3 Altcoins That Could Hit All-Time Highs In The Third Week Of December

The crypto market is still stabilizing, but price weakness has slowed across majors. As volatility compresses and buyers defend key levels, attention is shifting toward altcoins that could hit all-time highs even without a full market breakout. These are not random picks. They are coins already trading within 5–15% of their previous highs, where momentum,

The crypto market is still stabilizing, but price weakness has slowed across majors. As volatility compresses and buyers defend key levels, attention is shifting toward altcoins that could hit all-time highs even without a full market breakout.

These are not random picks. They are coins already trading within 5–15% of their previous highs, where momentum, structure, and liquidity align. If the broader market holds steady, these altcoins could surge higher without needing additional triggers.

Pippin (PIPPIN)

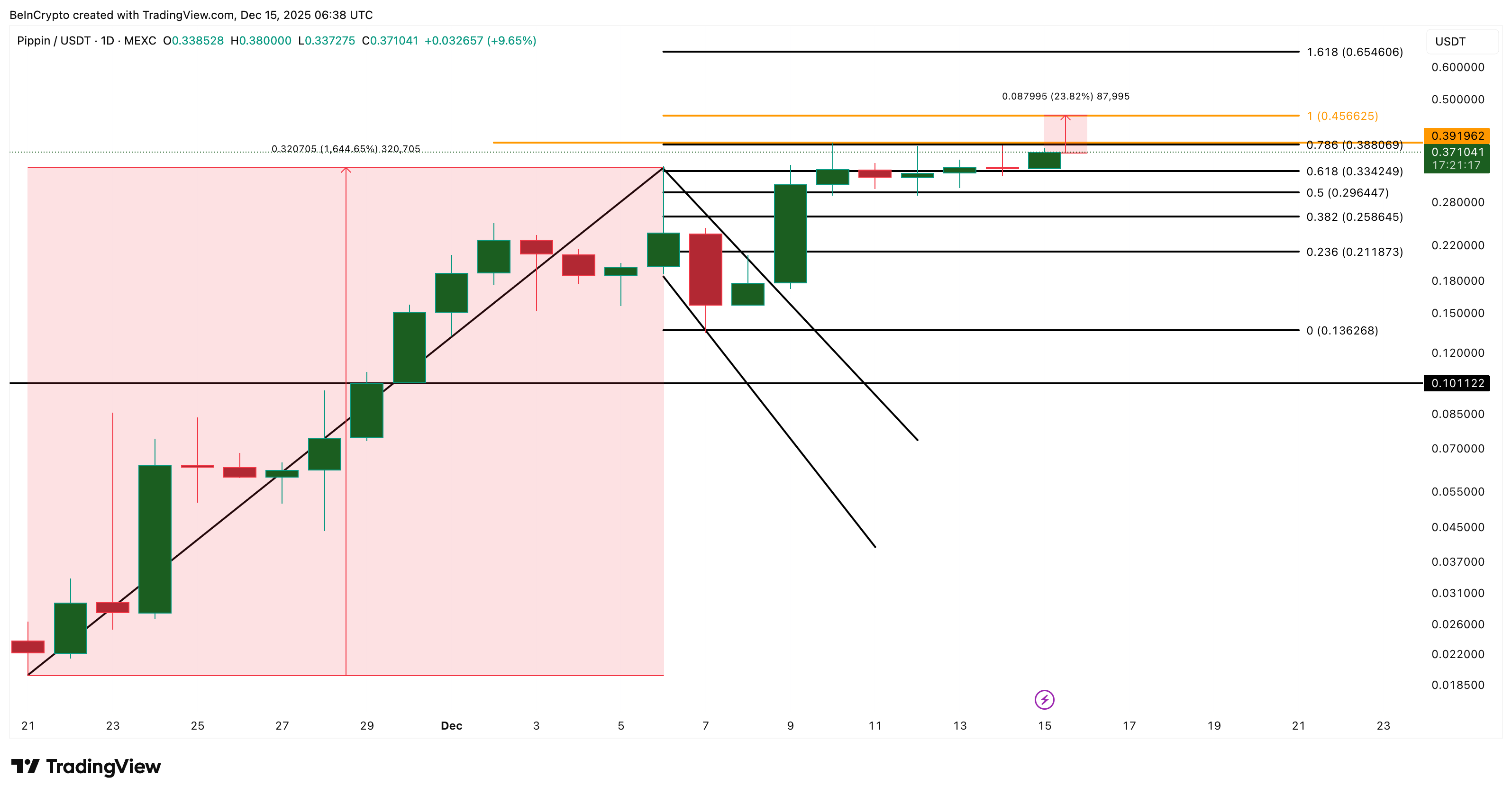

PIPPIN is one of the clearest examples among altcoins that could hit all-time highs this week. The token is a meme-category asset, but price behavior has been unusually bullish.

Since November 21, PIPPIN has trended higher in a controlled uptrend, forming a bull flag and then breaking above it with follow-through buying.

PIPPIN is currently trading near $0.37, sitting just 5% below its all-time high near $0.39. Price has held above prior resistance without sharp pullbacks, showing buyers are defending higher levels rather than chasing spikes.

PIPPIN Price Analysis:

TradingView

PIPPIN Price Analysis:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

From a structure perspective, a clean break above $0.39 would confirm a new all-time high. If that happens, the next upside zone sits near $0.45, which aligns with the measured move from the prior flag breakout. That level would mark continuation, not exhaustion.

On the downside, the structure remains healthy as long as PIPPIN holds above $0.25. Losing $0.13, followed by $0.10, would invalidate the broader setup and signal trend failure. For now, price remains well above those risk levels.

Audiera (BEAT)

Audiera (BEAT) token is another standout among altcoins that could hit all-time highs. BEAT is a Web3 cloud infrastructure token and has been one of the strongest movers this week. The token is up sharply over the past 24 hours and has gained nearly 90% over the last seven days.

BEAT’s most recent all-time high was set just days ago near the $3.31 area. Price is now consolidating just below that level, at around $2.83, rather than pulling back aggressively.

A confirmed move above the prior high would shift focus toward the $3.95 region, which aligns with a key extension level on the 12-hour chart. If momentum persists, higher zones near $5.58 come into view over time.

BEAT Price Analysis:

TradingView

BEAT Price Analysis:

TradingView

As long as BEAT holds above the $2.62–$2.94 support range, the trend structure remains intact. A sustained loss of that zone would be the first warning sign that upside momentum is fading. That could lead to a retest of $1.30, a key support zone.

Rain (RAIN)

Rain (RAIN) is the final name on this list of altcoins that could hit all-time highs if market conditions stay steady. It is a DeFi-focused token tied to lending activity within the Jupiter network. It has stayed relatively quiet compared to faster-moving names, but the structure has been tightening in a constructive way.

Over the past seven days, RAIN is up about 4.4%. In the past 24 hours alone, it has added roughly 6.7%, showing fresh momentum.

Price is currently trading near $0.0079. Its all-time high sits around $0.0084, which was set on November 24. That puts RAIN less than 6% away from price discovery. This matters because the token has already spent weeks consolidating just below that level, rather than rejecting sharply lower.

RAIN Price Analysis:

TradingView

RAIN Price Analysis:

TradingView

If RAIN manages a clean break above $0.0084, it would enter price discovery. Based on prior range expansion and Fibonacci projections, the next levels to watch sit near $0.0097, followed by $0.010 and $0.011 if momentum accelerates and the broader market holds.

Downside levels are also clear. Losing $0.0075 would weaken the structure. A deeper breakdown below $0.0062 would expose a larger gap in support, with $0.0032 as the next major historical level.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Clean Energy Market Fluidity: Ushering in a New Age with CFTC-Sanctioned Platforms

- REsurety's CleanTrade, a CFTC-approved SEF, revolutionizes clean energy trading by addressing market fragmentation and liquidity gaps. - The platform attracted $16B in notional value within two months, enabling institutional-scale investments in renewable assets. - Real-time analytics and compliance tools reduce transaction risks, empowering ESG-aligned investments across $1.2T markets. - By democratizing access and cutting costs by 30%, CleanTrade reshapes clean energy procurement for corporations and e

Solana's Latest Price Fluctuations: On-Chain System Vulnerabilities and Investor Sentiment in Advanced Blockchain Networks

- Solana's 2025 market volatility stems from technical vulnerabilities, validator instability, and shifting investor sentiment, with SOL experiencing a 150% drawdown from its peak. - Validator count dropped 68% since 2023, raising decentralization concerns as institutional participants adopt MPC solutions to mitigate downtime risks. - Institutional adoption grew via ETFs like SOEZ and BSOL , yet infrastructure risks prompted cautious on-chain behavior and diversified risk management strategies. - DeFi TVL

Bitcoin Leverage Wipeout: Systemic Threats in Cryptocurrency Derivatives Markets

- 2025 Bitcoin leverage liquidation events ($19B+ in October, $543M in December) exposed systemic risks in crypto derivatives markets, with Bitcoin short positions disproportionately affected. - Crisis revealed interconnectedness between crypto and traditional finance, as stablecoin de-pegging and liquidity shocks impacted U.S. Treasury markets and midcap tokens. - Regulators intensified oversight: FSB identified stablecoin/CASP gaps, Basel Committee adjusted prudential rules, and 70%+ jurisdictions advanc

Clean Energy Market Fluidity: How REsurety's CleanTrade Platform is Transforming Institutional Participation and Risk Strategies in Renewable Energy Trading

- REsurety's CleanTrade platform standardizes green energy trading, boosting institutional liquidity and risk management. - Launched in 2025, it facilitated $16B in trades, enabling transparent VPPA/PPA/REC trading and ESG-aligned hedging. - CFTC oversight reduces counterparty risk, aligning with decarbonization goals amid policy uncertainties. - Despite challenges like rising rates, CleanTrade bridges gaps by standardizing pricing and aggregating demand.