Date: Wed, Dec 10, 2025 | 05:30 AM GMT

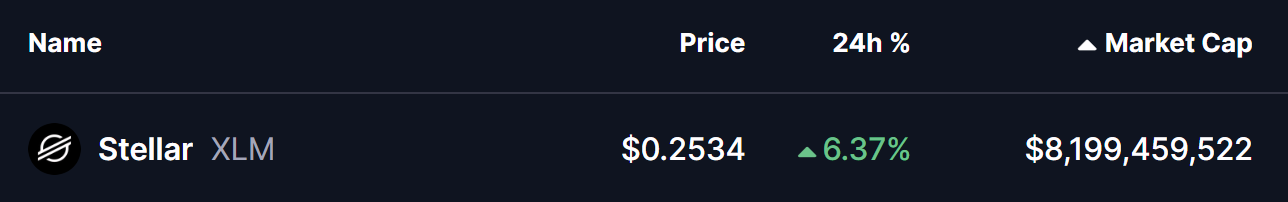

The cryptocurrency market has made a sharp bullish move in the past 24 hours as the prices of both Bitcoin (BTC) and Ethereum (ETH) jumped by 3% and 7%, which allowed major altcoins to regain ground including Stellar (XLM).

XLM has surged more than 6%, and beyond the price strength, its chart is signaling the formation of a bullish ascending triangle pattern — a setup that could pave the way for a breakout.

Source: Coinmarketcap

Source: Coinmarketcap

Ascending Triangle in Play

On the 4H chart, XLM has been shaping a textbook ascending triangle, a bullish continuation structure that typically appears before upside expansions. The upper boundary shows repeated rejection near $0.2608 while the lower trendline continues to rise, indicating strength building from buyers.

Earlier rejection from $0.2608 pushed XLM toward its base at $0.2390, but buyers stepped in aggressively. This reaction quickly drove the price back into the triangle resistance region and above the 100 MA, which now sits as reclaimed support at $0.2481 — a key signal that momentum is shifting back to bulls.

Stellar (XLM) 4H Chart/Coinsprobe (Source: Tradingview)

Stellar (XLM) 4H Chart/Coinsprobe (Source: Tradingview)

What’s Next for XLM?

From here, XLM price action appears to be preparing for another attempt at the neckline resistance between $0.2575 and $0.2608. A confirmed breakout and retest of this zone would validate the structure and open room for continuation.

The measured move projection from the ascending triangle points toward $0.3016, which reflects nearly 18% upside from current levels. As long as price continues to respect the rising support base and the 100 MA, bullish follow-through remains the primary expectation.

That said, the setup is forming on the 4H timeframe, which can still allow volatility. Until XLM closes decisively above $0.2608, the possibility of another rejection toward the trendline base remains active within the triangle compression.