Russia Revives Blacklisted Crypto Empire Garantex to Outrun Sanctions

Sanctioned Russian exchange Garantex is quietly moving funds again, according to an on-chain payout architecture uncovered by blockchain analytics firm Global Ledger. The forensic evidence confirmed that Russian actors have rebuilt a functioning payout system despite law enforcement efforts. Garantex Quietly Moves Millions A new investigation by Global Ledger reveals that Garantex, a Russian crypto

Sanctioned Russian exchange Garantex is quietly moving funds again, according to an on-chain payout architecture uncovered by blockchain analytics firm Global Ledger.

The forensic evidence confirmed that Russian actors have rebuilt a functioning payout system despite law enforcement efforts.

Garantex Quietly Moves Millions

A new investigation by Global Ledger reveals that Garantex, a Russian crypto exchange previously hit by Western sanctions and a server seizure, is still managing to move large sums of money.

Researchers have uncovered new Garantex-linked wallets on Bitcoin and Ethereum that, together, hold more than $34 million in cryptocurrency. At least $25 million has already been paid out to former users. These movements confirm that the operation is active despite international pressure to shut it down.

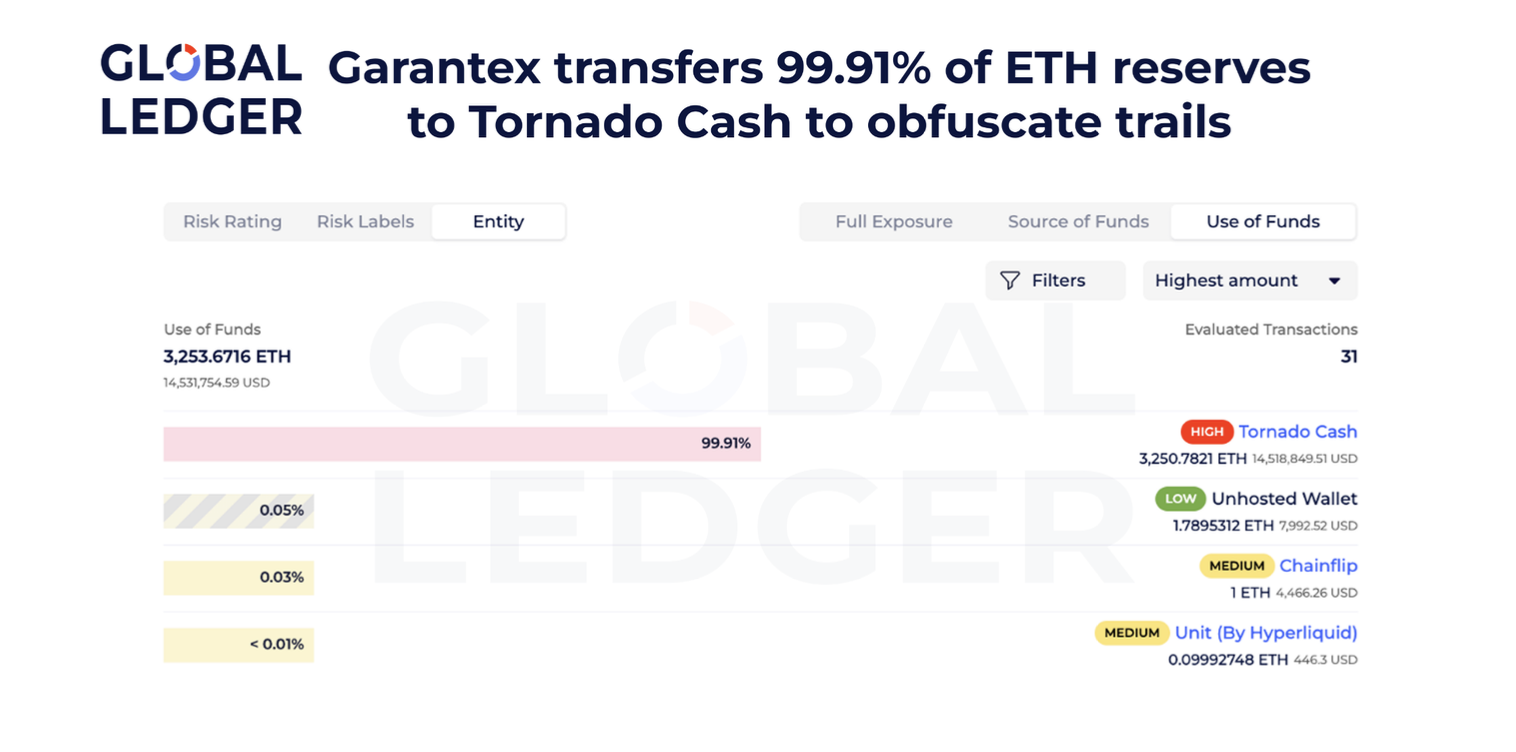

Global Ledger explained that Garantex is operating a payout system designed to conceal the flow of money. The exchange shifts its reserves into mixing services such as Tornado Cash, which scramble the funds to obscure their origin.

Garantex uses Tornado Cash to obscure money movement. Source:

Global Ledger.

Garantex uses Tornado Cash to obscure money movement. Source:

Global Ledger.

The money is then routed through a series of cross-chain tools. These facilitate the transfer of assets between networks, including Ethereum, Optimism, and Arbitrum. These transfers eventually end up in aggregation wallets, and from there, the funds are distributed to individual payout wallets.

The investigation also found that most Ethereum reserves remain untouched. More than 88% of the ETH linked to Garantex remains in reserve, indicating that only the initial phase of payouts has commenced.

The findings in the Global Ledger report are situated within a broader transformation within Russia’s financial system.

How Russia Uses A7A5 to Keep Trade Alive

Russia has made a remarkable shift in its approach to digital assets.

In early 2022, the Russian Central Bank proposed a blanket ban on cryptocurrencies, describing them as a threat to financial stability. By 2024, the country had reversed its position and began using crypto to support trade under sanctions.

President Vladimir Putin has also personally backed a new payment network called A7.

A7 launched a rouble-backed stablecoin named A7A5 at the start of 2025. This token enables the flow of money in and out of the conventional financial system, and according to Chainalysis, it has already supported more than $87 billion in trading activity.

Russian companies utilize A7A5 to convert rubles into USDT. This allows Russian firms to continue making cross-border payments even when banks refuse to process transfers linked to Russia.

While Russia works to build a financial system that no longer depends on Western channels, the Global Ledger findings add a critical new layer by showing that Garantex has not disappeared.

Instead, it has adapted its operations and continues to move money through structures that mirror newer state-backed systems.

Taken together, the evidence shows how states are developing new crypto-based payment systems that circumvent country-specific sanctions and erode traditional forms of external pressure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Rising Influence of EdTech on Career-Focused Investment Prospects

- Global EdTech market grows at 20.5% CAGR to $790B by 2034, driven by STEM/digital skills demand. - STEM workers earn 45% higher wages; 10.4% occupation growth vs 4.0% non-STEM, reshaping labor markets. - 2025 EdTech VC investments show 35% YoY decline, concentrating on AI tools and scalable upskilling platforms. - MENA/South Asia EdTech sees 169% funding growth, addressing equity gaps through global platforms. - AI-driven EdTech and M&A activity (e.g., ETS-Ribbon) highlight sector's shift toward outcome-

KITE Price Forecast Following Listing: Managing Post-IPO Fluctuations and Institutional Investor Outlook

- Kite Realty Group (KITE) fell 63% post-IPO despite strong retail occupancy and NOI growth, highlighting valuation disconnect between real estate fundamentals and tech IPO expectations. - Institutional sentiment split: COHEN & STEERS boosted holdings by 190% amid industrial pivot, while others divested $18. 3M , reflecting uncertainty over hybrid retail-industrial strategy execution. - Analysts remain divided on $24–$30 price targets, balancing KITE's 7.4% dividend increase and industrial shift against ma

The Increasing Importance of Blockchain Education for Strategic Growth in Emerging Markets

- Blockchain education in emerging markets is accelerating token adoption and financial inclusion by addressing technical barriers and fostering trust in decentralized systems. - Trust Wallet Token (TWT) enables low-cost remittances and DeFi access through gas discounts and fee reductions, targeting regions with weak traditional banking infrastructure. - Strategic partnerships like Trust Wallet-EBI and UNDP blockchain training programs amplify TWT's utility in governance, identity management, and cross-bor

ZCash Rally Raises Questions: How High Can ZEC Climb From Here?