Key Notes

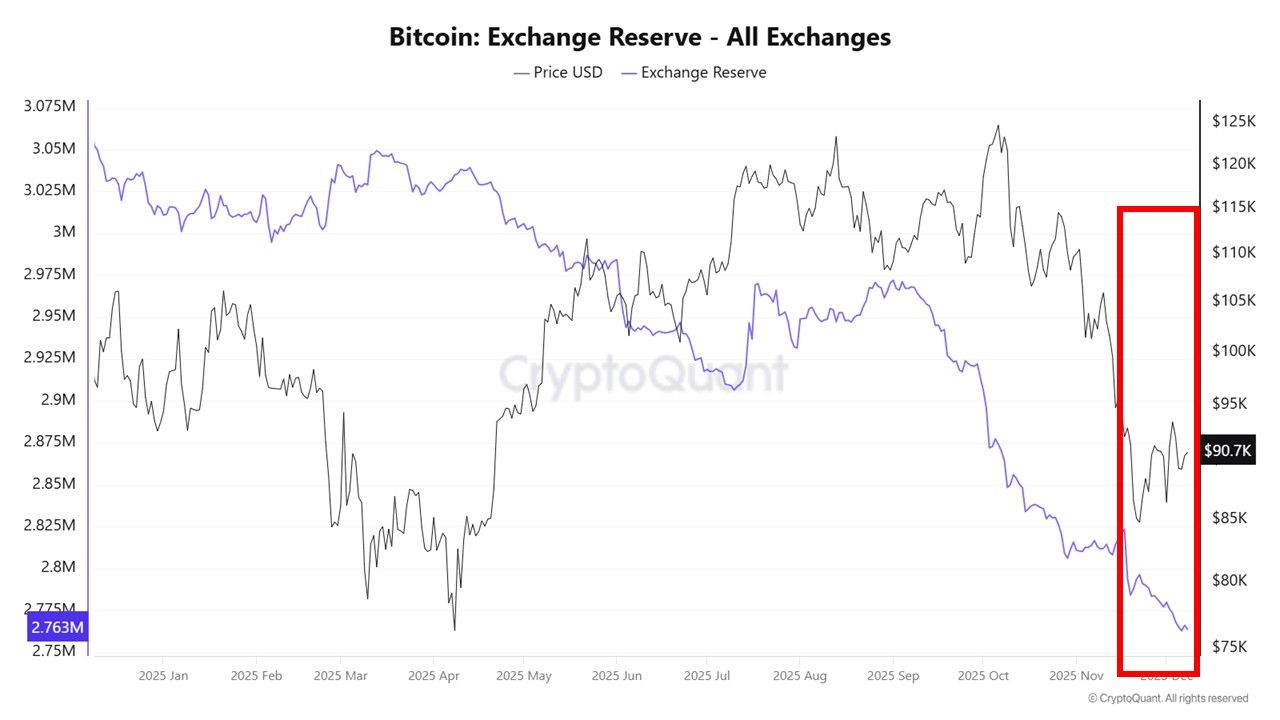

- Bitcoin exchange reserves have fallen to historic lows near 2.76M BTC.

- Long-term holders and institutions continue withdrawing BTC from exchanges.

- Analysts expect a possible breakout toward $100K heading into Christmas.

Bitcoin BTC $93 041 24h volatility: 3.6% Market cap: $1.85 T Vol. 24h: $44.66 B is once again trading at the $90,000 range with a 2% drop in 24 hours, raising short-term concerns.

However, analysts claim that BTC is quietly entering the early stages of a supply squeeze, a setup that has historically led to massive price rallies.

Meanwhile, exchange balances have fallen, and long-term holders are accumulating as the market watches whether Bitcoin can capitalize on this tightening supply heading into the Christmas period.

Exchange reserves hit historic lows

On-chain data from CryptoQuant shows Bitcoin entering one of its lowest liquid supply phases in history. Despite the recent pullback, centralized exchanges now hold only about 2.76 million BTC.

The decline shot up through November and December, while Bitcoin continued to bleed to multi-month lows.

Traditionally, falling prices trigger higher exchange inflows as traders prepare to sell. But, the opposite has occurred this year.

BTC exchange reserve | Source: CryptoQuant

Long-term holders and institutions have been withdrawing coins into custody, reducing the amount of supply available for immediate sale. CryptoQuant analysts predict that this pattern could evolve into a full supply shock if the current pace continues.

On the other hand, Santiment data shows a massive reduction in exchange supply across the past year. Roughly 403,200 BTC have left exchanges over the period, a 2.09% drop in total circulating supply held on trading platforms.

📊 As Bitcoin's market value hovers around $90K, crypto's top market cap continues to see its supply moving away from exchanges. Over the past year, there has been:

📉 A net total of -403.2K $BTC moving off exchanges

📉 A net reduction of -2.09% of $BTC 's entire supply moving… pic.twitter.com/Y0JTC880Np— Santiment (@santimentfeed) December 8, 2025

For Bitcoin, fewer coins on exchanges reduce the probability of swift, large-scale sell-offs. Santiment said that as Bitcoin hovers near $90,000 , the ongoing supply decline represents significant demand.

One year ago, exchanges held about 1.8 million BTC. Today, the figure is closer to 1.2 million, Santiment’s chart showed.

Analysts track a potential christmas breakout

Analyst Michael van de Poppe shared a chart indicating that Bitcoin continues to follow a bullish structure. If buyers hold the current range and prevent a deeper correction, price could push toward the $100,000 mark before Christmas, he said.

So far, so good. #Bitcoin is still following the bullish path.

It's all depending on the open in the U.S., if that's going to be causing the standard correction, then it's time to buy the dip.

Main thesis: we break up from here and we'll start attacking $100K pre-Christmas… pic.twitter.com/23lENQhzPd

— Michaël van de Poppe (@CryptoMichNL) December 9, 2025

Bitcoin Vector added that the macro liquidity backdrop may be turning in Bitcoin’s favor. They point out that earlier setups with similar characteristics led to full-blown rallies, making BTC the next crypto to explode .

Last time this setup appeared, BTC delivered over 390% upside.

This time the structure is different, but we’re starting from an environment that precedes liquidity expansion.

And when liquidity turns, risk assets take the lead. pic.twitter.com/U28lYN7JiM

— Bitcoin Vector (@bitcoinvector) December 8, 2025