One Critical XRP Price Level Surfaces — Holding It Could Trigger a 9% Bounce

XRP is trading near $1.99, down about 1% over the past 24 hours. Despite broader market volatility, it is only around 4% lower on the week, showing relative stability compared to many altcoins like ADA and BCH. More importantly, the chart is flashing an early bullish reversal signal. The setup is not confirmed yet, but

XRP is trading near $1.99, down about 1% over the past 24 hours. Despite broader market volatility, it is only around 4% lower on the week, showing relative stability compared to many altcoins like ADA and BCH.

More importantly, the chart is flashing an early bullish reversal signal. The setup is not confirmed yet, but if one key level continues to hold, the odds of a short-term rebound, at least 9%, increase meaningfully.

Bullish Divergence Appears as the XRP Price Defends Key Support

XRP has formed a bullish divergence on the daily chart between December 1 and December 14. A bullish divergence happens when the price makes a lower low, but the Relative Strength Index (RSI) makes a higher low. RSI is a momentum indicator that measures buying and selling strength. When RSI improves while price weakens, it often signals that selling pressure is fading.

On the daily chart, a standard bullish divergence like this can lead to trend reversal — from bearish to bullish.

Yet, this divergence alone is not enough. It only matters if the XRP price holds support.

Bullish Divergence:

TradingView

Bullish Divergence:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

That support sits near $1.97. XRP has repeatedly defended this zone, and on-chain data helps explain why.

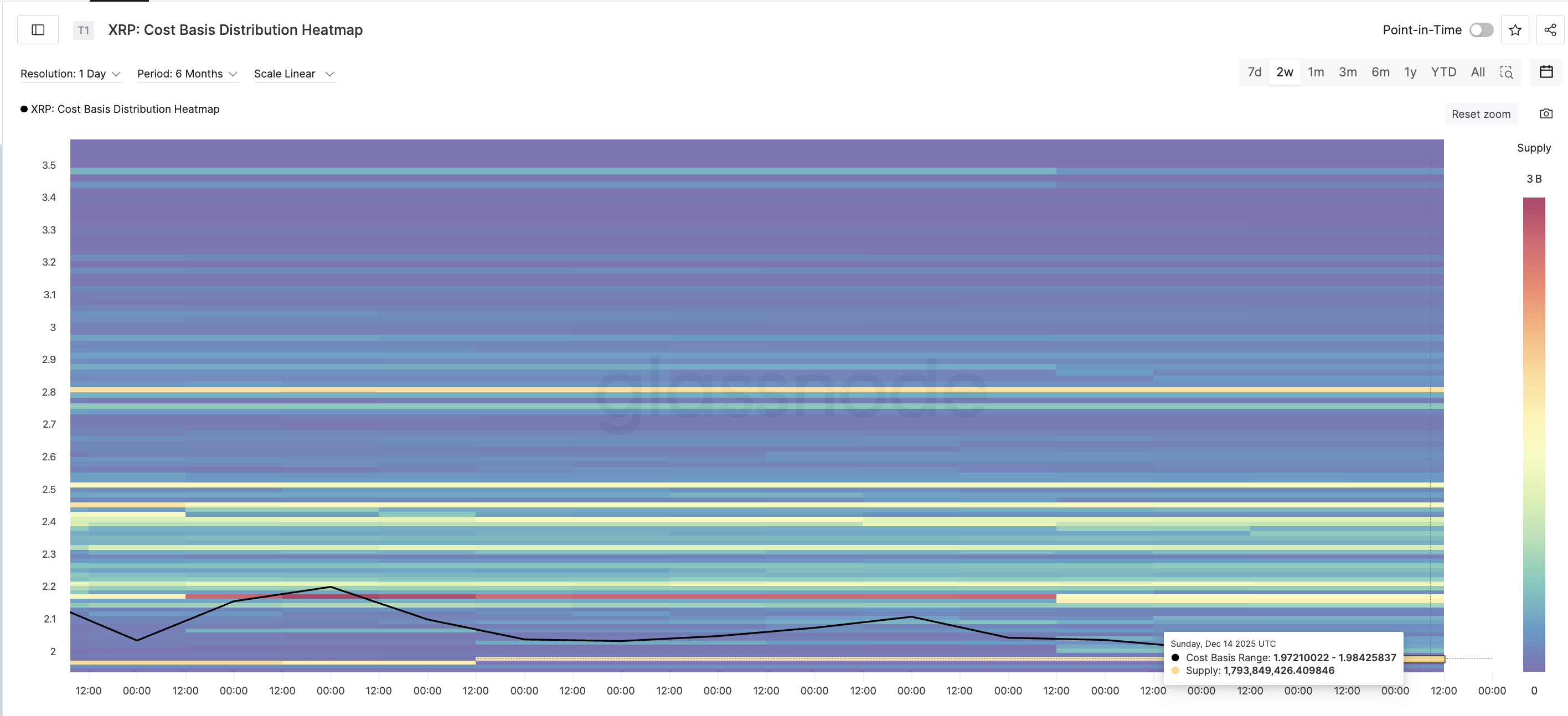

The cost basis heatmap shows a dense cluster of XRP bought between roughly $1.97 and $1.98.

Strong Support Cluster:

Glassnode

Strong Support Cluster:

Glassnode

Around 1.79 billion XRP were accumulated in this range. A cost basis heatmap shows where large groups of holders bought their coins. When price trades near these levels, holders are less likely to sell at a loss, which strengthens support.

As long as XRP stays above $1.97, the bullish divergence theory remains valid, provided the RSI reading stays strong.

Why $2.17 Is the First Real Test for the Bulls

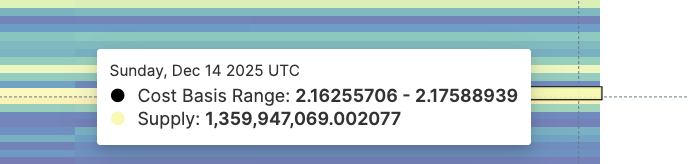

If support holds, XRP has room to move higher. The first upside target sits near $2.17, which is roughly a 9% move from current levels.

This level matters because the cost basis heatmap shows heavy supply between $2.16 and $2.17. About 1.36 billion XRP were acquired in this zone. That makes it a strong resistance area, where selling pressure is likely to appear.

XRP Price Can Face Resistance At This Level:

Glassnode

XRP Price Can Face Resistance At This Level:

Glassnode

If the XRP price pushes through $2.17 with a daily candle close, it could open the path toward $2.28, then $2.69, and eventually $3.10. Yet, those levels remain secondary for now and depend on broader market conditions.

The invalidation is clear. A daily close below $1.97 would weaken the reversal setup and expose downside toward $1.81 and $1.77.

XRP Price Analysis:

TradingView

XRP Price Analysis:

TradingView

For now, the XRP price sits at a decision point. The bullish reversal signal is active, but only if the most important support level continues to hold.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

An Altcoin Has Already Announced Its Readiness Against The Great Quantum Threat

Trump Eyes Fed Chair Candidate Waller as Rate-Cut Advocate Shapes the Debate

Slate crosses 150,000 reservations despite waning EV truck enthusiasm