Bitcoin Leverage Liquidation: Does It Pose a Systemic Threat to Retail Crypto Investors?

- October 2025's Bitcoin crash triggered $19B in leveraged liquidations, exposing crypto derivatives' fragility amid extreme retail leverage and thin liquidity. - High leverage (up to 1,001:1) and perpetual futures dominated by platforms like Hyperliquid amplified volatility, creating self-reinforcing downward spirals. - Behavioral biases (FOMO, overconfidence) and social media echo chambers drove irrational leveraged bets, while regulators paused risky ETFs and warned of systemic risks. - The crisis highl

Crypto Market Turmoil: Lessons from the 2025 Derivatives Crisis

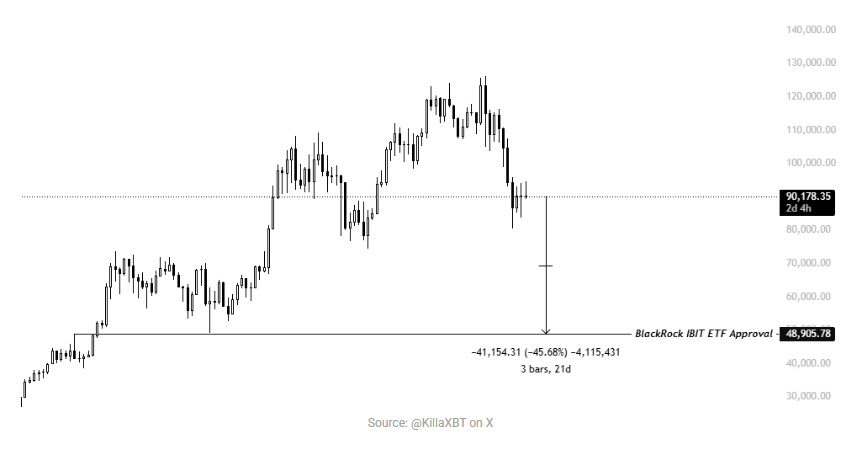

The world of cryptocurrency has always been marked by dramatic swings, speculation, and the allure of cutting-edge technology. However, in late 2025, a dramatic event highlighted the vulnerabilities within the crypto derivatives sector, revealing the dangers of excessive leverage, investor psychology, and systemic instability. In just one day in October, Bitcoin’s value plunged from $126,000 to $92,000, setting off a chain reaction of forced liquidations that erased $19 billion in positions, as reported by Galaxy Digital. This wasn’t an isolated occurrence—it exposed a troubling trend: retail traders embracing extreme leverage, influenced by psychological biases and a lack of regulatory oversight.

Understanding the Collapse

The crisis in October was driven by unprecedented leverage ratios—some reaching as high as 1,001:1—and the overwhelming popularity of perpetual futures contracts, which made up 78% of all trades. Trading platforms such as Hyperliquid and Bybit, known for their limited supervision, became hotbeds of volatility. As Bitcoin’s price dropped, automated trading systems and shallow liquidity intensified the sell-off, creating a self-reinforcing downward spiral that quickly escalated into a liquidity crunch. Many individual investors were caught off guard, suffering sudden liquidations that wiped out their savings and deepened the sense of disorder.

This episode highlights a fundamental contradiction: while leverage can boost profits, it can also inflict massive losses during downturns. As one market observer put it, “Leverage and liquidity are inseparable—when one falters, the entire market suffers.” The turmoil also exposed weaknesses in the crypto derivatives landscape, such as fragmented systems and a lack of dependable risk management tools.

The Role of Investor Psychology

Beyond the technical factors, human behavior played a crucial role in the crisis. Many retail traders, swayed by herd instincts and overconfidence, increasingly viewed Bitcoin as a short-term gamble rather than a long-term investment. Social media platforms like Reddit and X (formerly Twitter) amplified these tendencies, fueling FOMO (fear of missing out) and confirmation bias, which encouraged riskier, leveraged trades without a full grasp of the dangers involved.

Research from the Boston Institute of Analytics in 2025 revealed how these psychological biases, when combined with leverage, create a “perfect storm” for irrational choices. For instance, loss aversion—where investors dread losses more than they value gains—can lead them to cling to leveraged positions during market drops, hoping for a rebound, only to be forced out when liquidity vanishes. Meanwhile, overconfidence leads traders to underestimate the likelihood of sharp price movements, a critical error in such a volatile environment.

Regulatory Responses and Systemic Concerns

Regulators took notice of the October 2025 upheaval. The U.S. Securities and Exchange Commission (SEC) halted its review of highly leveraged ETF proposals, citing worries about “excessive risk exposure” for products tracking more than double the underlying asset’s performance. In Europe, the European Systemic Risk Board (ESRB) raised alarms about the stability of stablecoins and crypto investment products, calling for stricter enforcement under the Markets in Crypto-Assets (MiCA) regulations.

These actions reflect a growing awareness of the systemic dangers posed by unchecked leverage in crypto. However, as the ESRB pointed out, the global and interconnected nature of digital asset markets makes effective oversight challenging. One ESRB representative remarked, “The complex links between leverage, liquidity, and investor psychology create risks that no single authority can manage alone.”

Looking Forward: Managing Risk and Educating Investors

The key takeaway for individual investors is clear: leverage is a powerful but dangerous tool. While it can increase potential returns, it also magnifies losses when things go wrong. Institutional investors have generally shown greater discipline, using options, futures, and diversified strategies to manage their risk. This difference highlights a gap in knowledge and resources for retail traders—a gap that must be closed through better education and possibly new regulations.

The events of October 2025 stand as a stark warning. In the crypto world, where human psychology and leverage intersect, systemic threats are very real. As the industry continues to develop, the challenge will be to foster innovation while putting in place the necessary protections—ensuring that future investors learn from past mistakes rather than repeat them.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Litecoin Holds $100 Base as Chart Signals 2025 Recovery

Stablecoins Gain Popularity in Venezuela as Hyperinflation and Sanctions Persist

Fed Rate Cut Triggers Mixed Crypto ETF Performance as Bitcoin, XRP ETFs Post Inflows, Ether Outflows

Bitcoin To Retest $85,000 Mark In Coming Days – Here’s Why