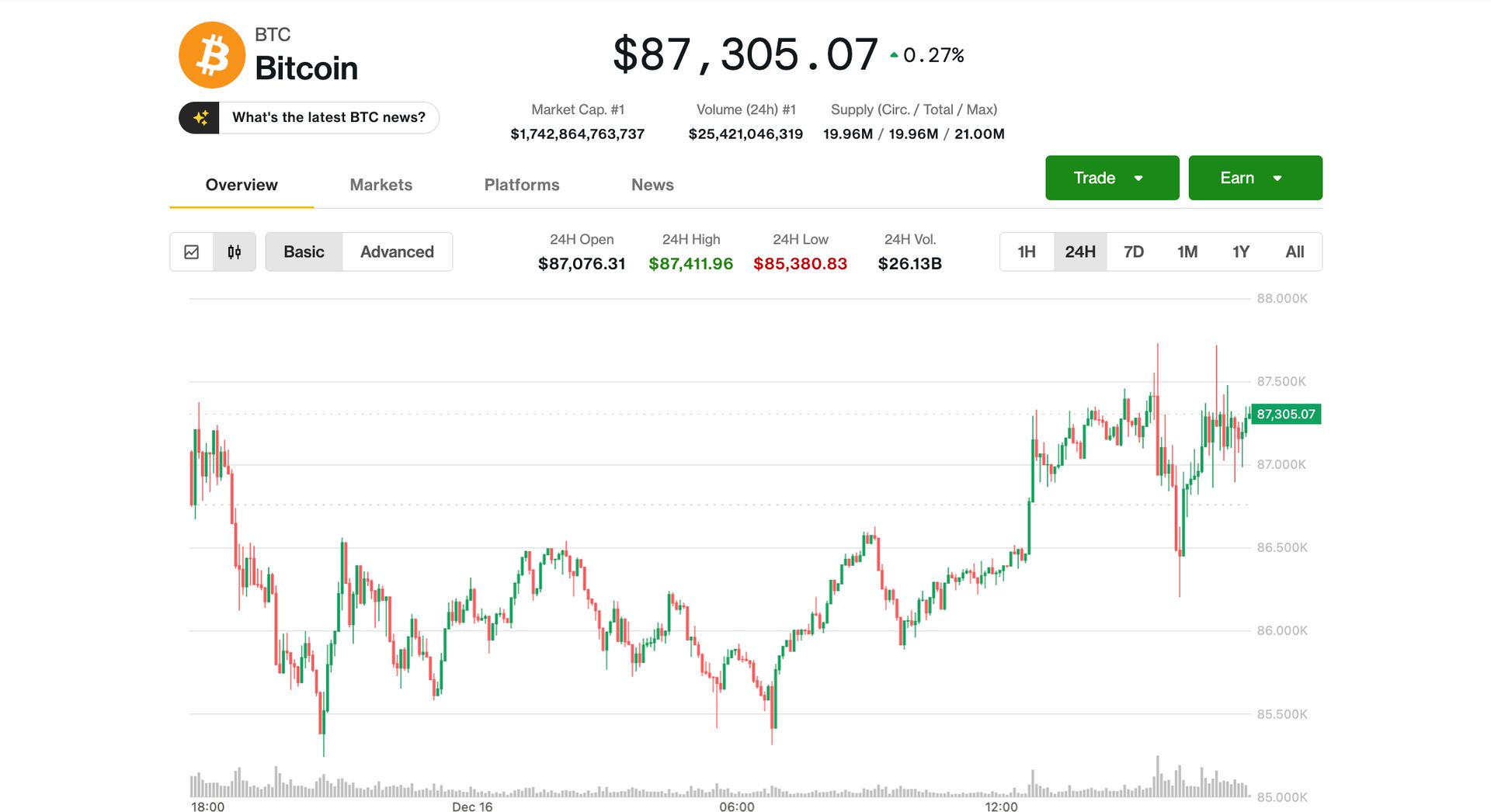

Bitcoin rebounds from Monday’s lows, but analysts say a drop below $80,000 is possible.

Strategy CEO Phong Le Predicts BTC Surge in 2026 Despite MSTR Decline

Ethereum Price Decline: 3 Alarming Factors Behind the Recent Drop