Date: Mon, Dec 08, 2025 | 06:58 AM GMT

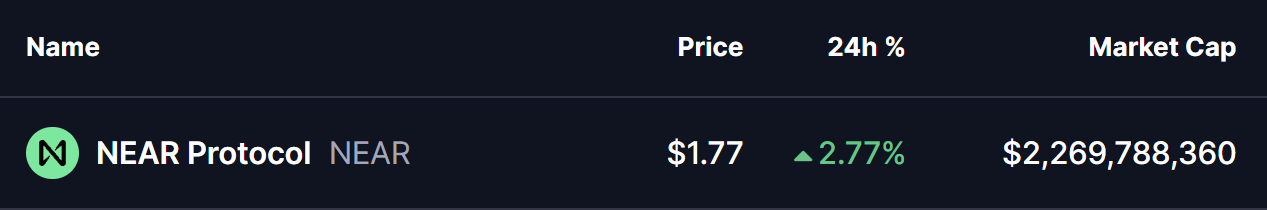

The broader crypto market is beginning to stabilize after a volatile weekend, with both Bitcoin (BTC) and Ethereum (ETH) recovering more than 2% today. This shift in sentiment is allowing several altcoins to reenter upward trajectories, including Near Protocol (NEAR), which is now showing signs of technical strength backed by a developing bullish structure.

Source: Coinmarketcap

Source: Coinmarketcap

Harmonic Pattern Hints at Potential Upside

On the 4-hour chart, NEAR is carving out a Bearish Butterfly harmonic pattern. While traditionally labeled bearish at completion, this setup usually drives stronger upside during its CD leg, before reaching the final reversal zone. The ongoing price movement suggests that NEAR is currently in that upward phase.

The pattern began at Point X near $1.989, followed by a corrective pullback into Point A. A rebound into the Point B region marked temporary resistance, before price retraced again into Point C near $1.643—an area now acting as the foundational support of the entire structure. From that point, NEAR has rebounded firmly and is currently trading around $1.77, indicating renewed buyer engagement.

Near Protocol (NEAR)/Coinsprobe (Source: Tradingview)

Near Protocol (NEAR)/Coinsprobe (Source: Tradingview)

Price is now pushing toward the 100 moving average at $1.818, a level that aligns directly with harmonic progression. A close above this threshold will be a key trigger for continuation, allowing bullish momentum to gather further strength.

What’s Next for NEAR?

As long as NEAR maintains structure above $1.643, the current pattern remains valid and technically constructive. If bullish pressure successfully breaks and sustains above the 100 MA, the harmonic projection points toward the Potential Reversal Zone (PRZ) between $2.099 and $2.239. This area represents the typical completion zone for the Butterfly formation and may provide NEAR with an upside window of nearly 18% before pattern exhaustion becomes relevant.

The near-term chart tone is also supported by improved momentum profiles, with emerging higher lows indicating strong participation from buyers even during small corrective pauses.

The road to the PRZ may include short-term resistance reactions, but if NEAR continues to build atop the 100 MA, the setup supports a breakout-driven move rather than a fade.