How to Achieve 40% Annualized Returns Through Polymarket Arbitrage?

Showcasing Live Trading Arbitrage Structure to provide a clear reference point for the increasingly intense predictive market arbitrage competition of today

Original Title: Arbitrage in Polymarket. $30,000/month.

Original Author: @igor_mikerin

Translation: Peggy, BlockBeats

Editor's Note: As the U.S. election approaches, trading activity on prediction markets continues to heat up. On December 9, 2025, discussions on X Platform regarding Polymarket arbitrage focused on cross-platform price spreads, automated trading bots, and hidden risks. With frequent price disparities between Kalshi and Polymarket and increasing technical barriers, the prediction market is evolving from a "speculative venue" to a genuine arbitrage infrastructure.

Transient opportunities, thin liquidity, rule divergences, and black swan events remain key challenges. The author of this article showcases a live arbitrage structure to provide a clear reference for the intensifying arbitrage competition in the current prediction market.

Below is the original text:

Approximately a month ago, I noticed some arbitrage opportunities on Polymarket.com. However, the platform's liquidity was insufficient to further expand my position, so I was planning to return to stock trading. Nevertheless, I currently have around $60,000 invested in various Polymarket markets. Most of these trades will expire after the election, at which point I will close them all at once. Below, I will introduce each of these positions and provide some free code for those interested in exploring this market.

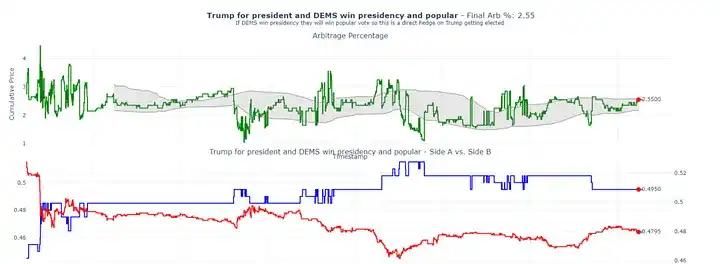

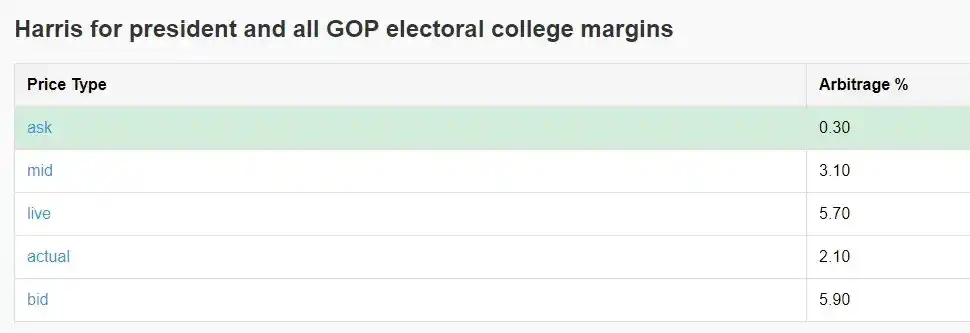

Arbitrage 1: Buy "Harris Elected President" and Simultaneously Buy All "Republican Wins Different Elector Margins" Outcomes

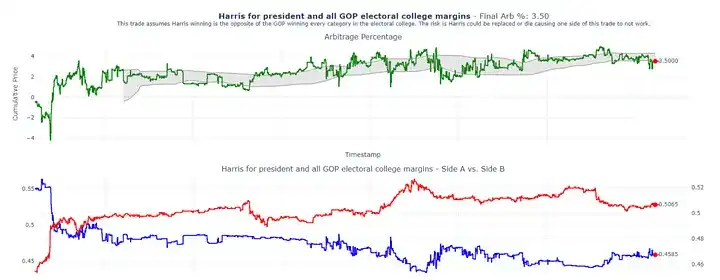

This strategy is quite straightforward: betting on Kamala Harris winning the presidential election while buying into all possible Republican winning margins in the Electoral College. Essentially, these two types of positions hedge each other. If the total price of both positions is less than 1, the price difference is the lockable arbitrage space. As of today, the arbitrage margin of this trade is 3.5%, with 41 days until the election. When annualized, this is roughly equivalent to a 41% annual return.

The following chart illustrates how I constructed this trade. You can see that I purchased nearly equal amounts of shares in almost all possible outcomes.

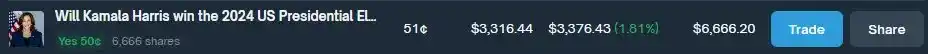

This is my position on Polymarket.com. You can see that I have essentially bought almost equal amounts of shares in each possible outcome.

This is a real-time summary of the positions I have placed on Polymarket. The average cost of these positions is 0.983, meaning my expected return is 1 – 0.983 = 1.7%. The cost basis of my most recent trade was 0.979, corresponding to a 2.1% return.

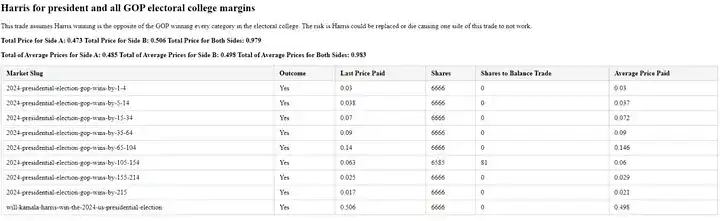

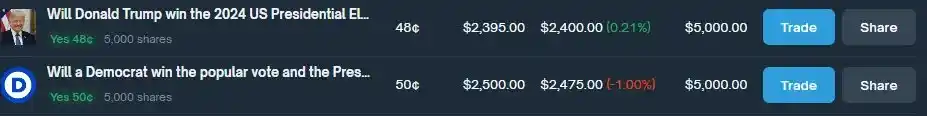

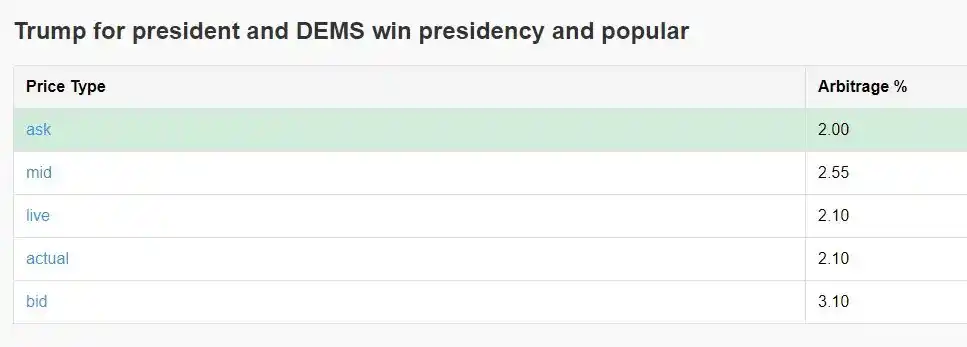

Arbitrage 2: Betting on Trump's election and hedging with "Democratic win the popular vote + win the presidency"

This strategy currently shows a 2.55% arbitrage opportunity. In this combination, we are betting on Trump's victory on one hand and hedging by betting on the Democratic Party winning both the popular vote and the presidency. While this is not a perfect hedge (as the Democratic Party could potentially win the presidency without winning the popular vote), according to my model, the probability of this scenario is extremely low. Therefore, I believe this hedge structure is robust.

Below are my actual trades, and you can see that I hold an equal amount on both sides of the bet.

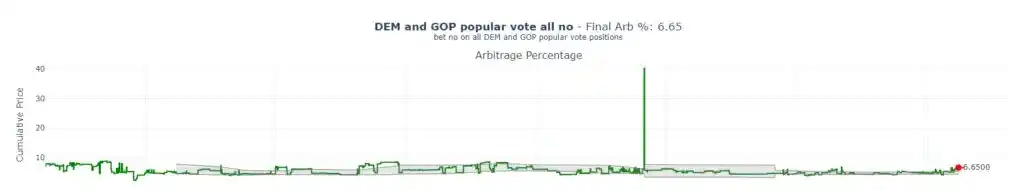

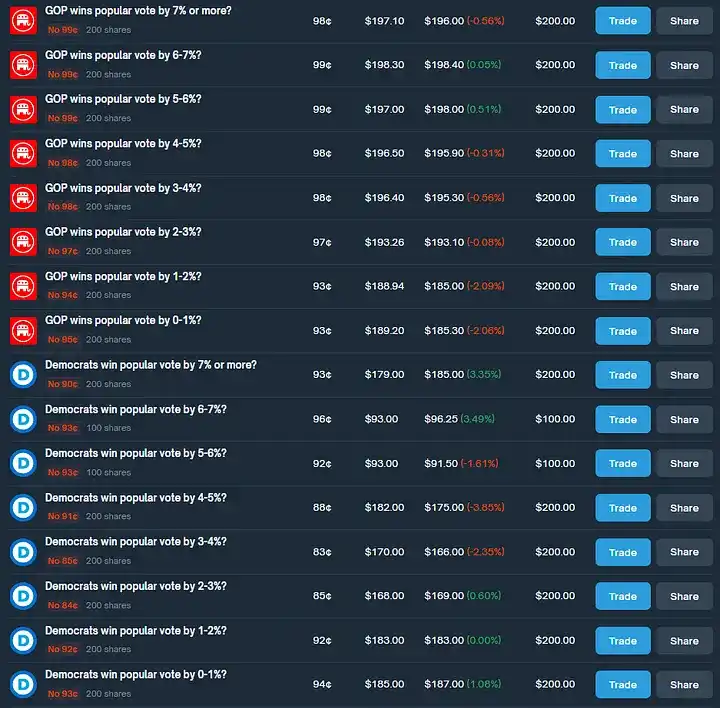

Arbitrage 3: Buying "No" on all outcomes of the Democratic and Republican popular vote

In this trade, I have bought the "No" option on all possible outcomes of the popular vote. Currently, the arbitrage opportunity for this trade is 6.65%.

Below are the trades I have placed. Except for one, all other trades will win on election day. Therefore, the total profit from all winning positions in these trades (excluding the single loss) must exceed the amount of that loss.

Be sure to read the rules carefully

An important note: Be sure to carefully read the rules of each market. Some positions may seem like arbitrage opportunities, but may hide significant risks. For example, if a candidate is assassinated, even if you think you have set up a "stable arbitrage," you may end up losing all your principal.

The Spread Is Crucial

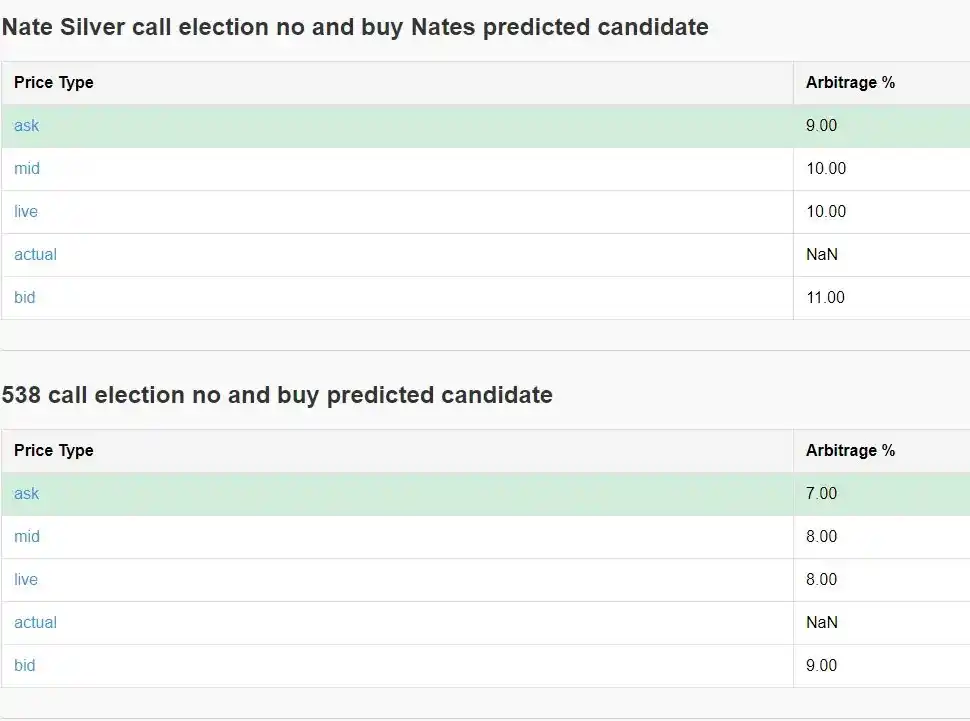

One of the biggest challenges I have encountered is market impact. Due to low platform liquidity, once I place an order, I often push the entire market's price in my direction. This can lead to discrepancies between the buy price, sell price, mid-price, real-time price, and actual execution price. Below are typical examples that have occurred in the aforementioned trades.

Good luck!

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

LUNA up 24.4% in 24 hours: Surge Fueled by Upgrades and Increased Inflows

- LUNA surged 24.4% in 24 hours on Dec 10, 2025, driven by rising on-chain activity, capital inflows, and anticipation of a major network upgrade. - The terrad v3.6.1 upgrade, set for Dec 18, aims to resolve legacy contract issues and enhance security, with successful testnet trials and rollback options in place. - Futures open interest rose to $25.55M, while technical indicators suggest continued bullish momentum, targeting $0.000098 resistance if the 50-week EMA is sustained. - Legal proceedings against

Evaluating HYPE Token: Authenticity and Price Fluctuations Amid the Changing Meme Coin Scene

- Hyperliquid's HYPE token combines DeFi infrastructure with meme coin speculation, distinguishing itself through Layer-1 blockchain technology and structured governance. - Unlike DOGE or SHIB , HYPE features transparent governance proposals, deflationary buybacks ($2.1B projected), and institutional partnerships to counter volatility. - While HYPE's 13% price drop post-token unlock shows market sensitivity, its RSI and support levels suggest resilience compared to BONK's 185% weekly swings. - The token's

The Growing Need for STEM and Technical Studies in American Higher Education

- U.S. higher education is rapidly adopting EdTech SaaS to address STEM workforce demands, with the global market projected to grow from $200.86B in 2025 to $907.7B by 2034. - AI-driven platforms like Frizzle and Labster are revolutionizing STEM education through automated grading, virtual labs, and personalized learning solutions. - Strategic university partnerships and micro-credentialing models (e.g., SkillBloom) are bridging skills gaps in data science, cybersecurity, and engineering. - Investors face

The Influence of Educational Facilities on Sustained Economic Growth and Investment Patterns: Farmingdale State College’s Contribution to Preparing the Workforce and Regional Development

- Farmingdale State College (FSC) aligns interdisciplinary programs with workforce needs, boosting 80% six-month employment rates for 2025 graduates. - Its STEM Diversity Summit and inclusivity initiatives address labor gaps, fostering equitable pathways in biotech and renewable energy sectors. - A $75M Center for Computer Sciences and Broad Hollow Bioscience Park expansion aim to double tech enrollment and create 135 jobs, strengthening Long Island’s innovation ecosystem. - FSC’s focus on applied learning