Zcash Leads in Hype — But Monero (XMR) Is Quietly Dominating Where It Matters

Privacy coins have emerged as one of the dominant narratives shaping cryptocurrency investment trends this year. The two leading altcoins in this sector by volume and market capitalization are Zcash (ZEC) and Monero (XMR). Investor attention has focused heavily on ZEC. Meanwhile, XMR continues to show strong and steady growth. XMR Outperforms ZEC in Many

Privacy coins have emerged as one of the dominant narratives shaping cryptocurrency investment trends this year. The two leading altcoins in this sector by volume and market capitalization are Zcash (ZEC) and Monero (XMR).

Investor attention has focused heavily on ZEC. Meanwhile, XMR continues to show strong and steady growth.

XMR Outperforms ZEC in Many Aspects Despite Lacking the Spotlight

In terms of daily spot trading volume in December, ZEC performed exceptionally well.

ZEC maintains a daily trading volume of nearly $1 billion. This level surpasses XMR and DASH, thanks to strong liquidity on major exchanges like Binance.

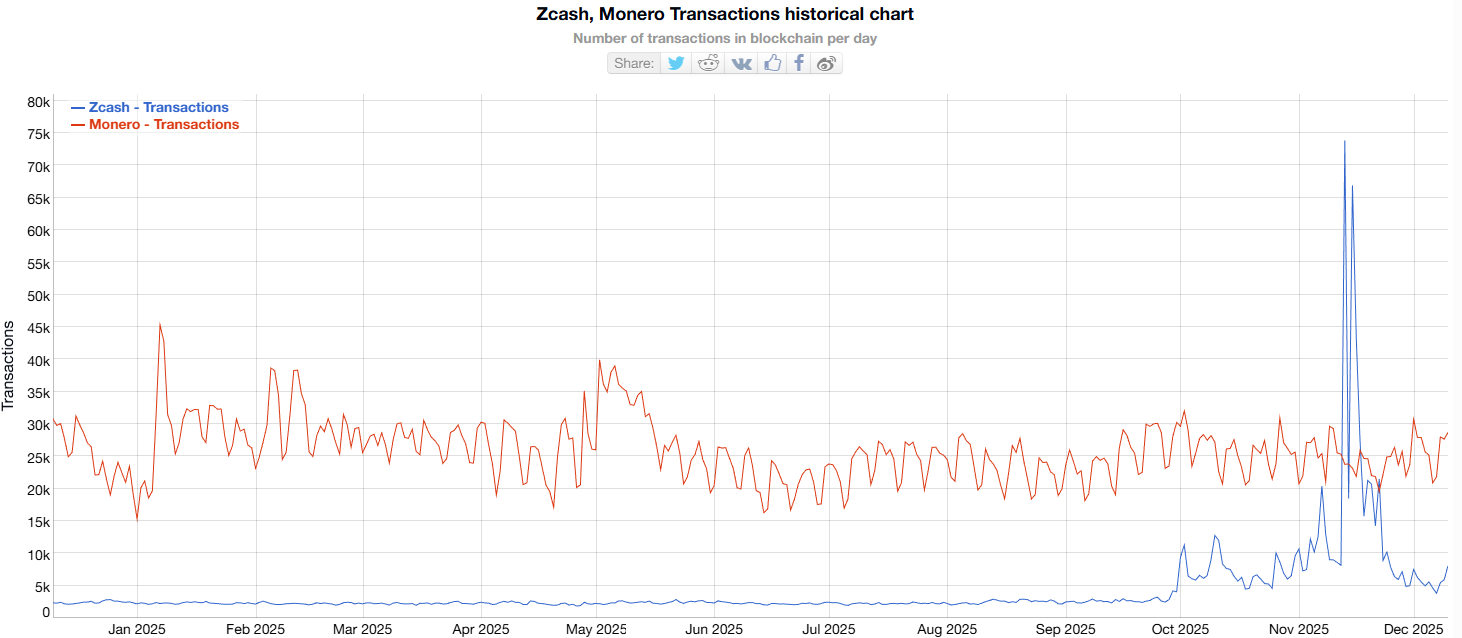

However, ZEC falls far behind in daily on-chain transactions. Data from BitInfoCharts shows XMR reaching an average of about 26,000 transactions per day. This figure is more than triple ZEC’s average of roughly 8,000 transactions per day.

Zcash, Monero Daily Transactions. Source:

BitInfoCharts

Zcash, Monero Daily Transactions. Source:

BitInfoCharts

The chart also indicates that XMR’s on-chain activity remains consistent over the long term. This trend reflects stable user behavior. In contrast, ZEC’s recent surge and sharp decline appear more like temporary excitement.

On-chain activity carries longer-term significance than spot volume. It reflects real usage patterns and user acceptance of XMR for anonymous transfers rather than short-term trading sentiment.

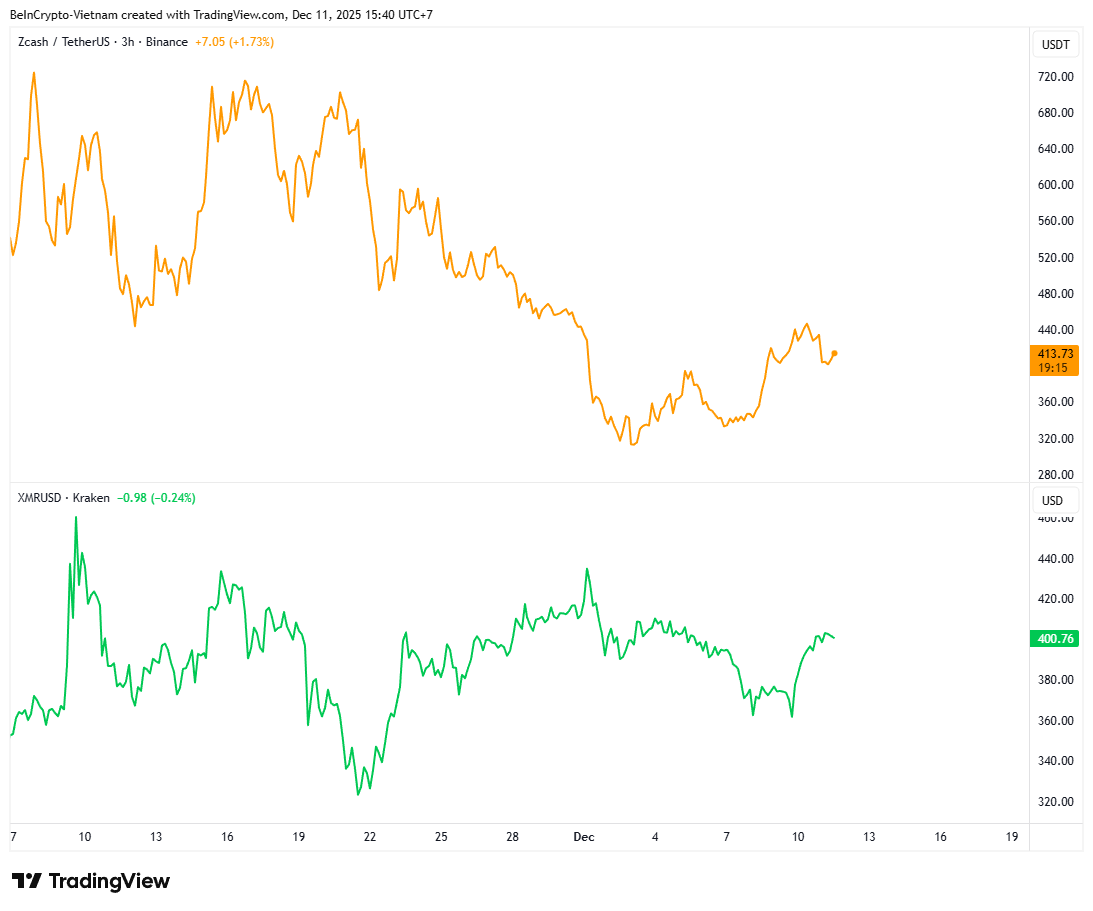

Additionally, ZEC’s price fluctuates due to increased volatility resulting from speculative trading. XMR’s price movement remains more stable.

TradingView data shows that ZEC has fallen by more than 40% over the past month. Many analysts now suggest the possibility of a bubble pattern. Meanwhile, XMR declined by roughly 12%.

Comparing The Price Performance Between ZEC and XMR. Source:

TradingView

Comparing The Price Performance Between ZEC and XMR. Source:

TradingView

From this perspective, ZEC suits traders who chase the privacy coin narrative and aim for quick profits during extreme FOMO cycles. The downside is deeper price drops and longer recovery periods.

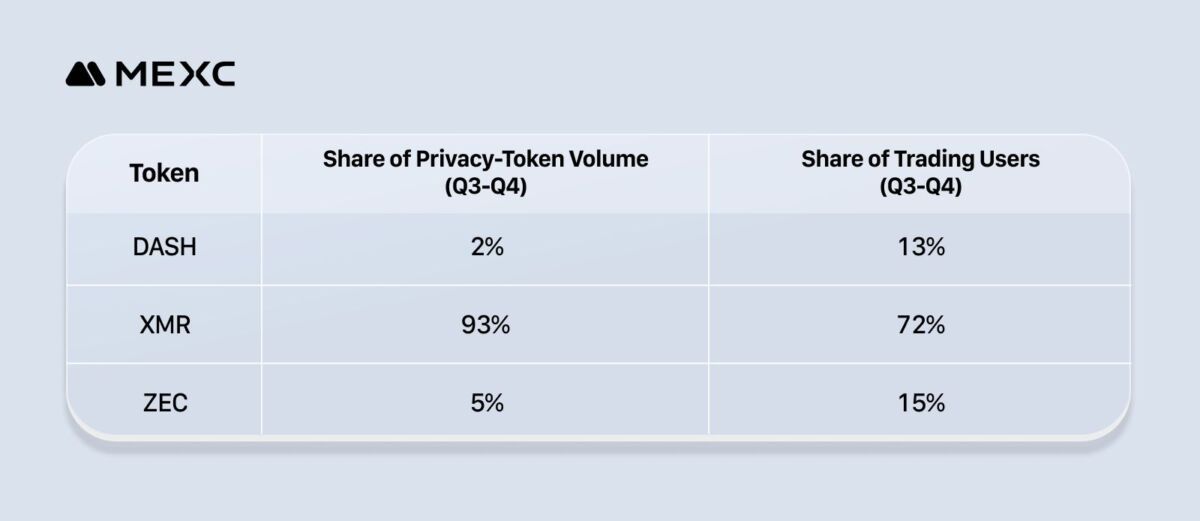

Furthermore, the latest report from MEXC Research reinforces XMR’s position. Over longer timeframes, XMR demonstrates superior trading volume and user activity compared to ZEC and DASH.

“Despite ZEC and DASH posting record-high trading volumes, Monero remains an asset of choice among privacy coin traders, accounting for 93% of total trading volume in Q3–Q4 and 72% of users in this segment,” MEXC Research reported.

The report also notes that growing interest in privacy assets reflects users’ increasing need for anonymity as regulators strengthen capital controls.

Therefore, regardless of holding ZEC or XMR, investors can continue to benefit next year. Experts predict privacy coins will remain a dominant market narrative in 2026.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A detailed overview of technology layoffs in 2025

PENGU Price Forecast for 2025: Steering Through Regulatory Challenges and Growing Institutional Confidence

- Pudgy Penguins (PENGU) faces regulatory uncertainty from SEC delays and EU MiCA, causing 30% price drops due to compliance risks. - Institutional interest grows with $273K whale accumulation and rising OBV, contrasting retail fear (Fear & Greed Index at 28). - Ecosystem expansion via Pudgy World and penguSOL, plus Bitso partnership, aims to boost utility but depends on user adoption and regulation. - Expert forecasts diverge: $0.02782 (CoinCodex) vs. $0.068 (CoinDCX), with technical analysis highlighting

PENGU USDT Selling Indicator and What It Means for Stablecoin Approaches

- PENGU/USDT's 2025 collapse triggered $128M liquidity shortfall, exposing systemic risks in algorithmic stablecoins. - Technical indicators (RSI 40.8, bearish MACD) and 52.55% 30-day price drop signal deepening market distrust. - Regulatory frameworks (GENIUS Act, MiCA) and AI-driven risk analytics emerge as critical responses to algorithmic vulnerabilities. - Experts urge hybrid models combining CBDC stability with AI governance to address algorithmic stablecoins' inherent fragility.

Hyperliquid (HYPE) Token: Analyzing the Drivers and Longevity Behind Its Latest Price Rally

- Hyperliquid's HYPE token surged to $42.03 in 2025 from $3.20, driven by product upgrades (HyperEVM, HyperCore) and institutional adoption. - Strategic partnerships with Anchorage Digital and Circle , plus regulatory compliance, boosted credibility and decentralized trading volume (73% market share by 2025). - Bitcoin's $123k high in July 2025 correlated with HYPE's peak, reflecting broader crypto market optimism for low-fee decentralized futures infrastructure. - Sustainability risks include token unlock