Stellar Quietly Sets New On-Chain Records in December — Is a Strong Price Rally Coming?

The Stellar (XLM) network is quietly experiencing a surge in on-chain activity in December 2025. However, muted price action has caused investors to overlook these new records. These signals may reflect positive fundamentals that could support an upcoming price recovery. So what exactly are these new records? What Do Stellar’s New On-Chain Records Mean for

The Stellar (XLM) network is quietly experiencing a surge in on-chain activity in December 2025. However, muted price action has caused investors to overlook these new records.

These signals may reflect positive fundamentals that could support an upcoming price recovery. So what exactly are these new records?

What Do Stellar’s New On-Chain Records Mean for December?

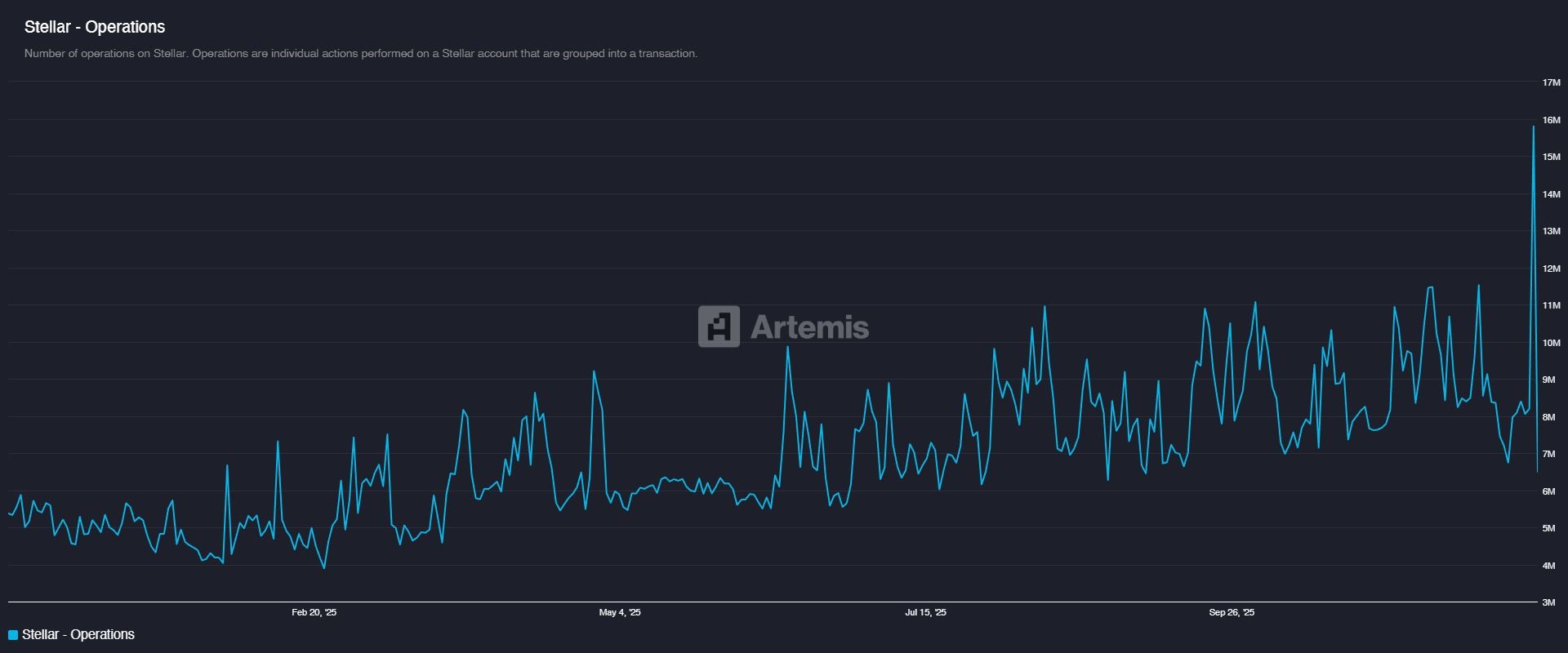

Operations on Stellar represent desired changes on the ledger. They are submitted to the network as grouped components within a transaction.

In December 2025, the number of Operations on Stellar reached the highest level of the year. This milestone marks a notable increase in network activity.

Operations on Stellar. Source:

Operations on Stellar. Source:

Many operations related to Payment or Path Payment indicate a strong flow of cash and assets, increasing the liquidity of the system.

This growth indicates that an increasing number of users, organizations, or applications are processing a greater number of transactions. It signals rising real-world demand.

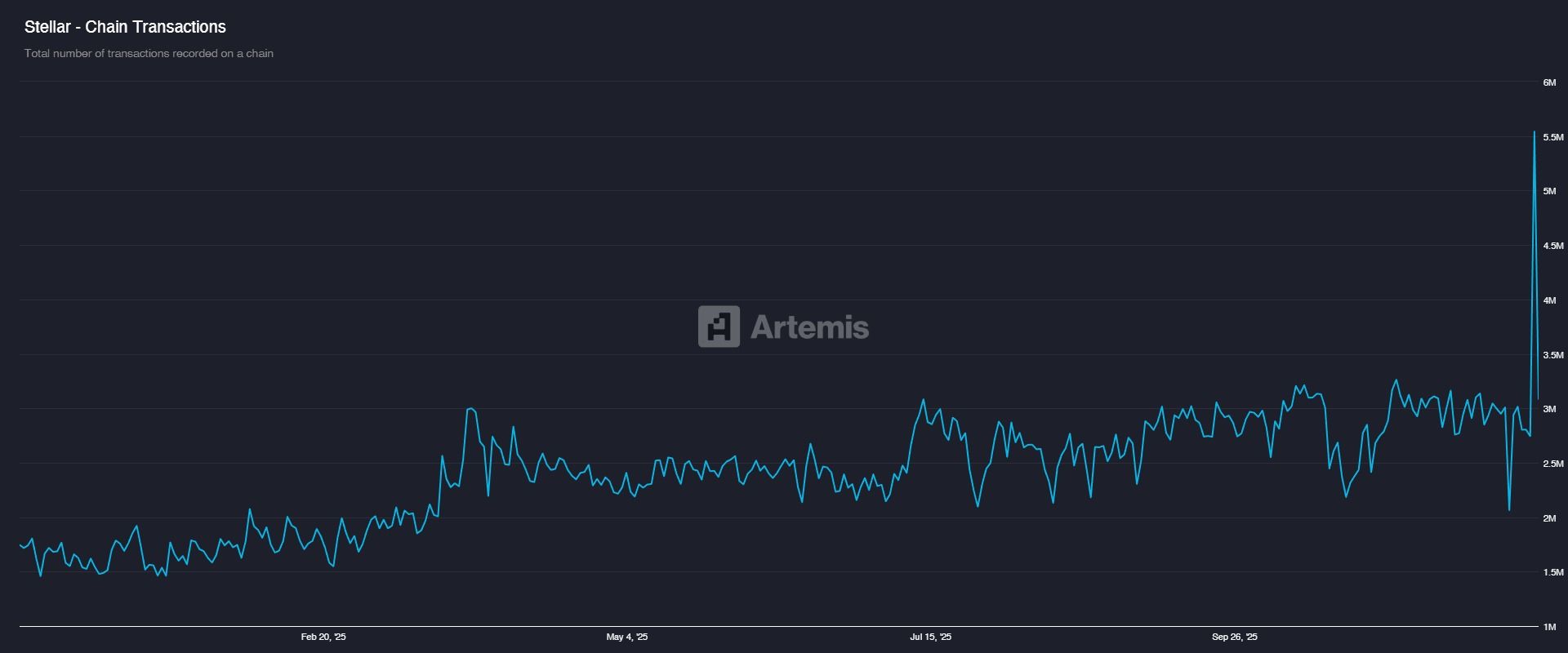

Second, chain transactions are growing steadily and showing signs of a breakout.

Stellar Chain Transactions represent the total number of transactions recorded on the Stellar chain. They include core actions such as asset transfers and smart-contract interactions.

Stellar Chain Transactions. Source:

Stellar Chain Transactions. Source:

Data from Artemis shows that Chain Transactions maintained an upward trend throughout the year. The chart also signals a notable spike in December.

Recently, US Bank — one of the largest commercial banks in the United States — began actively testing stablecoin issuance on the Stellar network. Institutional attention may attract retail interest and boost overall network activity.

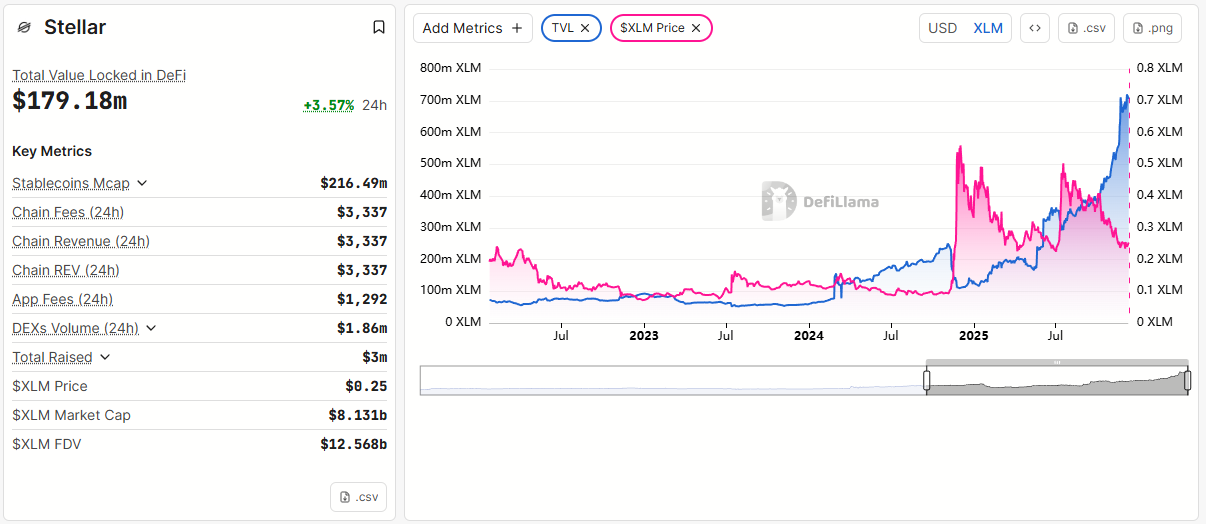

In addition, Stellar’s Total Value Locked (TVL) reached its all-time high in December 2025, surpassing $179.18 million.

Stellar’s Total Value Locked. Source:

Stellar’s Total Value Locked. Source:

TVL increased even though XLM’s price has not recovered. This pattern suggests that investors are locking more XLM into Stellar-based ecosystems.

Despite the strong on-chain activity, XLM currently sits at the most critical support zone of the year. The weekly chart highlights a range of $0.24 to $0.195.

Stellar (XLM) Price Weekly Demand Zone. Source:

Stellar (XLM) Price Weekly Demand Zone. Source:

“XLM/USDT is sitting right at its weekly support — a level that held multiple times in previous market cycles,” analyst CryptoPulse commented.

Analysts view this as an accumulation opportunity for those who expect a wider crypto recovery in late 2025 and early 2026. The next target remains at $0.40–$0.49.

However, fundamental strength does not always move in parallel with price action. Even XRP — an altcoin closely correlated with XLM — has refused to rally despite major developments from Ripple. Therefore, DCA strategies involving capital diversification or waiting until overall market sentiment improves may be less risky options.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Abrupt 50% Decline in SOL Value: Was This a Market Adjustment or a Total Crash?

- Solana (SOL) faced a 50% price drop in November 2025, sparking debates over whether it signaled a temporary correction or deeper collapse. - Fundamentals showed mixed signals: falling TVL and validator counts, but strong institutional inflows ($101.7M net ETF inflows) and rising DEX activity. - Retail panic ($19B liquidations) and bearish technical indicators (broken $140 support) contrasted with institutional confidence in Solana's infrastructure. - Analysts highlighted the critical $80B market cap supp

Internet Computer's Value Rises: On-Chain Growth and Ecosystem Enhancements Drive Sustainable Gains

The Emergence of a Governed Clean Energy Market and Its Influence on Institutional Investors

- CleanTrade secures CFTC SEF approval, enabling transparent clean energy trading akin to traditional markets. - Platform facilitates $16B in transactions by centralizing VPPAs/PPAs/RECs, reducing counterparty risks for institutional investors. - Global clean energy investment ($2.2T) now outpaces fossil fuels ($1.1T), driven by cost-competitive solar and policy support. - Clean energy markets show growing independence from oil prices while maintaining crisis resilience seen during pandemic recovery. - CFT

Bitcoin Faces Regulatory Turning Point in November 2025: Institutional Integration and Compliance Obstacles

- In November 2025, Bitcoin faces regulatory crossroads as U.S. SEC approves spot ETFs and EU MiCA harmonizes crypto rules, accelerating institutional adoption. - 68% of institutional investors now allocate to Bitcoin ETPs, driven by GENIUS Act clarity and infrastructure advances, signaling strategic asset-class integration. - Compliance challenges persist due to fragmented enforcement, with MiCA passporting inconsistencies and U.S. stablecoin audit requirements complicating cross-border operations. - Futu