The ZK Atlas Enhancement and Its Impact on Blockchain Scalability

- ZKsync's October 2025 Atlas Upgrade achieves 15,000–43,000 TPS with $0.0001 fees, enhancing Ethereum's L2 scalability via ZK proofs. - Institutional adoption by Deutsche Bank/UBS and $3.5B TVL validate ZK-based L2s as infrastructure for DeFi and real-time settlements. - Upcoming Fusaka upgrade (Dec 3, 2025) aims to double throughput, positioning ZKsync to outpace competitors with 60.7% CAGR growth projections. - $ZK token's $0.28/2025 and $1.32/2030 price targets reflect deflationary mechanics and $15B B

ZK Atlas Upgrade: Transforming Ethereum’s Layer 2 Scalability

Unveiled in October 2025, the ZK Atlas Upgrade marks a significant leap forward for Ethereum’s Layer 2 scalability. This upgrade reimagines both the technical and economic foundations of blockchain networks. With transaction speeds ranging from 15,000 to 43,000 TPS and transaction fees dropping to just $0.0001, ZKsync has established itself as a frontrunner in the zero-knowledge rollup space. The combination of this upgrade, increased institutional participation, and a robust development roadmap highlights the growing potential of ZK-based Layer 2 solutions for both decentralized finance and enterprise applications. For investors, these innovations are more than just technical achievements—they signal a new era of blockchain efficiency and capital optimization.

Breakthrough Technology and Market Leadership

The ZK Atlas Upgrade utilizes the Airbender proof system alongside a modular ZKsync operating system, delivering near-instant finality (less than one second) and robust cryptographic security. These enhancements are crucial for scaling Ethereum, addressing persistent challenges related to transaction speed and cost. To put this in perspective, Ethereum’s mainnet currently handles about 15–45 TPS, making ZKsync’s performance up to 3,000 times faster. This isn’t just theoretical—over $3.5 billion in total value is already locked within ZK ecosystems, and $15 billion in Bitcoin ETF investments have targeted ZK-centric projects in 2025.

The modular design of the upgrade further strengthens its appeal. Full compatibility with the Ethereum Virtual Machine (EVM) allows developers to launch Ethereum-based applications with minimal changes, making it easier for enterprises to adopt. This gives ZKsync a competitive edge over other Layer 2 solutions like Arbitrum and Optimism, which still grapple with balancing scalability and composability.

Institutional Integration and DeFi Expansion

Major financial institutions, including Deutsche Bank and UBS, have adopted ZKsync for secure settlements and digital rights management, reflecting growing institutional trust in ZK-based technologies. According to ZKsync CEO Alex Gluchowski, the Atlas Upgrade transforms Ethereum into a “real-time liquidity hub,” meeting the needs of global financial systems. This is especially important for DeFi, where fragmented liquidity has long been a challenge. The upgrade’s unified liquidity model removes the necessity for external bridges, enabling effortless cross-chain settlements and the tokenization of real-world assets.

For investors, ZK-based Layer 2s have evolved from experimental projects to essential infrastructure for institutional-grade DeFi. The ability to handle up to 43,000 TPS while ensuring cryptographic finality presents a strong case for asset managers seeking scalable and secure platforms.

Roadmap and Competitive Outlook

Looking ahead, ZKsync’s development plan features the Fusaka upgrade, set for December 3, 2025. This update aims to double throughput to 30,000 TPS and further enhance ZK-SNARK capabilities, positioning ZKsync ahead of competitors such as StarkNet and Arbitrum, which use less efficient proof mechanisms. Industry analysts forecast a 60.7% annual growth rate for ZK-based Layer 2 solutions, with the sector potentially reaching a $90 billion valuation by 2031.

The adoption of Vitalik Buterin’s GKR protocol further strengthens the ZK ecosystem. By halving verification times, GKR enables Layer 2s to process up to 43,000 TPS. This synergy between Ethereum’s core research and ZK advancements accelerates both adoption and investment in the space.

Investment Strategy and Market Dynamics

For institutional investors, the ZK Atlas Upgrade presents a unique opportunity, combining technical superiority with deflationary token economics. ZKsync’s native token ($ZK) has seen daily trading volumes surpass $300 million, supported by mechanisms such as buybacks, token burns, and staking incentives. Projections indicate that $ZK could reach $0.28 by the end of 2025 and climb to $1.32 by 2030, fueled by the rise of blockchain-based AI agents and broader market acceptance.

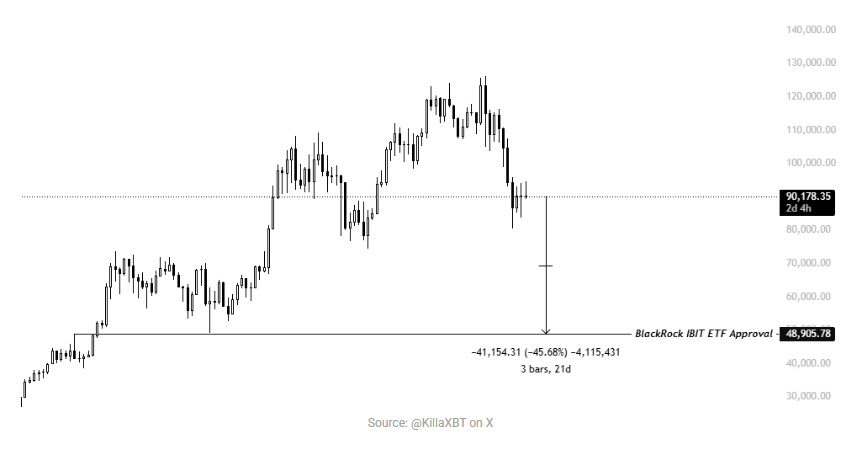

Investors should also be mindful of favorable macroeconomic trends. In 2025 alone, Bitcoin ETFs have funneled $15 billion into ZK projects, reflecting a shift toward scalable and interoperable blockchain infrastructure. This aligns with the increasing demand for real-time settlements and privacy-focused solutions in both decentralized and traditional finance sectors.

Summary

The ZK Atlas Upgrade is more than just a technical enhancement—it marks a strategic turning point for blockchain scalability. By merging high throughput, minimal costs, and enterprise-level security, ZK-based Layer 2 solutions are reshaping the economics of decentralized networks. For investors, the message is clear: ZK innovations are not only addressing Ethereum’s scalability challenges but are also unlocking a $90 billion market opportunity by 2031. With the upcoming Fusaka upgrade and the integration of the GKR protocol, ZKsync and its ecosystem are set to lead the next wave of blockchain adoption.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Litecoin Holds $100 Base as Chart Signals 2025 Recovery

Stablecoins Gain Popularity in Venezuela as Hyperinflation and Sanctions Persist

Fed Rate Cut Triggers Mixed Crypto ETF Performance as Bitcoin, XRP ETFs Post Inflows, Ether Outflows

Bitcoin To Retest $85,000 Mark In Coming Days – Here’s Why